US Median Solar Module Prices Rose 14% Between January and November: Report

The module prices are expected to shoot up in early 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

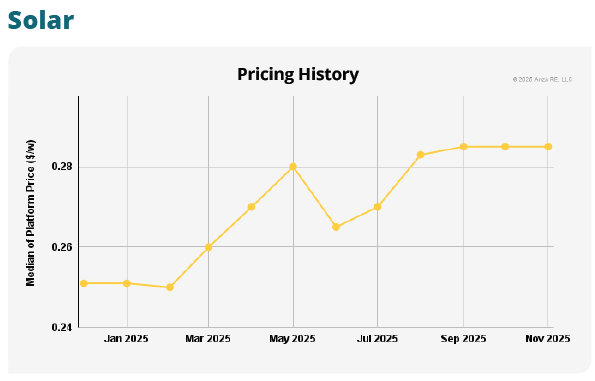

Overall solar module median pricing in the U.S. increased by 14% or $0.035/W from January to November, according to Anza Renewables’ Q4 2025 Quarterly Pricing & Domestic Content Report. The report highlighted that rapid and monumental policy changes drove the rise in module prices.

The module price was $0.25/W at the start of the year, rising to $0.28/W in May. According to the report, a tariff reprieve in June brought the prices back down to $0.265/W.

Anza also saw a surge in solar procurements ahead of the safe harbor to claim Investment Tax Credits, with over 20 customers collectively securing over 1 GW of solar power.

Anza said that while median module prices stood firm around $0.28/W in November, it expects the solar market to be shaken up in early 2026 due to the Section 232 investigation.

The Section 232 Investigation aims to determine whether imported solar modules or cells pose a threat to national security.

Module Technology

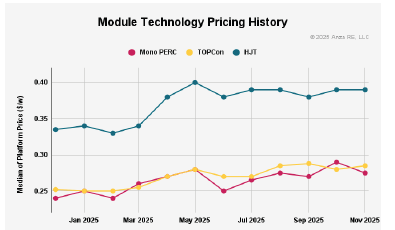

Prices of Monocrystalline Passivated Emitter and Rear Cell (Mono PERC) rose slightly above Tunnel Oxide Passivated Contact (TOPCon) modules, as buyers prioritized the mature Mono PERC supply chain during the safe harbor rush in the third quarter (Q3).

Since August, pricing for all three major technologies has remained essentially flat. The trend signals a return to more normalized spreads as the market stabilizes post the safe harbor deadline.

In November, the median pricing was $0.275/W for Mono PERC, $0.285/W for TOPCon, and $0.39/W for HJT.

Domestic and International Modules

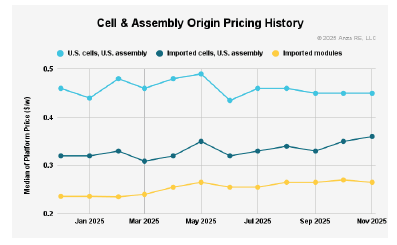

Prices of domestic solar modules using domestic cells dropped by 2.2%, or $0.01, from $0.43/W in August to $0.42/W in November.

Prices of domestic solar modules with imported cells increased by $0.02 or 5.9% from August to November, rising to $0.36/W.

The report noted that buyers preferred domestic solar modules using imported cells, with domestic balance-of-system components.

It added that buyers can also combine domestic modules using imported cells with U.S.-made components such as racking and inverters, or strategically blend them with other modules to reduce capital expenditure (CAPEX) and maximize value.

The report also noted that prices of imported modules remained flat at $ 0.265/W from August to November.

Energy Storage

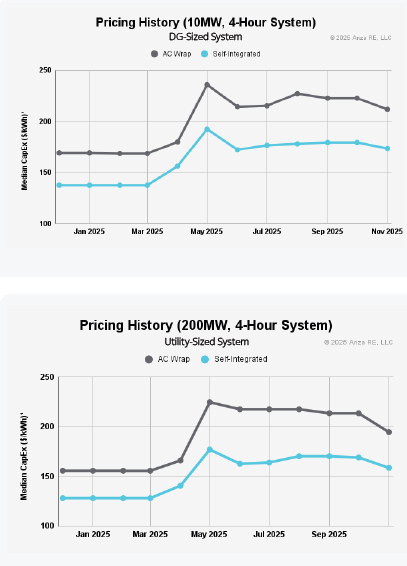

The AC Wrap median CAPEX price of Energy storage systems in the distributed generation (DG) segment fell to $212/kWh in November, a 6.8% drop of $15/kWh from August. The energy storage prices in the segment peaked at $236/kWh in May.

The distributed generation battery systems in the report consist of a 10 MW/4-hour DG system, and the utility-scale battery systems include a 200 MW/4-hour utility-scale system.

The self-integrated median pricing for energy storage in the distributed generation segment settled at $173/kWh, a 2.6% drop, or $5/kWh, from August. The energy storage prices peaked at $193/kWh in May.

For utility-scale projects, the AC Wrap median prices reached $194/kWh in November. The prices within the segment dropped by $23/kWh or 10.6% from August to November. Energy storage prices in the segment rose to $224/kWh in May.

Within the same segment, self-integrated pricing reached $158/kWh, a $12/kWh or 6.8% drop since August. Energy storage prices in the segment peaked at $177/kWh in May.

Outlook

According to the report, the number of suppliers providing U.S.-made cells will jump to 10 by 1H 2026 and to 12 by 1H 2027.

The number of suppliers offering U.S.-made battery energy storage system containers, modules, and cells is expected to double from three at the end of 2025 to six by the first half of 2026. The number of suppliers offering U.S.-made BESS containers, modules, and cells is expected to escalate to 10 by the end of 2026 and to 13 by 2027.

Anza reported that solar module prices for distributed generation projects in the U.S. increased by 3.7% to $0.28/W in Q3.

According to Anza, median platform prices for U.S. solar cells and modules were steady at approximately $0.5 per watt through April 2025, then declined modestly by 2% to $0.49 per watt in July.