Copper Demand to Rise 24% to 43 MTPA, Tightening Supply: Report

Industrialization in India and Southeast Asia could add 3.3 MTPA of demand by 2035

October 21, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

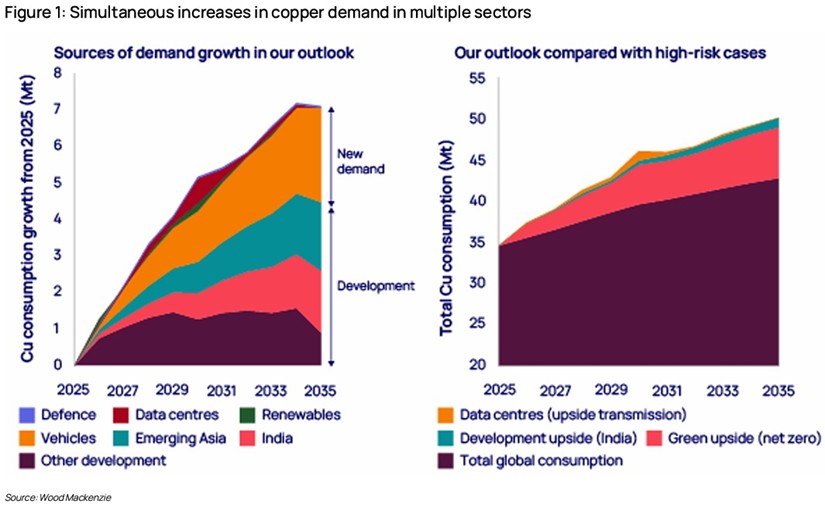

The total demand for copper is forecasted to rise 24% to 42.7 million tons per annum (MTPA) under the base case, largely driven by global economic development and electrification, according to a Wood Mackenzie report.

The report titled “High-wire act: Is soaring copper demand an obstacle to future growth?” said that while steady demand for the metal seems assured, demand shocks might provide significant upside surprises.

The report highlights four major disruptors influencing copper consumption, even as the energy transition progresses slowly. These include the growing demand driven by electric vehicles (EVs), renewable energy, and grid infrastructure; the surge in electricity use from AI-powered data centers; Europe’s €800 billion (approximately $930 billion) military buildup fueling higher defense spending; and the rapid industrialization taking place across India and Southeast Asia.

These disrupting factors are projected to account for a 40% or 3 MTPA combined demand growth by 2035. Traditional economic developments are expected to add an additional 4.5 MTPA.

Critically, technological breakthroughs and policy developments can trigger demand shocks at any time.

The report also mentions other factors that could pose considerable upside risks. A net-zero acceleration could add 4.2 MTPA of additional demand. Industrial activity in India alone could add 2 MTPA from AI centers, and a further 6 MTPA could come from accelerated economic development in Asia.

A 2024 report by the International Energy Forum warned that copper mining may be unable to keep pace with soaring demand for the metal.

The report predicts that after electricity transmission, copper will now play a pivotal role in electricity generation and geopolitics. The shift to renewable energy will need a steady 2 MTPA of additional supply over the next decade. For some countries, this is less about decarbonization and more about energy independence and security.

In 2025, battery and plug-in hybrid EVs have achieved 22% market penetration and are expected to double this share to 44% over the next decade.

EVs consumed 1.7 MTPA in 2025. Another 2.6 MTPA needs to be brought to the market by 2035 to supply the forecasted 4.3 MTPA required by then, corresponding to the 10% expected annual growth over this period.

Data Centers

Wood Mackenzie’s Power team, which tracks global data center projects, forecasts AI consuming an additional 2,200 TWh of energy by 2035. This development would raise copper demand just for grid infrastructure to 1.1 MTPA by 2030.

However, data center developers are mostly indifferent to copper prices since the metal comprises less than 0.5% of the total project costs. In an already constrained market, this could result in sudden demand surges and the intensification of price volatility.

The report states that a single year of doubled buildout could cause price spikes of at least 15%. This could also quickly deplete copper stocks. Commodity markets could lurch dramatically and unpredictably if high-value sectors shrug off input costs.

Copper Surge in Asia

Corresponding to their annual growth of 7.8% and 8.2%, respectively, industrialization in India and Southeast Asia is expected to add 3.3 MTPA of copper demand by 2035. However, the report states that if their development sees even half of China’s development trajectory, the construction industry alone would need an additional 3 MTPA of copper, and the electrical networks would require another 2.4 MTPA.

