Big Push for Solar, EVs, Critical Minerals and Strategic Manufacturing in Budget 2026

The Budget adds 35 capital goods for EV battery manufacturing to the duty-exempt list

February 1, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The Union Budget 2026–27 has placed clean energy and manufacturing at the center of India’s growth strategy, unveiling targeted outlays, customs duty rationalization, and policy reforms to accelerate renewables, electric vehicles (EVs), critical minerals, and semiconductor manufacturing.

The Budget, presented to Parliament by Finance Minister Nirmala Sitharaman, reinforces the government’s heavy reliance on solar-led deployment, with higher allocations for rooftop systems and farm solarization, while spending on wind, bioenergy, and grid infrastructure remains largely flat.

She noted that the power sector is among the six focus domains for India’s growth potential and global competitiveness during the next five years.

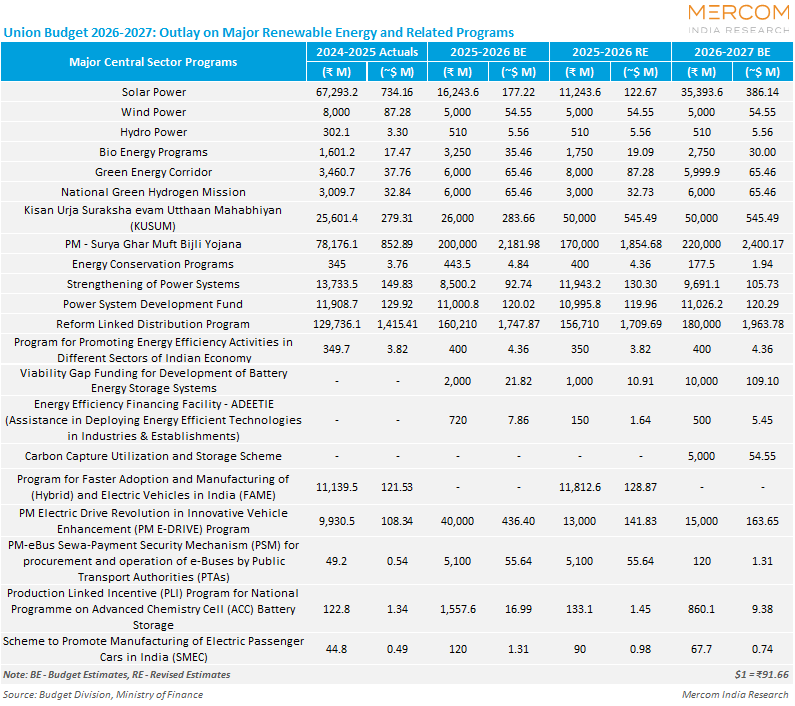

Allocations

The allocation for the solar sector has increased from ₹242.24 billion (~$2.64 billion) in 2025 to ₹305.39 billion (~$3.33 billion) this year.

The outlay for the Pradhan Mantri Krishi Urja Suraksha evam Utthaan Mahabhiyaan (PM KUSUM) program has gone up from ₹26 billion (~$283.57 million) last year to ₹50 billion (~$545.33 million) in Budget 2026.

The flagship PM Surya Ghar: Muft Bijli Yojana continues to dominate the allocations, with spending set to rise from ₹200 billion (~$2.18 billion) to ₹220 billion (~$2.39 billion).

The PM Surya Ghar aims to install rooftop solar in 10 million households by 2027. In December, the program had reached 2,396,497 residential households, achieving nearly 24% of the target.

The Ministry of New and Renewable Energy (MNRE) has been allocated ₹329.14 billion (~$3.59 billion, up 24% from ₹265.49 billion (~$2.89 billion) in last year’s Budget.

Outlays for wind and other renewable energy programs remains flat at ₹5.51 billion (~$60.09 million).

The National Green Hydrogen Mission’s funding is doubled from the revised outlay of ₹3 billion (~$32.72 million) in FY 2025-26 to ₹6 billion (~$65.44 million) in the latest Budget.

The allocation for the bio-energy program has been set at ₹2.75 billion, down from ₹3.25 billion in FY 2025-26.

The proposed spending on the crucial Green Energy Corridor (GEC) program for interstate power transmission has remained the same. The allocation for GEC in FY 2026-27 is ₹5.99 billion (~$65.33 million), compared with the Budget allocation of ₹6 billion (~$65.44 million) in FY 2025-26 and the revised estimate of ₹8 billion (~$87.25 million).

In her speech, the Finance Minister identified ensuring long-term energy security and stability as one of the ‘kartavyas’ (duties) to accelerate and sustain economic growth.

