Utility-Scale Solar Projects Comprised 54% of New Capacity in the U.S. in 2024

Annual utility-scale solar capacity additions rose to 30 GW

October 24, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Utility-scale projects in the U.S. remained the primary contributor to solar expansion in 2024, accounting for 80% of new solar and 54% of all new capacity additions, according to a report by Lawrence Berkeley National Laboratory (LBL).

LBL’s Utility-Scale Solar 2025 update considers projects of at least 5 MW capacity as utility-scale solar.

Utility-Scale Deployment

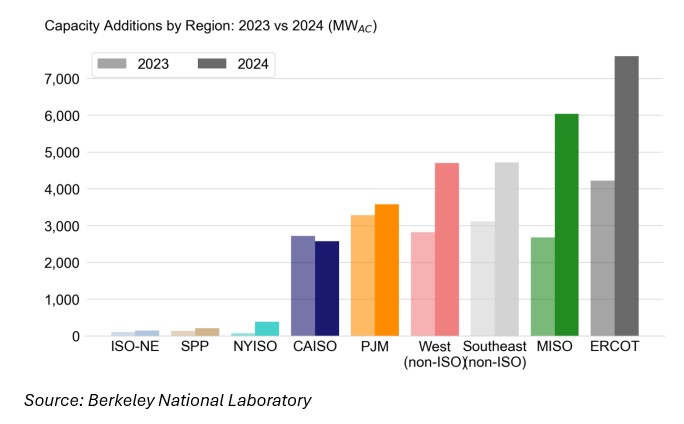

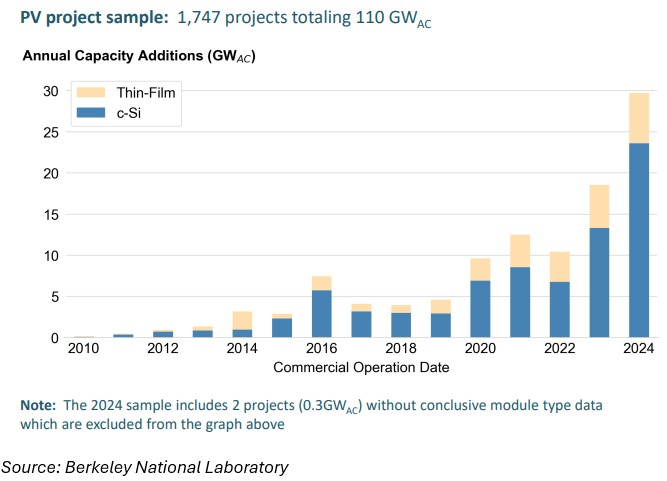

Annual utility-scale capacity additions in the U.S. rose to 30 GW in 2024, rising 56% from 19 GW in the previous year.

However, the report stated that the new capacity is not uniformly spread across the U.S. The growth is concentrated in the Electric Reliability Council of Texas (ERCOT), with 7.6 GW, the Midcontinent Independent System Operator (MISO), with 6 GW, and the non-Independent System Operator (ISO) West and Southeast, both with 4.7 GW.

Between 2023 and 2024, solar performance remained relatively stable with regional variations. Non-ISO West’s capacity factor was 11% points higher than that of the New York Independent System Operator (NYISO).

Average Solar Generation Costs

The national average levelized cost of energy (LCOE) for standalone solar was impacted by higher financing costs, increasing CAPEX, and slightly lower estimated performance. The levelized cost of energy (LCOE) for this segment increased by 13% from $53/MWh in 2023 to $60/MWh in 2024 (without tax credits).

Considering available tax credits, including the Investment Tax Credits, Production Tax Credit, and energy community bonus, the LCOE rose from $36 to $41/MWh.

According to the report, the average LCOE ranged from $31 in the non-ISO West to $77/MWh in NYISO (with tax credits). Regional differences in performance and capital expenditure drove these prices.

PPA Prices

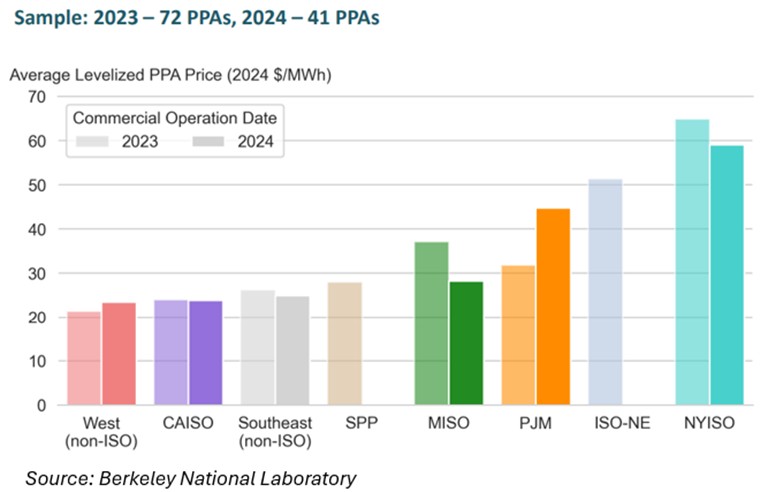

Power purchase agreement (PPA) prices for utility-scale solar projects coming online in 2024 ranged from $22/MWh to $40/MWh, with wide differences across regions. These prices reflect the bundled price of electricity and renewable energy certificates (RECs) sold by the project owner. Lawrence Berkeley said project PPAs in its sample commencing operations in 2024 had average levelized prices of $29/MWh, rising 14% from 2023. This increase was driven by the sample shifting to higher-priced regions. NYISO had the highest average price in 2024 at $59/MWh. Non-ISO West had the lowest average prices of $24/MWh.