Wood Mackenzie said the convergence of electrification, AI infrastructure, defense spending, and Asian industrialization creates multiple avenues to a demand explosion for copper. The main challenge for stakeholders will be whether the almost inevitable demand shocks for the metal can be managed individually or if they will occur all at once.

Case for New Investment Models

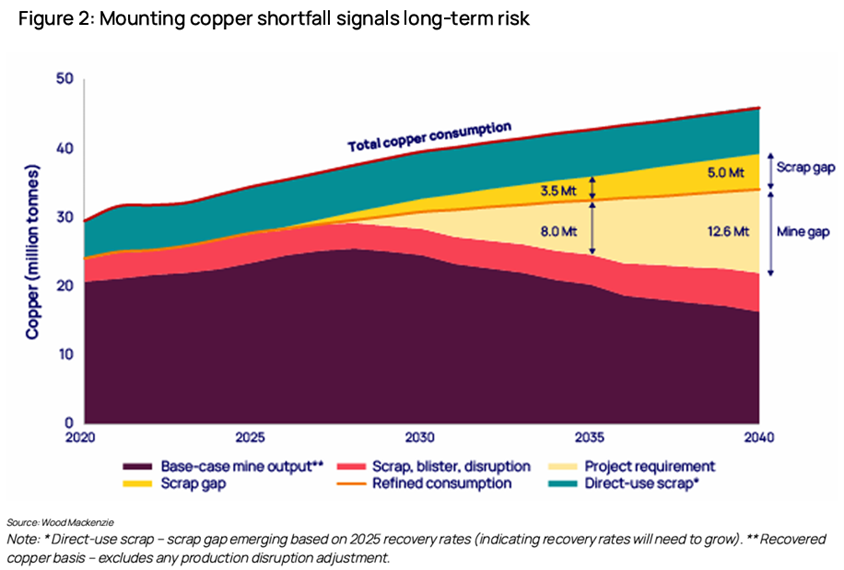

The copper market will require approximately 8 MTPA of new capacity from greenfield and brownfield projects to address the anticipated supply gap over the next decade. It will also need an additional 3.5 MTPA from direct scrap use.

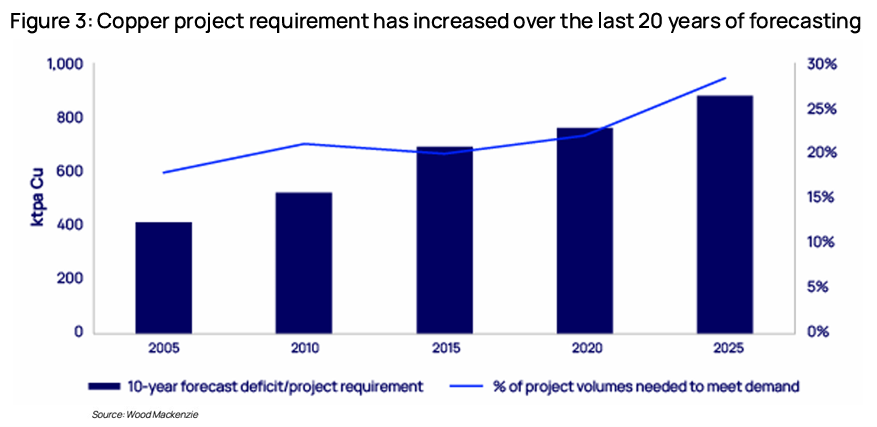

Forecasting for the next twenty years indicates a steady rise of an average of 880 KTPA over the coming decade. This is nearly double the rate from the previous ten years, accounting for an unprecedented projected base-case supply of 28%. Wood Mackenzie expects the total development costs for these projects to exceed $210 billion.

The report highlights a lack of investment and access in copper mine development. It also adds that environmental permits, social opposition, and technical hurdles have posed challenges to many plans and opportunities.

