Renewables Expansion Pushes ACME Solar’s Q2 FY26 Revenue 104% YoY

The company’s PAT stood at ₹1.15 billion, up 108.3% YoY

November 4, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Gurgaon-based independent power producer ACME Solar Holdings has posted a revenue of ₹6.01 billion (~$67.81 million) in the second quarter (Q2) of the financial year (FY) 2026, a 103.8% increase year-over-year (YoY) from ₹2.95 billion (~$33.28 million).

The company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) totaled ₹5.34 billion (~$60.25 million), up 108.3% from ₹2.56 billion (~$28.88 million) in the same quarter of the previous year.

The company’s profit after tax (PAT) grew 652.1% to ₹1.15 billion (~$12.97 million) from ₹150 million (~$1.69 million) in Q2 FY25.

ACME Solar attributed this to the continued expansion of its renewable portfolio and operational discipline.

In an earnings call, Manoj Kumar Upadhyay, Chairman and Managing Director, ACME Group, stated that the company finished five years of continuous testing of its firm and dispatchable renewable energy (FDRE) solutions with positive results.

He added that the company also aims to reduce its land requirement by 15% to 20%. Upadhyay said this will help ACME increase its solar generation by 15% to 20% from the same area in high-radiation regions.

1H FY 2026

The company reported revenue of ₹11.85 billion (~$133.73 million) in the first half (1H) of FY 2026, increasing 86.6% YoY from ₹6.35 billion (~$71.66 million).

Its EBITDA during this period stood at ₹10.65 billion (~$120.19 million), rising 90.7% from ₹5.58 billion (~$62.97 million) in 1H FY 2025.

ACME Solar’s PAT for 1H FY26 was ₹2.46 billion (~$27.76 million), growing 1,373.4% from ₹170 million (~$1.92 million) in the same period of the preceding year.

Operational Highlights

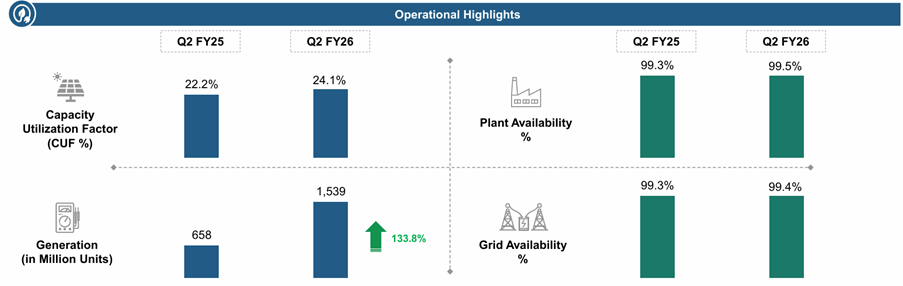

The company generated 1,539 million units of renewable energy in Q2 FY26, up 133.8% from Q2 FY25. This was driven by a higher capacity utilization factor (CUF) and new capacity additions. Rajasthan-based operational assets with 2,250 MW contracted capacity are reported to have delivered an average CUF of 25.8%.

Projects CUF increased to 24.1%, compared to 22.2% in the same quarter of the previous financial year. ACME’s project and grid availability stood at 99.5% and 99.4%, respectively, for Q2 FY26.

Business Highlights

During Q2, the company partially commissioned 28 MW of its 100 MW Acme Eco Clean (wind) project in Gujarat, increasing the total commissioned capacity to 378 MW as of 1H FY26.

ACME Solar stated that its operational portfolio is expected to yield a run-rate annual project EBITDA of ₹20.25 billion (~$228.53 million) to ₹20.75 billion (~$234.17 million), resulting in a pre-tax return on capital employed of approximately 14.5%.

It secured solar plus energy storage system projects totaling 670 MW/2,240 MWh, FDRE projects of 50 MW/220 MWh, and standalone battery energy storage systems (BESS) with a capacity of 550 MWh.

ACME’s total portfolio stands at 7,390 MW, comprising 13.5 GWh of BESS installation.

The company has received orders for 2 GWh of BESS, growing its total BESS order capacity to 5.1 GWh. The first phase of this BESS delivery is scheduled for December this year, with phased commissioning planned to commence from Q4 FY26.

ACME also operationalized 10 MWh of BESS in October 2025 in Rajasthan on a pilot basis. This storage system is designed for FDRE/solar plus BESS.

In September this year, ACME Solar executed a share purchase agreement to acquire 100% equity shares of AK Renewable Infra for an enterprise value of ₹792.5 million (~$9 million).

In August this year, ACME’ board of directors approved a plan to raise ₹30 billion (~$342.23 million) in one or more tranches by issuing equity shares or other equity-linked instruments and securities.