US Solar Module Prices Dropped to $0.25/W Between November and February 2025

The market recalibrated prices following Trump’s tariff policy announcements

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

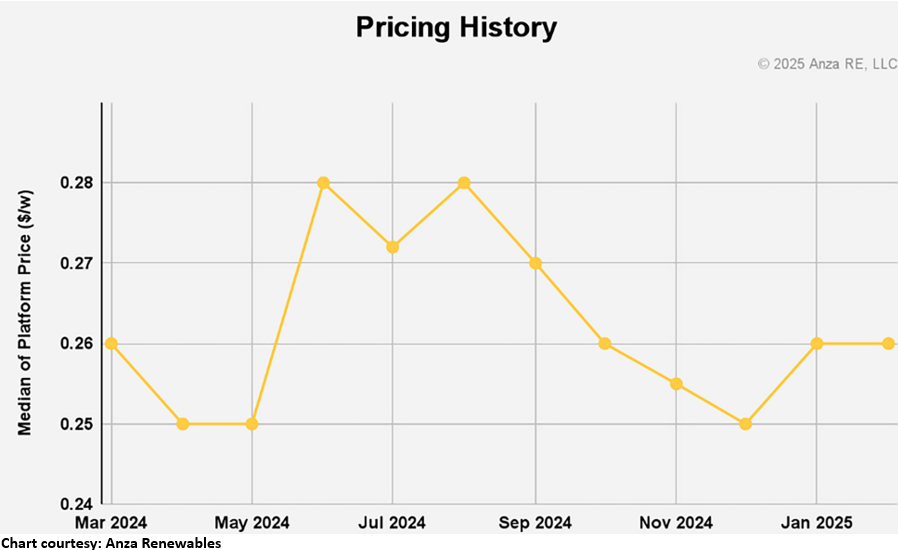

Solar module prices in the U.S. dropped to a near record low of $0.25 per watt from November 2024 to February 2025, according to a report by Anza Renewables. The company noted that module prices declined steadily through November 2024 from last summer’s highs of $0.28 per watt.

Prices increased by 4% between December 2024 and January 2025. This increase occurred due to the market pricing recalibration in response to President Trump’s tariff policies, forcing expectations to reset after months of gradual declines.

In March this year, Trump rescinded an order of the previous administration that designated solar photovoltaics as elements of national security under Section 303 of the Defense Production Act.

Module prices leveled by February because of growing uncertainty over future tariff adjustments and policy debates.

The report states that the market is navigating complex shifts caused by evolving trade policies and buyer caution despite a 2% price increase since November.

Mono PERC

The recent market shifts benefited the mono-passivated emitter and rear contact (PERC) cell suppliers. This development occurred because of the ongoing tunnel oxide passivated contact (TOPCon) patent litigation among multiple Tier-1 suppliers.

TOPCon

Customer concerns over possible disruptions in TOPCon supply drove some of them to prefer Mono PERC modules. This preference change increased module prices by 4.2% since November to $0.25 per watt.

The report highlights that even though domestic cell suppliers reacted strongly to the litigations, many consumers do not view them as high risk. Therefore, the report does not consider litigation risks as the sole factor behind the consumers’ purchase decisions.

The median TOPCon module pricing remained steady at $0.26 per watt during the reference period.

Many consumers prefer TOPCon modules for their performance despite the potential retroactive litigation fines. TOPCon modules’ pricing is aligning more closely with MONO PERC notwithstanding the slight shift in market sentiment. This preference again highlights that legal issues are not causing mass TOPCon avoidance.

HJT

According to the report, heterojunction technology (HJT) module pricing decreased by 2.9% during the reference period. The decrease in HJT price reflects the pressures on TOPCon and Mono PERC modules.

HJT module manufacturers are likely testing their product pricing to discover the price point matching the advantages of higher efficiency, lower temperature coefficients, and reduced cold condition performance losses.

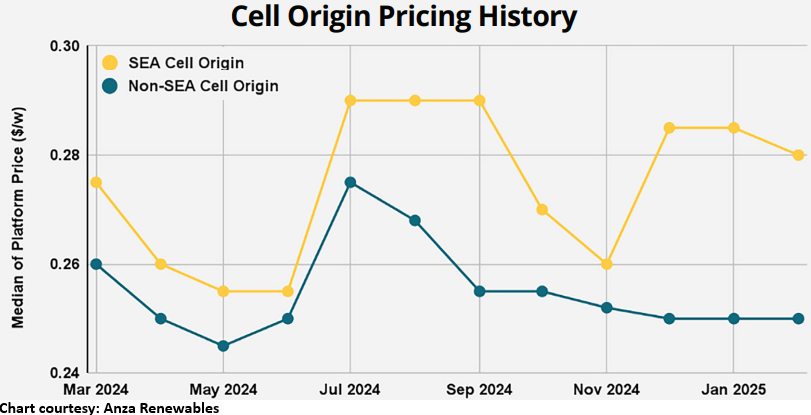

Cell Origins

Cells sourced from tariff-affected countries, including Cambodia, Malaysia, Thailand, and Vietnam, drove a 7.7% price increase for modules using these components. Meanwhile, pricing for solar modules using cells from non-Southeast Asian nations decreased by 0.8% as buyers pivoted towards regions less impacted by the .

Recently, the U.S. Department of Commerce announced its final determinations in the anti-dumping and countervailing duty investigations concerning crystalline silicon photovoltaic cells and modules imported from Cambodia, Malaysia, Thailand, and Vietnam.

The widening solar cell price range between Southeast Asian nations and other countries underscores market pricing sensitivity to geopolitical trade policies.

Consumers are reconsidering their solar cell sources to diversify strategically and mitigate geopolitical risks.

Anza Renewables said it used median distributed generation list prices from more than 35 module vendors for this report. This sample size covers over 95% of the U.S. module supply.