Capacity and Net Values

According to the report, solar’s wholesale energy and capacity values declined by 35%, from $48/MWh to $32/MWh, below generation costs for recent projects. This price reduction was caused by declining natural gas prices, fewer summer heat waves, and rising solar penetration.

California Independent System Operator (CAISO) had 30% solar penetration and the lowest standalone solar value of $18/MWh. High capacity values in the Southwest Power Pool (SPP) supported greater prices of $60/MWh.

Solar Plus Battery Project Costs

Interest in hybrid solar-plus-storage systems continued to rise in 2024, with 33 new projects announced during the year. Battery capital costs climbed to $458/kWh from $381/kWh in 2023.

For PV-plus-storage systems, added costs increased with higher storage capacity ratios (0.57) and longer durations (around 3.3 hours), reaching $1/WAC-PV in 2024, translating to an estimated LCOE adder of $25/MWh (post tax credits) or $36/MWh (before tax credits)

In 2024, capital costs of new solar-battery hybrid projects remained roughly flat at $2.5/W.

Fourteen existing and 35 new solar projects added storage in 2024. Solar-rich non-ISO West added the highest battery capacity, coupled with 1,905 MW of solar projects. It was followed by CAISO adding 1,465 MW.

Capacity in Interconnection Queues

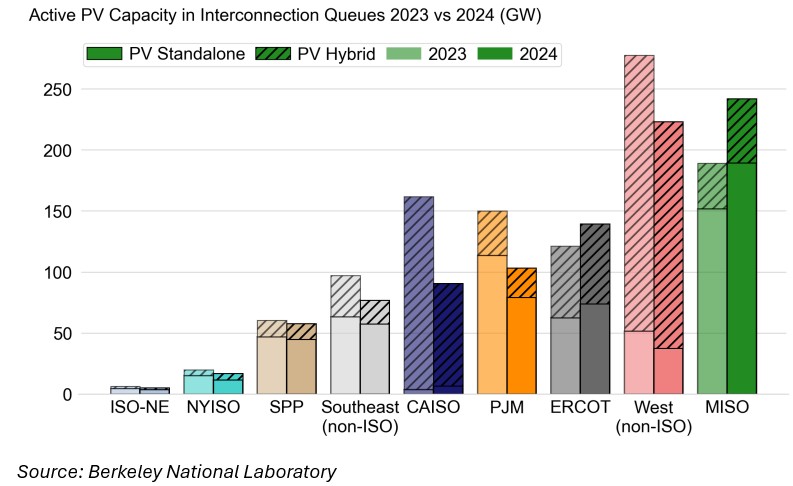

Active solar capacity in interconnection queues decreased 12% to 956 GW.

Seven out of nine regions had contracting interconnection queues as a potential early outcome of the Federal Energy Regulatory Commission’s 2023 reforms. In 2024, 164 GW of solar capacity entered the queues (with the remaining capacity entering in previous years).

Across the U.S., 452 GW of queued solar capacity includes 47% battery capacity. The report states that hybridization is more common in regions with greater solar deployment, including CAISO (93%) and non-ISO West (83%).

Utility-Scale Projects by Region

In 2024, utility-scale and distributed solar projects accounted for a combined 67% of all solar capacity added to U.S. grids, contributing 54% and 13% respectively. Utility-scale solar capacity additions over the last seven months of 2025 are on par with the same period in 2024.

California and Nevada’s utility-scale solar market share was more than 19% of in-state generation. This generation exceeded 9% in North Carolina, Massachusetts, D.C., New Mexico, and Utah.

Utility-scale solar is present in all states except North Dakota and New Hampshire.

Texas added the most capacity with 7.7 GW, followed by Florida with 3.2 GW, California with 2.5 GW, Illinois with 1.6 GW, and Ohio with 1.5 GW. Ine states added over 1 GW of new capacity.

West Virginia added its first large-scale solar project, of up to 80 MW, in 2024. Missouri, Nebraska, Oklahoma, and Kentucky led 14 states to more than double their solar capacity during the year.

New Solar Projects

New solar projects have an average capacity of 120 MW, which is 40% larger than in 2023. In 2024, 52 projects with over 200 MW capacity came online.

The Gemini solar project, with a capacity of 690 MW, built in Nevada during the year, is the largest to date. Several projects with capacities larger than 1 GW are also in the pipeline.

Nearly all new projects chose single-axis tracking over fixed-tilt tracking.

Crystalline Silicone Modules

The use of crystalline silicone modules grew to 79% of added capacity in 2024. A dominant technology for large-scale projects in the U.S. since 2015, these modules saw a temporary decline in 2022 before resurging.

According to the report, thin-film modules grew in popularity between 2016 and 2022. These modules achieved a new annual deployment of 6 GW in 2024, a new record. However, their market shared declined.

The U.S. installed a record 50 GW of new solar capacity in 2024, a 21% year-over-year (YoY) rise, according to the Solar Energy Industries Association’s (SEIA) U.S. Solar Market Insight 2024 Year in Review report.

According to a report by the SEIA and Wood Mackenzie, U.S. utility-scale solar installations reached 9 GW in Q1 2025, representing a 7% YoY decline.