Mine Development Risks

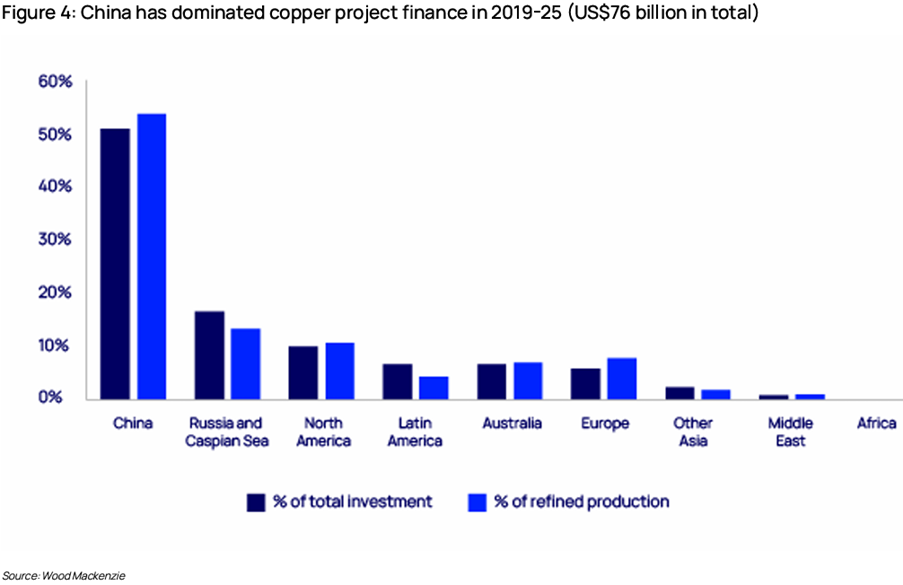

Wood Mackenzie said Western miners are constrained by investor risk appetite and environmental, social, and governance (ESG) pressures. Because of these risks, miners have been tentative about new mine development and prefer the legal protections and regulatory stability of the Organization for Economic Co-operation and Development (OECD) jurisdictions over higher-risk regions.

The report identifies Argentina as a potential site for new mine development, but notes that the country’s political environment may pose challenges. The Democratic Republic of Congo (DRC), another possibility, faces hurdles in the form of cobalt oversupply and export curbs.

In contrast to Western miners, risk-tolerant Chinese, Russian, and other players are advancing into higher-risk, yet resource-rich, African and Central Asian regions and beyond.

Wood Mackenzie states that this expanding shortfall underscores the need for increased output from greenfield and brownfield developments to address the coming supply requirements.

The supply imbalance is expected to rise due to accelerated demand and constrained supply growth, driven by risk aversion, financing bottlenecks, and geopolitical fragmentation, raising serious questions about long-term security and resilience.

Investor appetite for new mine development remains muted despite rising requirements for sustained investment supply. Mining companies are increasingly favoring mergers and acquisitions over riskier greenfield and brownfield operations for achieving greater copper exposure.

Such mergers are considered to build stronger and more sustainable businesses with better cash flow potential for funding future project pipelines. However, the report states that such mergers also reflect a broader investor preference for short-term returns and operational synergies instead of investments in large projects for long-term growth that are capital-intensive.

High Western Hurdles

Miners require billions of dollars to develop large copper projects. Western miners rely on private lenders for this funding, who are imposing increasingly demanding conditions. Such lenders impose strict terms, including stress-tests at copper prices 20% to 30% below forecasts, and require high equity contributions for greenfield projects (specifically from smaller firms), as well as stringent ESG compliance.

Such constraints not only increase costs but also discourage investments in politically volatile jurisdictions holding some of the richest undeveloped deposits, such as in the DRC.

In contrast, Chinese state-owned companies such as China Molybdenum have access to low-cost and long-term loans from policy banks, including China Exim Bank and China Development Bank. They operate under national strategic mandates rather than pure profit metrics.

These enterprises accept higher political risk, utilize infrastructure-for-resources deals, and act quickly without shareholder interference. The report states that China has dominated the DRC’s copper and cobalt production through this approach.

Chinese firms are continuing to integrate mining, refining, and manufacturing in high-risk jurisdictions. This is helping the country gain greater control over future copper supply chains.

China accounts for over half of the global demand for copper and other critical minerals such as lithium, nickel, cobalt, graphite, and magnet rare earth elements, according to an IEA report.

Resource-backed competition from Russia and oil-rich Middle Eastern countries is increasing.

Additionally, even when Western miners push forward, they face numerous challenges, including high project costs, financing complexity, reliance on multilateral support, geopolitical risks, increased financing costs, and issues common to other capital-intensive sectors.

Geopolitical Disruptions

The report noted that U.S. President Trump’s recent tariffs add to the miner’s investment uncertainty.

From a Western capital market perspective, despite the recent increase, copper prices remain too low to incentivize at the required investment scale. Project incentive prices may need to exceed $11,000/ton ($5/lb), or 10% above the current levels, to accelerate copper mine development. This would account for the environmental, technical, or permitting challenges, as well as the dollar’s strength.