Power Sector Reforms Help DISCOMs Post Profits in FY 2025 for First Time

The utilities posted a cumulative profit of ₹27 billion, while AT&C losses dipped to 15.04%

January 27, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

India’s rated power distribution utilities reported a consolidated profit after tax (PAT) of ₹27.01 billion (~$294.7 million) in FY25, marking a sharp turnaround from a loss of ₹270.22 billion (~$2.95 billion) recorded in FY24, according to the Ministry of Power’s 14th Annual Integrated Rating and Ranking Report.

It was the first time DISCOMs cumulatively reported a positive PAT on an accrual basis.

The turnaround was attributed to reform initiatives in the distribution sector, including the Revamped Distribution Sector Scheme, additional prudential norms, prudent tariff structures, incentivizing states to implement reforms, uniform accounting processes, and enforcement of legal contracts through timely payments.

Of 72 power distribution utilities, 65 utilities were evaluated on performance across various metrics in the latest Integrated Rating, compared with 63 utilities assessed in the previous edition.

Torrent Power Ahmedabad and Torrent Power Surat were newly added to this year’s ratings.

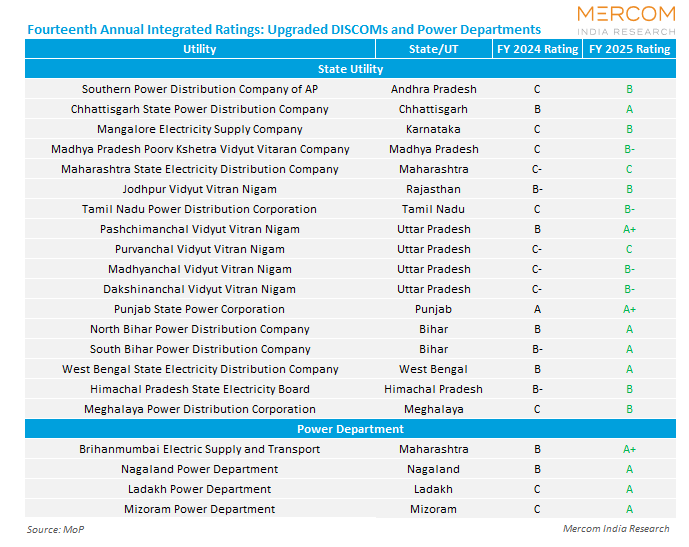

Of the 65 rated utilities, 31 power distribution utilities across the broader assessment framework received A+ or A grades, while 11 utilities were rated C or C-. Grades were upgraded for 22 utilities comprising 18 DISCOMs and four power departments, while 10 utilities saw downgrades, including nine DISCOMs and one power department.

Notable upgrades included Pashchimanchal Vidyut Vitran Nigam (B to A+), Brihanmumbai Electricity Supply and Transport (B to A+), Ladakh Power Department (C to A), and Mizoram Power Department (C to A).

The number of DISCOMs and power departments awarded a C grade or lower declined to 11 in the 14th ratings, improving from 18 in the previous year.

Several government-owned DISCOMs recorded profit this year. Punjab State, Tamil Nadu Power Distribution Corporation, and Ajmer Vidyut reported the highest profits in FY25.

Utilities are improving performance through faster digitalization, stronger customer service, and grid modernization.

DISCOMs are migrating legacy systems to cloud-based enterprise resource planning/systems, applications, and products platforms to streamline billing, asset management, and internal operations, supported by paperless electronic office workflows.

Customer experience and collections are improving through omnichannel support, 24/7 call centers, AI chatbots, and WhatsApp-based grievance redressal and expanded digital payments.

Utilities are also deploying smart metering and automation systems such as advanced metering infrastructure, supervisory control and data acquisition systems, geographic information systems, and advanced distribution management systems to enhance real-time visibility, billing accuracy, and outage response.

Loss reduction remains a key focus, backed by network upgrades, anti-theft drives, and AI-enabled vigilance tools, while parallel efforts promote energy efficiency, rooftop solar adoption, electric vehicle charging infrastructure, and workforce safety.

Operational performance also improved during the year. The average cost of supply–average revenue realized (ACS-ARR) gap, calculated on a tariff-subsidy-received basis, narrowed to ₹0.06 (0.001)/kWh in FY25 from ₹0.20 (~$0.002)/kWh in FY24.

On a year-on-year basis, the ACS-ARR gap improved by ₹0.25 (~$0.003)/kWh to ₹0.07 (~$0.001)/kWh.

Aggregate Technical and Commercial (AT&C) losses declined to 15.04% in FY25 from 15.97% in FY24. PFC attributed the reduction to technical interventions, including feeder segregation, low-tension-to-high-tension network conversions, and intensified anti-theft measures.

A total of 38 utilities comprising 33 DISCOMs and five power departments reported AT&C losses below 15%, while 22 utilities achieved improvements exceeding 2% compared to the previous year.

Billing efficiency improved to 87.59% in FY25 from 86.99% in FY24, while collection efficiency rose to 97% from 96%.

Collection efficiency improved from 96.60% in FY24 to 97% in FY25, with 17 utilities achieved 100% collection efficiency in FY25. Collection efficiency improved for 29 utilities, with 12 utilities recording a significant gain of over two percentage points.

Days receivable for DISCOMs improved to 112 days from 113 days, while days payable to generation and transmission companies improved significantly to 113 days from 132 days.

The Ministry of Power also noted that red-card metrics were assigned to Andhra Pradesh Central Power Distribution Company, Andhra Pradesh Eastern Power Distribution Company, Andhra Pradesh Southern Power Distribution Company, Bangalore Electricity Supply Company, Gulbarga Electricity Supply Company, Maharashtra State Electricity Distribution Company, Kerala State Electricity Board, and Tamil Nadu Power Distribution Corporation, for an adverse auditor’s opinion. Manipur State Power Distribution Company received a red-card metric for defaulting to Power Finance Corporation.

On the regulatory front, tariff orders were issued on time in 23 states and union territories in FY25, while true-up orders were issued by 52 utilities, of which 19 were delayed. Automatic pass-through of fuel costs was implemented by 30 state regulators, allowing DISCOMs to pass on the rise in power purchase costs during the year.

Incentivizing DISCOMs to improve their performance, Union Minister of Power and Minister of Housing and Urban Affairs Manohar Lal said that Power Finance Corporation and REC have decided to extend additional incentives in the form of interest-rate rebates to DISCOMs that demonstrate sustained improvements in operational and financial performance.

In FY24, 42 state DISCOMs, 10 private DISCOMs, and 11 state power departments were evaluated for their performance across various metrics during the financial year 2023-24.