IEA Forecasts Massive 4,600 GW Growth in Global Renewable Power by 2030

Global renewable power capacity to more than double by 2030

October 21, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

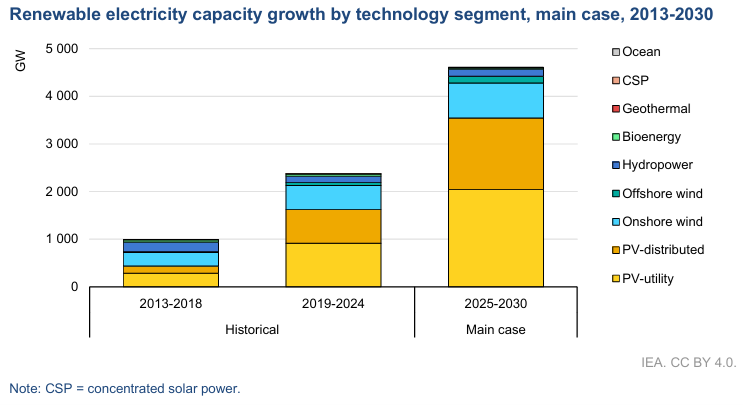

The installed renewable energy worldwide is expected to increase by 4,600 GW by 2030, according to the International Energy Agency’s (IEA) latest ‘Medium-Term Forecast’ report. The growth is being driven primarily by solar installations, which will account for nearly 80% of the increase in renewable capacity over the next five years.

However, despite this remarkable growth, the agency has revised its outlook downward by 5% from last year, citing changing policies, market conditions, and curtailment challenges in several key economies.

Despite challenges in supply chains, grid integration, and financing, the renewable sector continues to expand rapidly. This addition is equivalent to the total power generation capacity of China, the European Union, and Japan combined, the report said.

Global Outlook and Solar Dominance

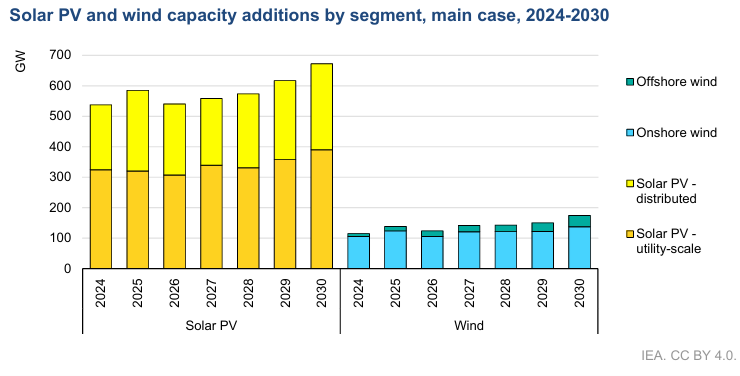

According to the IEA’s report, the pace of renewable additions between 2025 and 2030 is expected to double that of the previous five years (2019–2024). Solar systems, both utility-scale and distributed, will account for nearly 80% of total additions.

Solar systems, both utility-scale and distributed, will account for nearly all growth, driven by falling module prices, faster permitting, and growing social acceptance. Distributed applications, including rooftop solar for homes, businesses, and industries, are projected to contribute 42% of all growth, reflecting rising consumer interest in energy independence and bill reduction.

The report highlights that higher retail electricity prices following the global energy crisis have accelerated adoption in countries such as South Africa, Pakistan, and Brazil, where businesses and households are installing solar-plus-storage systems to overcome unreliable grids.

Wind Energy

Onshore wind capacity additions are projected to grow by 45%, reaching 732 GW globally by 2030. While supply chain bottlenecks and lengthy permitting processes remain concerns, new government policies in both advanced and developing countries are addressing these barriers.

The offshore wind sector is expected to more than double its growth compared to the previous five years, reaching 140 GW by 2030, led by China and Europe.

Yet, in a sign of growing challenges, the IEA has cut its offshore wind forecast by 27% compared to last year, pointing to project cancellations and under-subscribed auctions in the U.S., Japan, and several European markets, due to rising costs and weakened investor confidence.

Hydropower and Storage

The IEA estimates that hydropower capacity will grow modestly, adding about 154 GW between 2025 and 2030. Notably, pumped-storage hydropower capacity additions are forecast to double to 16.5 GW annually by 2030, providing crucial flexibility for variable renewables.

China alone accounts for 60% of global PSH growth, while India, Spain, and Austria are rapidly expanding such projects to support grid stability.

Geothermal power installations are expected to reach record highs in the market, such as the U.S., Japan, Indonesia, and several emerging economies. Rising grid integration challenges have renewed global interest in pumped-storage hydropower, with growth projected to be nearly 80% faster over the next five years compared to the previous period.

Curtailment Concerns

The report introduces the impact of renewable curtailment. As the share of variable renewables increases, grid congestion and limited flexibility are resulting in growing power wastage.

IEA analysts have shifted to a trend-based assessment of curtailment, revealing that actual generation from renewables in 2030 may be around 850 TWh lower than last year’s estimates.

This underscores the urgent need for investment in grids, interconnections, and storage systems to ensure that renewable electricity can be fully utilized.

Despite impressive deployment, the IEA cautions that the rise of variable renewable energy brings integration challenges. Curtailment, when renewable power is wasted due to grid limits or lack of demand, has become more frequent in China, Europe, and parts of Latin America.

In Brazil and Chile, curtailment risks for wind and solar projects have led to utility-scale cancellations, dampening overall forecasts.

