Globally, 582 GW of Renewables Added in 2024, 91% of All New Capacity

To triple renewable energy capacity by 2030, 1,122 GW must be added each year

October 23, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

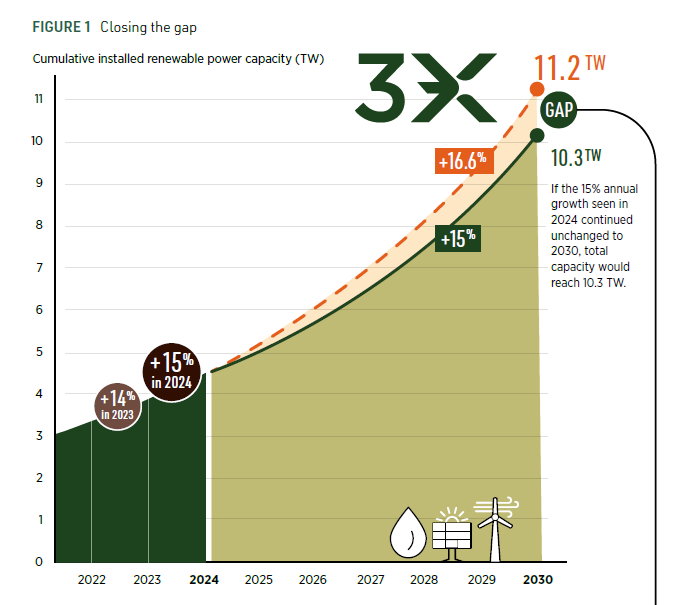

In 2024, 581.9 GW of new renewable energy capacity was added globally, representing a 15.1% annual growth rate and a 0.7% increase over 2023.

The findings were published in the International Renewable Energy Agency (IRENA)’s report titled ‘Delivering on the UAE Consensus: Tracking progress toward tripling renewable energy capacity and doubling energy efficiency by 2030’.

Despite the increase, the report states that the capacity growth still falls short of the trajectory required to achieve the target of 11.2 TW by 2030. To achieve this target, an average of 1,122 GW must be added each year between 2025 and 2030.

The report noted that at the current pace, solar will be able to achieve 6.15 TW capacity additions by 2030, and only 10.3 TW of renewable energy capacity will be installed, falling 7.7% short of the target capacity addition.

Since capacity additions in both 2023 and 2024 fell short of the required growth rate, renewable capacity must be expanded by 16.6% annually to deliver 6.7 TW of installed renewable power capacity in the decade’s remaining six years.

Solar energy accounted for most of the new capacity additions in 2024, with 452.1 GW added in the year.

This was followed by wind energy, with onshore wind capacity increasing to 105.7 GW from 103.7 GW in 2023, while offshore deployment growth slowed to 8.6 GW from 11.6 GW in the previous year.

Uneven Spread of Renewables

The geographic deployment of renewables remains highly uneven, with Asia, Europe, and North America accounting for 85.4% of installed renewable power capacity at the end of 2024. Africa, Central America and the Caribbean, Eurasia, the Middle East, Oceania, and South America shared the remaining 14.6%.

A majority of renewable power additions in 2024 were from Asia, accounting for 7.1% of the global renewables capacity additions. Europe expanded its capacity by 71.9 GW, a 9.2% growth year-over-year (YoY) to reach 19.1% of global capacity.

Reducing Costs

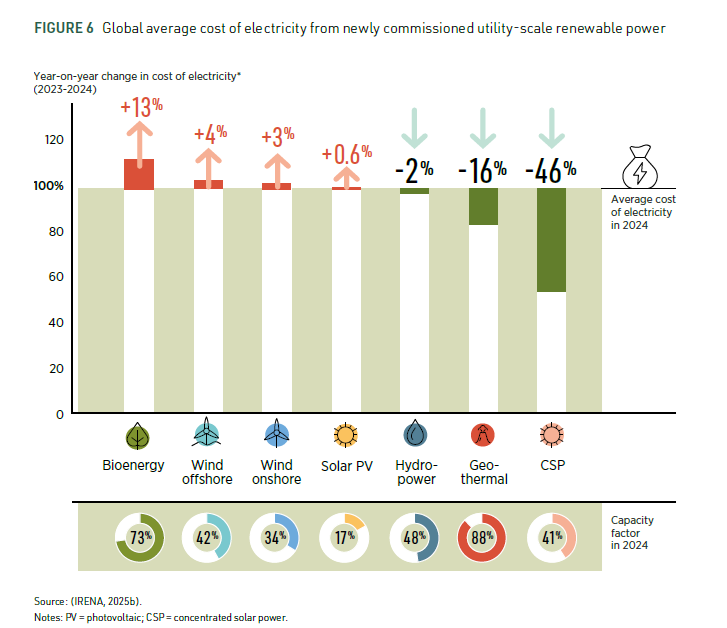

Renewables remained the most cost-competitive option for new electricity generation in 2024, with 91% of newly commissioned utility-scale capacity delivering power at a lower cost than the cheapest newly installed fossil fuel-based alternative.

