Corporate Solar Funding Down 16% YoY in 2025; Deal Count Rises, M&A Robust

Venture capital and private equity funding stood at $3.5 billion in 2025

January 22, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

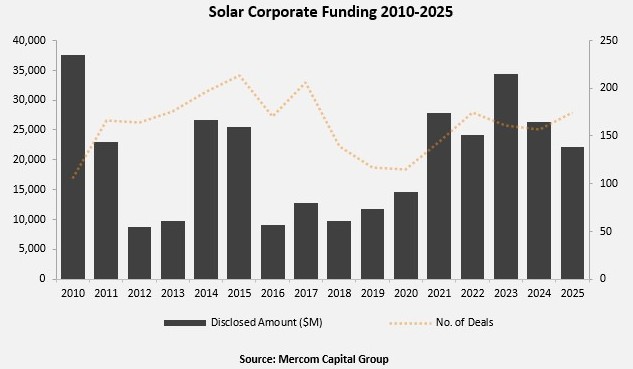

The total global corporate solar funding dropped by 16% year-over-year (YoY) with $22.2 billion raised in 175 deals, compared to $26.3 billion in 157 deals in 2024, according to Mercom Capital Group’s newly released 2025 Annual and Q4 Solar Funding and M&A Report.

“Since the Trump administration took office in Q1 2025, the U.S. clean energy sector has operated under continued uncertainty. The announcement of the One Big Beautiful Bill in Q2 added near-term disruption, but greater clarity began to emerge by Q3. Despite a decline in overall solar funding, more deals were signed in 2025 than in 2024, as investors shifted toward smaller, lower-risk transactions. Overall funding activity remained resilient, supported by sustained interest in solar driven by rising U.S. power demand, particularly from AI-driven data centers,” said Raj Prabhu, CEO of Mercom Capital Group.

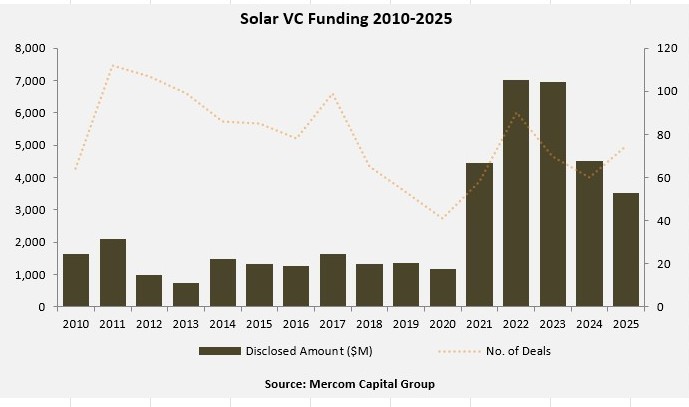

Global venture capital (VC) and private equity funding in the solar sector totaled $3.5 billion across 75 deals in 2025, 22% lower than the $4.5 billion raised in 60 deals in the previous year.

There were eight VC funding deals of at least $100 million in 2025.

Of the $3.5 billion raised in VC funding in 75 deals in 2025, $2.7 billion (77%) went to solar downstream companies.

Solar companies raised $581 million; balance-of-system companies raised $99 million; thin-film companies raised $51 million; manufacturers raised $46 million; service providers raised $16 million; and concentrated solar power (CSP) companies raised $6 million.