Electric Vehicles: Battery Ecosystem Gets Policy Support

Electric mobility has received a clear fiscal boost through customs duty exemptions that lower manufacturing costs. The Budget adds 35 capital goods for EV battery manufacturing and 28 capital goods for mobile phone battery manufacturing to the duty-exempt list.

The extension of Basic Customs Duty exemption on capital goods used for manufacturing lithium-ion cells for batteries used in battery energy storage systems (BESS) is likely to reduce the capital expenditure for cell manufacturing and BESS projects.

In addition, customs duties on lithium-ion (Li-ion) battery waste and scrap have been fully exempted, supporting both domestic manufacturing and recycling. These measures are intended to strengthen India’s battery supply chain, a critical bottleneck for large-scale EV adoption.

Critical Minerals

Budget 2026 takes a strategic view of raw material security by fully exempting customs duties on cobalt powder, lithium-ion battery scrap, and waste and scrap of lead and zinc, among other critical minerals.

A program for rare-earth permanent magnets was launched in 2025. The government now proposes to support the mineral-rich states of Odisha, Kerala, Andhra Pradesh, and Tamil Nadu in establishing dedicated rare-earth corridors.

Further, a policy to recover critical minerals from mining tailings has been announced, signalling a move towards resource efficiency and circular economy practices. Together, these steps aim to ensure stable access to inputs essential for renewables, EVs, and electronics manufacturing.

Carbon Capture Utilization

Budget 2026 has also proposed a program to adopt Carbon Capture Utilization and Storage (CCUS) with an outlay of ₹200 billion (~$2.18 billion). This is expected to help decarbonization of key hard-to-abate sectors.

Duty Cuts on Solar Cells and Modules

Under the proposed National Manufacturing Mission, clean-tech manufacturing will be supported across solar cells, wind turbines, grid-scale batteries, electrolyzers, and very high-voltage transmission equipment.

On the trade side, the Budget rationalizes customs duties to correct inverted duty structures. Effective duties on solar modules have been reduced to 20%, while duties on solar cells have also been lowered through a rebalancing of Basic Customs Duty (BCD) and cess. These measures aim to improve cost competitiveness while sustaining incentives for local manufacturing.

The Finance Minister also announced the exemption of BCD on the import of sodium antimonate for use in the manufacture of solar glass.

Power Sector Reforms

On power sector reforms, Sitharaman said, “We will incentivize electricity distribution reforms and augmentation of intrastate transmission capacity by states. This will improve the financial health and capacity of electricity companies. Additional borrowing of 0.5% of the Gross State Domestic Product (GSDP) will be allowed to States, contingent on these reforms.”

The government has allocated ₹180 billion (~$1.96 billion) for the reforms-linked distribution program from ₹160.2 billion (~$1.72 billion) allocated in Budget 2025.

Also, to achieve scale and improve efficiency in public sector non-banking financial companies, the Finance Minister proposed, as a first step, restructuring the Power Finance Corporation and the Rural Electrification Corporation. Renewable energy projects are beneficiaries of significant lending from these agencies.

Green Energy Infrastructure

Recognizing that renewable capacity growth must be backed by system reliability, Budget 2026 extends policy support to energy storage and transmission infrastructure. Grid-scale batteries and advanced transmission equipment have been identified as priority manufacturing segments under the clean-tech framework.

The Finance Minister announced the introduction of the Infrastructure Risk Guarantee Fund to provide partial credit guarantees to lenders, improving bankability and debt access for large grid-scale and standalone BESS projects.

In parallel, the government announced a Nuclear Energy Mission with a long-term target of 100 GW of nuclear capacity by 2047. An outlay of ₹200 billion (~$2.18 billion) has been earmarked for research and development of Small Modular Reactors (SMRs), with at least five indigenously developed SMRs to be operational by 2033. While nuclear is not renewable, it is positioned as a low-carbon complement to solar and wind.

Semiconductors and Electronics

Semiconductors and electronic components, which underpin EVs, renewable energy systems, and grid technologies, continue to receive policy attention. The Budget corrects inverted duty structures by raising customs duty on finished electronic goods, such as interactive flat panel displays, to 20%, while reducing duties on open cells and key components to 5% or nil.

The industry has reacted positively to the Budget, with stakeholders saying it positions manufacturing at the heart of India’s energy transition. By extending customs duty exemptions for batteries, energy storage systems, critical mineral processing, and nuclear infrastructure, they say the government has provided long-term policy certainty that will accelerate global-scale manufacturing in India.

Subscribe to Mercom’s real-time Regulatory Updates to ensure you don’t miss any critical updates from the renewable industry.