fit

The government of Japan has announced the results of the 18th utility-scale solar photovoltaic projects auction, allocating 105 MW to 33 successful bidders. The...

China’s National Energy Administration (NEA) has approved 22.78 GW of the Feed-in Tariff (FiT) based solar projects. These solar PV projects are expected to be...

Andhra Pradesh Chief Minister Jaganmohan Reddy held a review meeting with the state’s energy department to deliberate on the recent decision to revisit the Power...

Ending months of uncertainty in the solar market, the Price Bureau of China’s National Development and Reform Commission (NDRC) announced the level of solar FIT payments...

The Karnataka Electricity Regulatory Commission (KERC) has issued a discussion paper to set tariff for solar power projects, including solar rooftop projects for the...

The African Development Bank (AfDB) has approved a senior loan of $18.17 million for the development of 50 MW Kopere solar power project in Nandi County, Kenya. The...

Japan’s Ministry of Economy, Trade and Industry (METI) has proposed that companies granted permits for solar projects between the fiscal years of 2012 to 2014 under...

After announcing installation caps in the second quarter, China is expected to be currently evaluating the feasibility of increasing its solar installation target to...

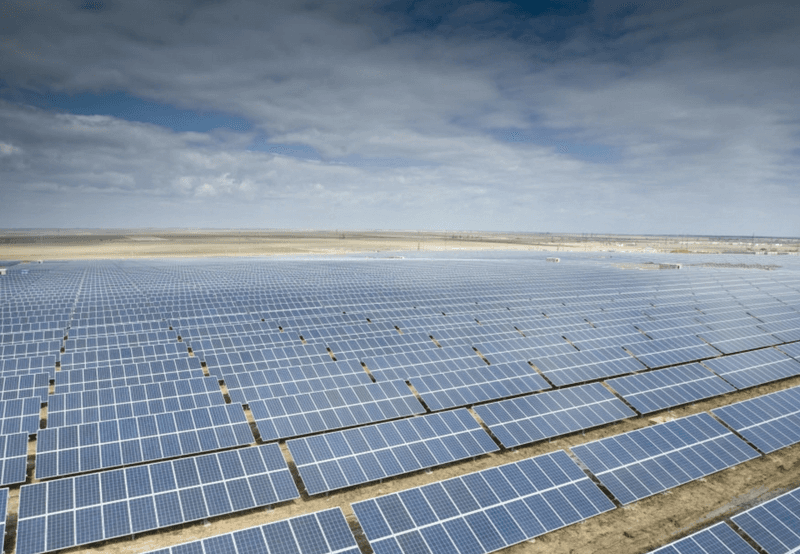

China added 34.5 GW of solar PV capacity in the first three quarters of 2018. This takes China’s total installed solar PV capacity to 164.74 GW, of which 117.9 GW are of...

China added 24.3 GW of solar PV capacity in the first half (1H) of 2018. This takes China’s total installed solar PV capacity to 154.51 GW, out of which 112.6 GW...

China’s renewable story is going through a transformation in 2018. After many years of growth in renewable energy, the country is beginning to change its policies that...

The first half of 2014 was not spectacular for solar installations globally, but with recent policy adjustments being implemented, especially in China, another strong...

1

...

1