To mitigate these challenges, the IEA stresses the importance of modernizing transmission infrastructure, introducing flexible market mechanisms, and expanding storage solutions.

Forecast Revision

IEA has lowered its medium-term forecast for global renewable capacity by 248 GW (around 5%) compared to the October 2024 outlook. While the overall trajectory remains strong, major policy and regulatory developments in leading markets, particularly the U.S. and China, have contributed to this adjustment.

U.S.

The U.S. forecast has been revised down nearly 50% across all technologies except geothermal. The reduction reflects the early phase-out of investment and production tax credits, new foreign entity of concern restrictions affecting supply chains, and an executive order suspending offshore wind leasing and limiting solar and wind projects on federal lands.

Wind energy, both offshore and onshore, has seen its capacity growth projections cut by 60%, while solar PV is expected to expand 40% less than previously anticipated.

Despite these setbacks, the IEA notes that corporate demand for clean energy remains strong, with U.S. companies continuing to sign long-term renewable power purchase agreements to hedge against future price volatility.

China

China, which remains the global leader in renewable deployment, has seen its forecast revised down by 5%, equivalent to 129 GW of capacity, due to recent policy reforms.

The government has replaced long-term fixed contracts at provincial coal benchmark prices with competitive auctions and contracts for difference, aligning renewables more closely with wholesale market dynamics.

While this transition supports the market integration of renewables and ensures a more sustainable long-term pricing system, it also reduces short-term investor profitability, leading to a temporary slowdown.

Nevertheless, China continues to dominate global solar and wind markets, accounting for nearly half of all offshore wind additions and over 60% of new PSH capacity by 2030.

Over 90% of global solar module production remains concentrated in China, despite diversification efforts in India, the U.S., and Europe.

India

In contrast to other major economies, India’s renewable forecast has been revised up by nearly 10%, driven by record-breaking auction capacity in 2024 and a revival of its onshore wind industry. India’s new rooftop solar support scheme and streamlined permitting for pumped-storage hydropower have bolstered investor confidence.

The IEA projects that India will soon overtake the European Union to become the second-largest renewable energy market after China. The country is also advancing hybrid renewable projects that combine solar, wind, and battery storage.

Policy shifts

In the U.S., the early phase-out of federal tax incentives and other regulatory changes has lowered growth expectations by nearly 50% compared to the previous year’s forecast.

In China, the transition from fixed tariffs to auction-based systems has impacted project economics, resulting in a downward revision of capacity projections. These reductions are partially offset by upward revisions in India, Europe, and developing economies, driven by new policies, increased auction volumes, and the expanded deployment of rooftop solar systems.

Corporate power purchase agreements, utility contracts, and merchant plants are expected to account for about 30% of global renewable capacity expansion by 2030, doubling their share from last year’s forecast.

Solar is projected to remain the most cost-effective option for new power generation in most markets. Meanwhile, wind energy, despite facing near-term supply challenges, is expected to grow significantly as bottlenecks ease, particularly in China, Europe, and India. Hydropower and other renewable technologies will continue to play a vital role in providing grid flexibility and system stability.

Global Auctions

A key trend reshaping global renewable markets is the shift from fixed feed-in tariffs to competitive auctions, which now account for 60% of all new utility-scale capacity additions expected between 2025 and 2030, a dramatic rise from 25% last year.

This shift is most pronounced in China, India, and Europe, where contracts for difference are increasingly being adopted. The U.S. continues to rely on state-level renewable portfolio standards and utility procurement mechanisms.

IEA data from the first half of 2025 show that onshore wind accounted for 33% of global auction volumes, matching solar PV for the first time. However, offshore wind auctions dropped sharply to 2.5 GW, reflecting ongoing cost and financing pressures.

Supply Chain Risks

The IEA warned that supply chains for solar modules and rare earth elements used in wind turbines remain heavily concentrated in China, with key production segments likely to stay over 90% dependent on Chinese manufacturing through 2030.

Although several countries are investing in supply chain diversification, the risk of concentration persists. The report further highlighted that the rapid expansion of variable renewables is creating operational challenges, including grid congestion, curtailment, and negative electricity price events in multiple markets.

It called for urgent investment in grid infrastructure, storage capacity, and flexible generation systems to enable cost-effective integration of renewables.

Limited Gains in Transport

Renewable energy use in transport is projected to increase by 50% by 2030, driven mainly by the adoption of renewable electricity for electric vehicles (EVs) in China and Europe, as well as the growth of biofuels in Brazil, Indonesia, and India.

EVs will make up more than 15% of the global vehicle fleet, primarily through renewable electricity for EVs and biofuels. China and Europe will lead EV-related renewable consumption, while Brazil, Indonesia, India, and Malaysia drive biofuel expansion through stricter mandates.

Biofuels will also play a growing role, with India’s ethanol and biodiesel programs, Indonesia’s B40 mandate, and Brazil’s RenovaBio program reducing oil import dependence.

Overall, global biofuel demand is 50% higher than previously projected, though producers continue to face tight margins due to feedstock costs and policy uncertainty, particularly in North America.

Renewable energy is set to achieve a historic milestone by overtaking coal-fired generation either in 2025 or by 2026 at the latest, according to the International Energy Agency’s Electricity Mid-Year Update 2025.

In August this year, the IEA reported that geothermal capacity has the potential to meet up to 15% of the global electricity demand growth by 2050 with continued technological improvements and a reduction in project costs, in its ‘The Future of Geothermal Energy’ report.