EU Installs 27.1 GWh Battery Storage in 2025, Utility-Scale Leads Growth

SolarPower Europe flags 10x scale-up needed to hit 2030 goal

February 13, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

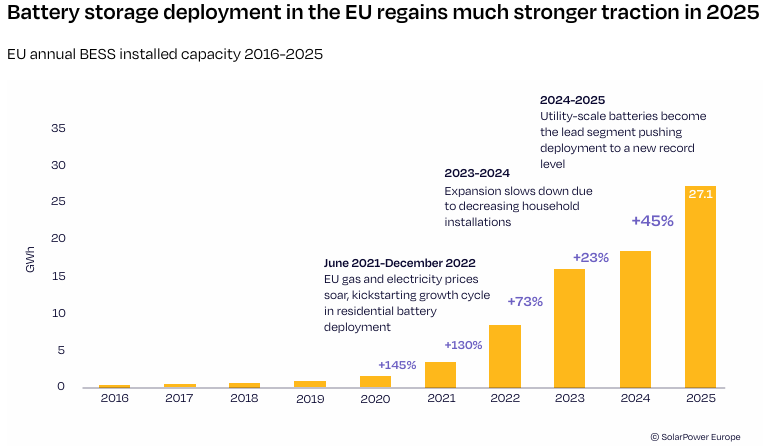

The European Union (EU) has installed 27.1 GWh of new battery storage capacity in 2025, marking a 45% year-over-year (YoY) increase and the bloc’s 12th consecutive record year, according to SolarPower Europe’s EU Battery Storage Market Review 2025.

In 2024, Europe’s battery energy storage market had grown by 15%.

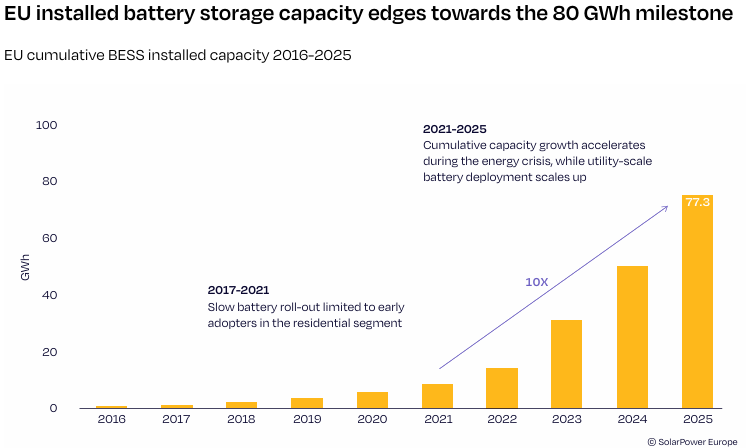

The additions bring the cumulative EU battery fleet to 77.3 GWh by the end of 2025, representing a tenfold increase since 2021, when total capacity stood at 7.8 GWh. Utility-scale systems accounted for 15 GWh of new installations, or 55% of annual additions, becoming the main driver of market growth for the first time.

Residential installations declined 6% YoY to 9.8 GWh, marking the second consecutive annual contraction, while commercial and industrial (C&I) systems grew 31% to 2.3 GWh but remained a smaller segment with 8% of annual additions.

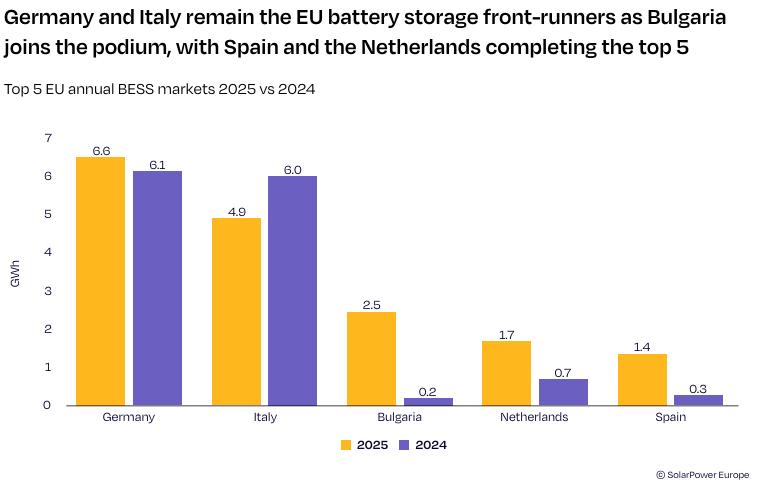

Ten EU Member States exceeded 1 GWh of annual deployment in 2025, compared to four in 2024.

