India Slaps 30% Antidumping Duty on Solar Cell Imports from China

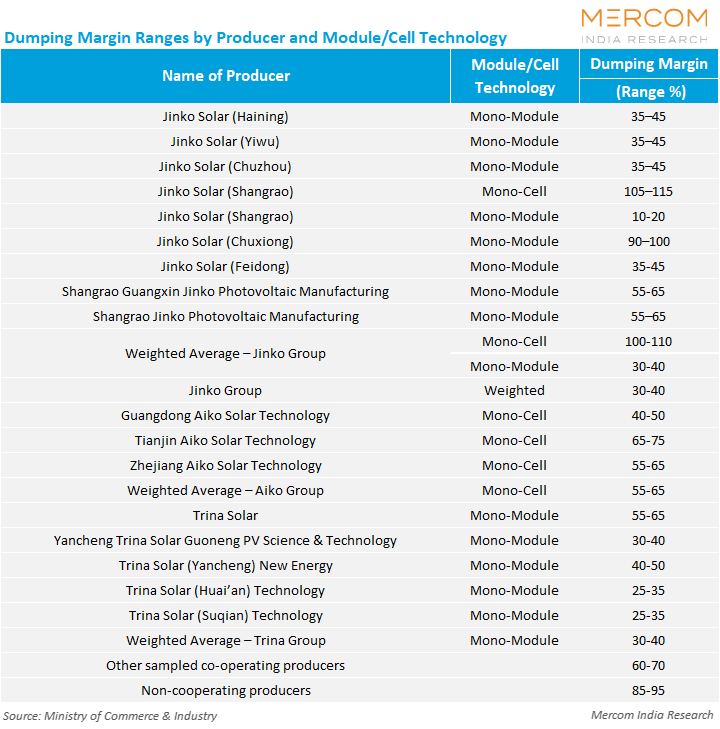

The DGTR determined a dumping margin of up to 105-115% for Chinese imports

September 30, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

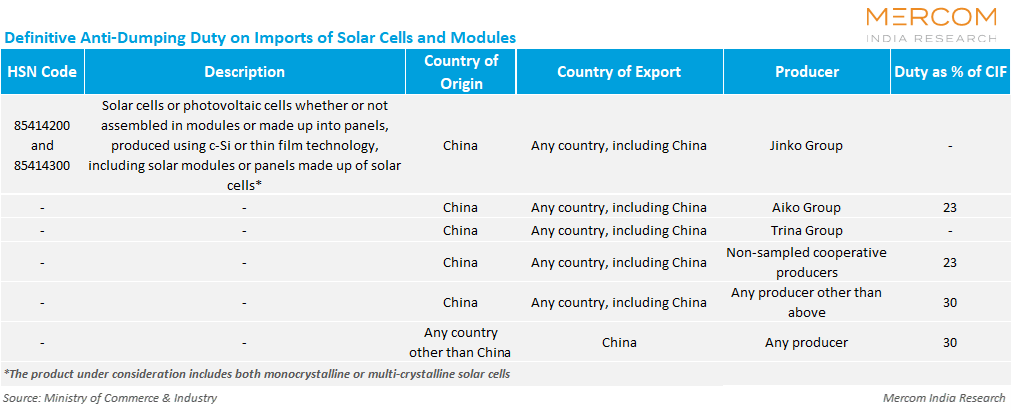

The Directorate General of Trade Remedies (DGTR) has imposed antidumping duties up to 30% on imports of solar cells, whether or not assembled into modules, originating in or exported from China for three years.

The duty imposition follows the conclusion of the antidumping investigation initiated by DGTR in December 2024.

The investigation was initiated following a joint application filed by FS India Solar Ventures, Jupiter International, Tata Power Solar, and TP Solar. The probe was conducted for the period between April 1, 2023, and March 31, 2024. The injury period was between 2020 and 2021.

The probe was conducted on 118 Chinese companies that export solar cells or modules to India.

In its final conclusions, DGTR determined that imports of solar cells from China had caused material injury to the domestic industry. It said China was dumping solar cells at a dumping margin of up to 105-115% into India. It also determined an injury margin of up to 35-40% from solar cell imports from China.

Stressing the need for the imposition of an antidumping duty on imports from China, the domestic industry stated that the price of solar cells imported from China had sharply declined during the injury period and by 55% during the subsequent period. Additionally, they noted that the volume of imports from China increased by 271% during the injury period, and the volume of solar cell imports further rose by 63% in the subsequent period.

The domestic industry noted that after the 2020-21 fiscal year, the profits of the domestic sector declined by 275% and its cash profits declined by 158%.

DGTR observed that Indian manufacturers faced severe financial stress due to the dumping of solar cell imports from China. FS India, a domestic producer, stated that due to dumped imports, it was forced to sell 41% below cost, compared to its projected 28% below cost, resulting in losses 69% higher than expected.

Despite higher customs duties, import volumes surged by 373% compared to the previous year and by 240% over the 2020-21 period.

Solar cell imports from China alone accounted for 77% of total inflows during the investigation period.

DGTR noted that price undercutting for mono-crystalline solar cells was “positive and significant,” while overall imports depressed and suppressed domestic prices. Domestic producers were forced to sell below cost as landed import prices continued to decline further during the investigation period.

While production by Indian manufacturers increased by 456% during the period, domestic sales rose by only 112% due to the presence of imported solar cells from China in the market.

The domestic industry had also alleged that Chinese exporters circumvented U.S. and Türkiye’s trade measures to prevent dumping of imports by diverting shipments through Thailand, Cambodia, Vietnam, and Malaysia. The investigation found that China had unutilized manufacturing capacities equivalent to 576% of India’s total demand.

Recently, DGTR initiated an investigation into the alleged dumping of solar encapsulants exported and originating from South Korea, Thailand, and Vietnam.