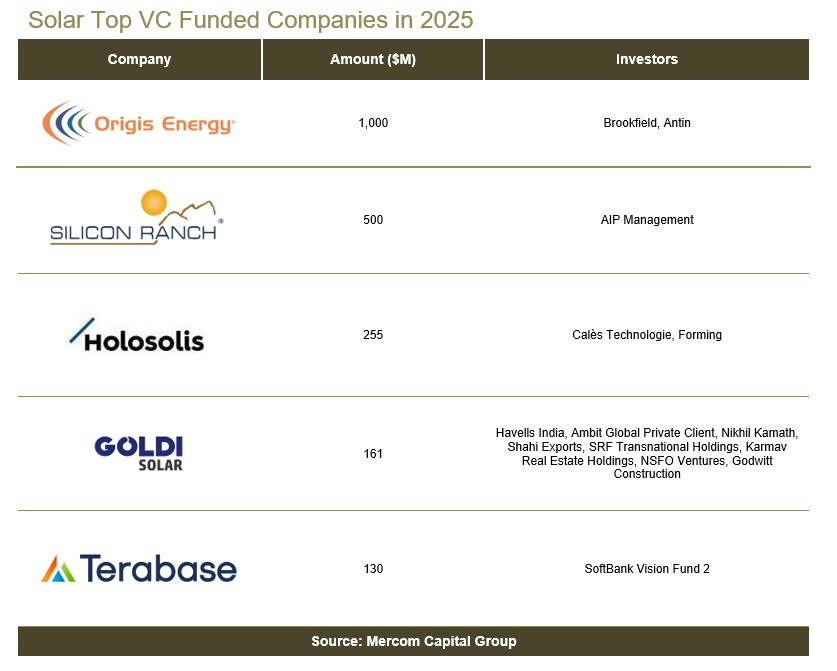

The top VC-funded companies in 2025 were Origis Energy ($1 billion), Silicon Ranch ($500 million), HoloSolis ($255 million), Goldi Solar ($161 million), and Terabase Energy ($130 million).

Public market financing in the solar sector in 2025 totaled $2.6 billion, 13% lower than the $3 billion raised in 2024. Nine companies went public in 2025, raising $926 million, compared to 2024, when 9 companies raised $1.3 billion.

In 2025, announced debt financing totaled $16.1 billion, 14% lower than $18.8 billion in 2024, and securitization deals totaled $3.4 billion across nine deals.

Mergers and Acquisitions (M&A) activity was 17% higher YoY in 2025, with 96 corporate M&A transactions, up from 82 in 2024.

The largest transaction was by Ares Management Corporation (Ares), which announced that Ares Alternative Credit funds (Ares Alternative Credit) and other affiliated Ares funds have completed the acquisition of a 20% stake in Plenitude for $2.3 billion at an implied enterprise value of over $13.8 billion.

Plenitude is a subsidiary of Eni Renewable Energy that develops, owns, and operates utility-scale solar projects, integrating solar generation with clean power retail and electric mobility solutions.

Prabhu noted that despite a decline in global corporate solar funding, M&A activity increased and remained consistent throughout the year. “Even with lower funding levels across the solar sector, M&A activity stayed strong as buyers were able to secure better deals at more attractive valuations. Delays in interconnection approvals further increased demand for assets at advanced stages of development or already under construction,” he said.

Solar downstream companies led corporate M&A activity in 2025, acquiring 72 companies, followed by manufacturers with nine transactions and balance-of-system companies with five.

Equipment and service provider companies completed three M&A transactions each, materials companies two, and solar and CSP companies completed one M&A transaction each.

The number of large-scale solar project acquisitions in 2025 increased by 13% to 246 from 217 in 2024. The total acquired capacity dropped to 37.4 GW, a 1% decrease compared to 37.7 GW the previous year.

Of the 37.4 GW of large-scale solar projects acquired in 2025, 52% were acquired by project developers and independent power producers.

Investment firms accounted for 24.5% of total large-scale project acquisitions, followed by others (energy trading companies, industrial conglomerates, energy cooperatives, mining, and IT firms) at 12.5% in 2025.

Utilities, oil and gas companies, installers, and manufacturers acquired the remaining 11% of large-scale projects.

Providing an outlook for 2026, Prabhu added that Project M&A increasingly gravitated toward late-stage and operating assets. Grid constraints, long interconnection queues, and permitting delays increased the premium on assets with secured interconnection and permits. As a result, project M&A remained one of the more resilient pockets of solar investment in 2025, even as other financing and corporate M&A activity slowed.

Three hundred and ninety companies and investors are covered in this 161-page report, which contains 110 charts, graphs, and tables.

To learn more about Mercom’s 2025 Annual and Q4 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/annual-and-q4-2025-solar-funding-and-ma-report