Leading Countries

Germany led installations with 6.6 GWh, followed by Italy with 4.9 GWh, Bulgaria with 2.5 GWh, the Netherlands with 1.7 GWh, and Spain with 1.4 GWh. These five markets accounted for 63% of total EU additions.

Bulgaria recorded 1,200% YoY growth, largely supported by EU funding, while the Netherlands grew 149% amid high price volatility and the phase-out of net metering. Spain’s installations rose 399% YoY, while its residential segment fell 60%.

Italy’s overall market declined 18%, with residential installations dropping 40% despite a capacity market and the MACSE auction being oversubscribed four times. Germany’s merchant utility-scale market remained strong, but grid connection queues exceeded 700 GW, highlighting bottlenecks.

Flexibility Pressures

The report links battery growth to rising system flexibility needs. EU solar installations reached 65.1 GW in 2025, down 0.7%, marking the first annual decline in a decade.

Negative power prices occurred during 3.4% of hours in 2025, equivalent to around 310 hours, with the Netherlands, Spain, and Germany each recording 540 negative price hours.

Solar capture rates between January and September 2025 were 58% in Germany and 52% in Spain. Spain curtailed more than 5 TWh of solar generation in 2025, nearly double the previous year, and experienced a major blackout in April 2025 that exposed system vulnerabilities.

EU flexibility needs are projected to increase from 325 TWh in 2021 to 1,608 TWh by 2030, a fivefold rise, with batteries expected to supply 810 TWh as the main provider of daily flexibility.

By 2030, 40% of EU electricity demand is expected to require flexible resources. Solar cannibalization effects, merchant revenue volatility, grid congestion, and overreliance on gas for balancing remain risks to system stability and project bankability.

Manufacturing Capacity

Europe reached approximately 252 GWh of nominal battery cell production capacity in 2025. However, 92% of this capacity is focused on electric vehicles rather than stationary storage applications.

Around 70% of the European production is based on nickel-rich chemistries such as NMC and NCA, while 29% is lithium iron phosphate (LFP). The report notes that Europe has strong capabilities in electrolyte and separator production but faces structural gaps in the manufacturing of cathode and anode active materials.

The EU imports roughly 50% of its battery demand. Production costs remain around 50% higher than in China, although the price premium has narrowed to about 30%.

Europe attracted €33 billion (~$39.29 billion) in battery factory investments, supported in part by the Innovation Fund, which allocated €1 billion (~$1.19 billion) in grants and €1.5 billion (~$1.79 billion) in loans under the Battery Booster initiative.

Technology and Financial Trends

Utility- scale battery energy storage systems (BESS) are increasingly co-located with solar. Hybrid solar plus storage projects accounted for 15% of grid-scale BESS in 2025, up from less than 10% in 2024, although co-location still accounted for 14% of EU utility storage, compared to 31% in the U.S.

Turnkey battery system prices declined to around €200 (~$238.09)/kWh, and the levelized cost of storage (LCOS) for new projects fell below $60/MWh, supporting merchant business models.

LFP chemistry adoption continued to rise, and higher-capacity cell formats are replacing 314Ah cells. Digitalization, ESG traceability, and battery passports are gaining importance. The report notes a transition from oversupply to a tighter balance between supply and demand for cells by late 2025.

For 2026, the report projects utility-scale additions to reach approximately 13 GW, about 50% higher than in 2025, with C&I expected to grow 33% and residential installations forecast to rebound by 18%.

Policy and 2030 Targets

SolarPower Europe states that the EU must scale battery storage capacity to around 750 GWh by 2030 to meet system needs, requiring another tenfold increase from current levels.

Key policy priorities include faster permitting, elimination of double charging, milestone-based prioritization of grid connection queues, improved access to capacity mechanisms for BESS, and coordinated raw-material strategies under the Critical Raw Materials Act.

The report warns that, without accelerated deployment of flexibility, the EU risks missing its 2030 solar targets. Total renewable energy investment in the EU reached €200 billion (~$238.09 billion) in 2025, compared to €435 billion (~$517.85 billion) in China.

The UK, though outside the EU, installed 5 GWh in 2025 and is approaching 20 GW of operational battery capacity, with grid reforms removing 150 GW from connection queues.

The report said sustained deployment, supply chain integration, and regulatory reform will determine whether the EU can deliver the required 750 GWh battery fleet by the end of the decade.