During the year, new utility-scale onshore wind projects remained the cheapest source of renewable electricity, with a $0.034/kWh global weighted average levelized cost of electricity. It was followed by new solar capacity additions at a tariff of $0.043/kWh and new hydropower at a tariff of $0.054/kWh.

By 2024, total installed costs fell to $691/kW for solar, $1,041/kW for onshore wind, and $2,852/kW for offshore wind.

The costs of fully installed and commissioned battery storage projects fell by almost 30% between 2023 and 2024, contributing to a decline of 93% between 2010 and 2024, from $2,571/kWh to $192/kWh.

Energy Storage Systems

In 2024, 74 GW, approximately 180 GWh, of battery storage was added, representing nearly double the capacity additions from 2023.

IRENA noted that the growing need for grid reliability, combined with declining technology costs, is driving a rapid transformation of the battery energy storage landscape.

In 2024, capacity growth in the battery energy storage system was driven by China, the U.S., and Europe, which collectively accounted for nearly 85% of global battery energy storage system additions.

With an estimated addition of more than 3 GW of electrolyzer capacity in 2024, the global cumulative capacity exceeded the 6 GW mark.

Electric Vehicles

Electric vehicles (EVs) accounted for a record 21% of global new car sales in 2024. The EV sales were driven by increased competition, policy support, and technological advancements.

EV market shares are growing rapidly, especially in the passenger car segment (26%) and the two and three-wheeler segment (45%).

To achieve this, the combined stock of battery electric vehicles and plug-in hybrid electric vehicles will need to increase from around 57 million in 2024 to 360 million by 2030.

Investments

Total global investment in renewable power generation capacity reached $624 billion in 2024, up 7% from the previous year. In 2024, global solar investment soared to $436 billion, outpacing all other renewable power generation technologies combined.

The tripling of renewable power capacity by 2030 will require an additional $8.6 trillion in investment between 2025 and 2030.

According to the IRENA report, meeting the UAE Consensus renewable energy and energy efficiency goals will require $29 trillion to $30 trillion in cumulative investment in renewables, grids, flexibility measures, and energy efficiency.

Annual average investments in renewable power capacity between 2025 and 2030 must increase by 2.3 times to approximately $1.44 trillion per year, compared to $600 billion in 2024.

Investments in grid infrastructure grew 9% in 2024 compared to 2023, and investments in battery storage grew by 33% YoY in 2024, reaching $54 billion.

Global investment in battery factories almost doubled to reach a record high of $74 billion in 2024.

However, the report said that while the U.S. was expected to double its share of global battery investments to10% in 2025–2026, recent funding cuts for the renewable energy sector will significantly affect both domestic and global progress.

Between January and May 2025, the U.S. saw cancellations of $22 billion worth of new factories and energy transition-related projects, foregoing the creation of 16,500 new jobs.

Investments in factories manufacturing solar, wind, battery, and hydrogen technologies dropped by 21% to $102 billion in 2024.

This decline reflects the net impact of a 72% drop in investments in the solar manufacturing sector due to oversupply.

Investments in wind turbine factories fell by almost 80% in 2024.

India

India’s solar module manufacturing capacity grew to an estimated 68.2 GW in 2024, up from 49.3 GW in 2023.

The report highlighted that due to the U.S.’ anti-circumvention tariffs on Southeast Asian modules and cells using Chinese wafers and other products, they shifted their exports to the Indian market.

The country added 3.4 GW of new wind capacity in 2024, and the wind manufacturing sector accounted for 0.8% of the global share.

India also received 1% of global investments in factories for manufacturing solar, wind, battery, and hydrogen technologies.

India’s share of global investment is expected to more than triple from 2.5% in 2023–2024 to almost 8% in 2025–2026

Steps to Undertake

The report states that to meet the goals of tripling renewable energy capacity by 2030, countries must take firm steps to strengthen the supply chain and bring clarity to policies and regulations globally.

It also stressed the need for countries to include specific, measurable renewable energy capacity targets within their Nationally Determined Contributions (NDC) and integrated energy plans that align with the UAE Consensus energy goals. It also proposed that governments must issue NDC investment strategies promoting quantified, bankable mitigation projects supported by robust investment mechanisms.