Will Antidumping Duties on Cells Spark a New Wave of Solar Investment in India?

Manufacturers expect a short-term supply crunch for modules

October 13, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The recent recommendation by the Directorate General of Trade Remedies (DGTR) to impose an antidumping duty of up to 30% on Chinese solar cells is likely to boost the domestic solar cell manufacturing sector.

The antidumping duty recommendation also applies to modules using solar cells, originating in or exported from China. The DGTR has proposed to impose the duty for three years.

Despite the challenges of cell supply crunches and rising module costs, both module and cell manufacturers have welcomed the move toward developing a more resilient domestic solar industry.

Solar cell manufacturers believe that the duty, combined with the Approved List of Models and Manufacturers (ALMM-II) mandate for cells, will lend the same confidence that ALMM-I gave to module manufacturers.

They believe that with reduced competition from cheaper Chinese solar cells in the market, manufacturers will gain more confidence in setting up larger cell capacities in the future.

Are Antidumping Duties Needed?

Kamini Gupta, Communication Manager at AXITEC Energy India, stated that the request for the duty was driven by Indian manufacturers’ difficulty in competing with low-priced cells from China.

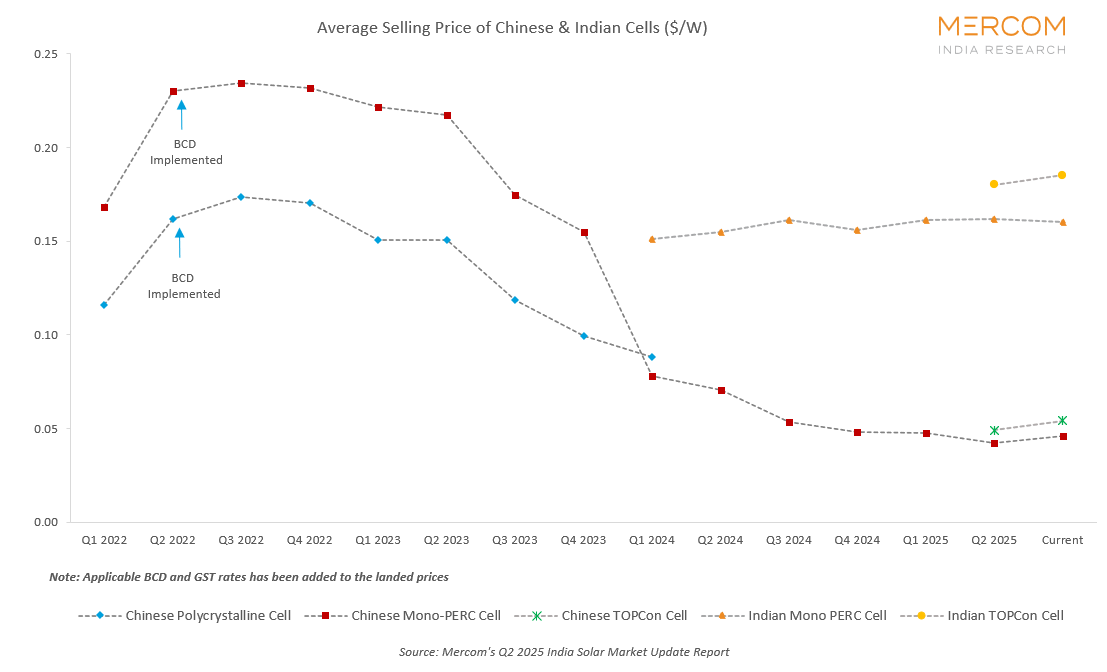

“The steep fall in Chinese prices, often 50% or more in recent years, was pressuring local manufacturers. The duty isn’t about closing doors to trade; it’s about ensuring that Indian companies can operate on a level playing field without being forced to sell below cost.”

Avinash Hiranandani, Vice Chairman and Managing Director at RenewSys India, attributed the huge dumping margins for Chinese solar cells to the fact that China is probably struggling with overcapacity.

He added that China continues to dump goods into the India market while Indian cell manufacturers are investing billions into setting up facilities without any safety net.

Cost Impact

Module manufacturers say that utility-scale projects and open access installations, which heavily depend on competitively priced modules, are likely to experience a short-term cost impact.

Gupta added that rooftop solar, particularly in the residential and commercial & industrial (C&I) segments, could also see some price adjustments. “Government-driven projects that mandate domestic content requirement (DCR)-compliant modules are relatively insulated, since they already rely on domestically manufactured cells and modules.”

Gautam Mohanka, Director at Gautam Solar, stated that India’s domestic market has just begun to gain momentum, and many manufacturers are currently scaling or expanding their production capacity, which requires a substantial amount of capital. Antidumping duty will provide domestic players with much-needed sales growth and enhance their cash flow.

While module manufacturers predict some short-term issues in the supply chain, they expect these issues to be resolved once they achieve economies of scale.

Hiranandani said that while the duty is likely to create hurdles for module manufacturers in the short run, it will, however, provide more confidence for the growth of the upstream ecosystem. “At present, India still lacks sufficient capacity, but new capacities are coming up. The duty will encourage more investments in cell and module manufacturing, including upstream expansion into wafers and ingots.”

As more domestic cell lines become operational, India’s reliance on Chinese cell imports will decline significantly by 2027–2028.

Manufacturers say that the imposition of the antidumping duty will also lead to a decline in imports of Chinese modules.

While the ALMM-II will mandate the use of solar cells for modules in most projects from June 2026, Hiranandani stated that the antidumping duties could serve as an additional layer of protection for cell manufacturers.

Vinay Rustagi, Chief Business Officer at Premier Energies, stated that despite ALMM, imports of cells and modules have continued to be strong, as many projects have exemptions. He added that there have been reports of imported cells and modules being used fraudulently in place of Indian products.

“The additional duty is meant as a further protection against imports. As we have seen, basic customs duty has not been a sufficient deterrent, as the Chinese companies have absorbed that and continued to lower their prices.”

Rustagi said imports are expected to decline drastically over the next three years anyway, so there should be no adverse material effect on consumers.

However, he said the industry is waiting for the final approval from the Ministry of Finance to see what duties are levied and on whom.

Project developers also expect short-term cost escalations but anticipate that this will normalize once domestic cell manufacturing capacities scale up.

Manish Mehta, Co-Founder and Chief Commercial Officer at Sunsure Energy, stated that project costs are expected to rise by ₹1.3 (~$0.014)/W due to higher input costs for module manufacturing, as a large proportion of domestic module makers currently rely on imported Chinese cells.

Pricing of DCR Vs Chinese Modules

In its final report investigating the impact of Chinese imports on the solar sector, the DGTR noted that domestic manufacturers were forced to sell at a loss below the cost price. With the reduced competition, module prices are expected to increase slightly in the short term.

Hiranandani said that even after the market correction, there won’t be a significant difference in module prices. “While the Goods and Services Tax (GST) rate change dropped module prices by ₹1 (~$0.011)/W, the antidumping duty will increase the module prices by the same amount.”

However, Hiranandani noted that even with the imposition of the 30% duty, Chinese cells would be three times cheaper than domestic solar cells.

Gupta also concurred that even with duty, Chinese cells may still appear slightly cheaper in some cases, given the scale of production and subsidies in China.

However, Mohanka noted the era of rock-bottom prices for solar cells and solar modules will end in Q3. “The antidumping duties have come at a very critical time, as Chinese manufacturers are experiencing narrow margins with export rebate slashes and rising costs of raw materials like silicon. Additionally, supply chain constraints and rising domestic production costs in China are limiting their ability to reduce prices further. In other words, reducing the cost of solar cells or modules any further will most likely be impossible for Chinese players.”

Hiranandani also believes that Chinese players dumping solar cells in the Indian market are unlikely to reduce their prices further to be competitive due to the Chinese Involution law pushing its manufacturers to sell at cost and reduce subsidies disbursed to Chinese companies.

He added that with the reduction of Chinese subsidies, the price of solar cells is likely to increase by up to 7% in the coming months.

Gupta said that whether Chinese companies will further reduce prices remains to be seen, but there is a limit to how much they can lower costs before it becomes unsustainable.”

Mohanka said that the margins in solar manufacturing are quite low, and for a short while, solar module manufacturers will have to restructure their finances and budgets to accommodate the impending rise in costs.

However, he added that in the long run, as domestic production strengthens and scales, the cost of indigenous solar modules will decrease, making India more self-reliant.

Another module and cell manufacturer stated that the industry is in a wait-and-see mode regarding the pricing of Chinese cells compared to DCR cells. He noted that in the past, it has also been difficult to estimate the prices of Chinese cells, both before and after duty.

Supply Chain Issues

While the manufacturers attempt to bridge the gap between solar and module capacities, module supplies could be impacted for up to six months.

According to Mercom India Research’s “State of Solar PV Manufacturing in India 1H 2025” report, India added 44.2 GW of solar module manufacturing capacity and 7.5 GW of solar cell capacity in the first half of 2025.

Indian manufacturers currently have 182 GW of solar module capacity and 86 GW of cell capacity under construction and expected to be commissioned by 2027.

Gupta noted that there could be a temporary strain since module capacity in India has grown faster than cell capacity. She added that the gap is already being addressed through planned expansions.

Milan Tank, Senior Manager (Sales and Business Development) at Redren Energy, said that several manufacturers, including Redren Solar, are expanding their module capacities and investing in new cell facilities. “Redren plans to double its module manufacturing capacity from 1.6 GW to 3.2 GW and establish a 2 GW cell production line by 2027.”

Need for Countervailing Duties

Module manufacturers say that discussions have been ongoing in the industry regarding countervailing duties (CVD), but the focus is currently on antidumping duties.

Mohanka stated that the DGTR has frequently recommended CVD on Chinese cells; however, these recommendations are yet to be approved by the Finance Ministry. “It is important to understand that such measures require considerable deliberation, wherein international trade policies of internal agreements within the WTO and other treaties must be balanced with the nation’s interests in supporting domestic players.”

Possibility of Trade Diversions

Manufacturers also raise concerns that Chinese manufacturers may circumvent the antidumping duty by routing their exports through Southeast Asian countries like Vietnam and Malaysia.

However, the manufacturers believe the scope of implementing such practices is limited, given the stringent investigative measures employed by India to promote domestic manufacturing.

He added that Indian governing bodies have successfully recognized exports from Chinese manufacturers operating through third countries to evade antidumping duties and other tariffs, and are devising policy frameworks to address this issue effectively.

Tank noted that relocating large-scale production to other countries also entails significant costs and time, potentially deterring Chinese companies.

The imposition of antidumping duties is expected to drive larger capacity additions in cell manufacturing, backed by the ALMM List-II for cells.