US Initiates Anti-Dumping Probe Into Indian Solar Cell Imports

The USITC will release the preliminary determination by September 2, 2025

August 12, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The U.S. Department of Commerce (Commerce) has initiated anti-dumping duty (AD) and countervailing duty (CVD) investigations against imports of crystalline silicon photovoltaic cells, whether or not assembled into modules, from India, Indonesia, and Laos.

The investigation follows trade petitions filed by the Alliance for American Solar Manufacturing and Trade in July.

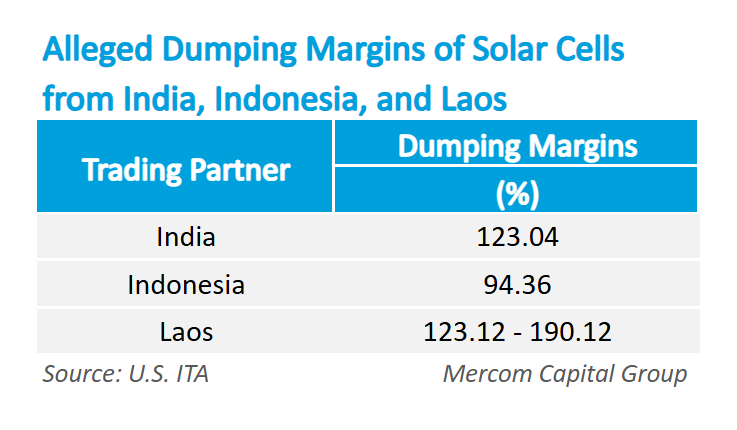

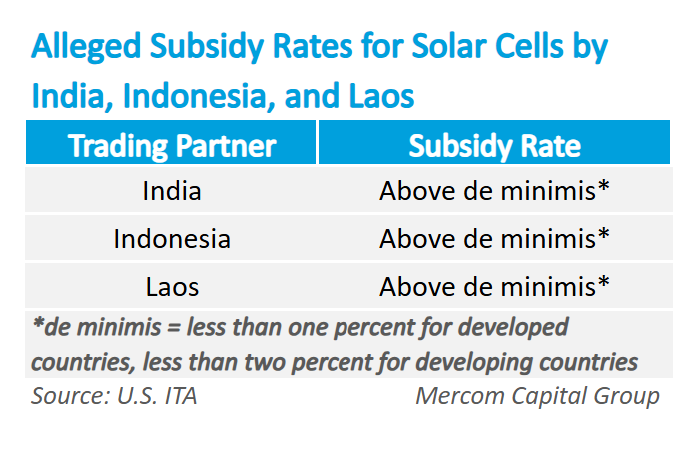

Commerce said it has been alleged that India is dumping at a rate of 123.04%, and Laos at 123.12% to 190.12%, and Indonesia at 94.36%. All three countries are dumping with a subsidy rate of more than 2%.

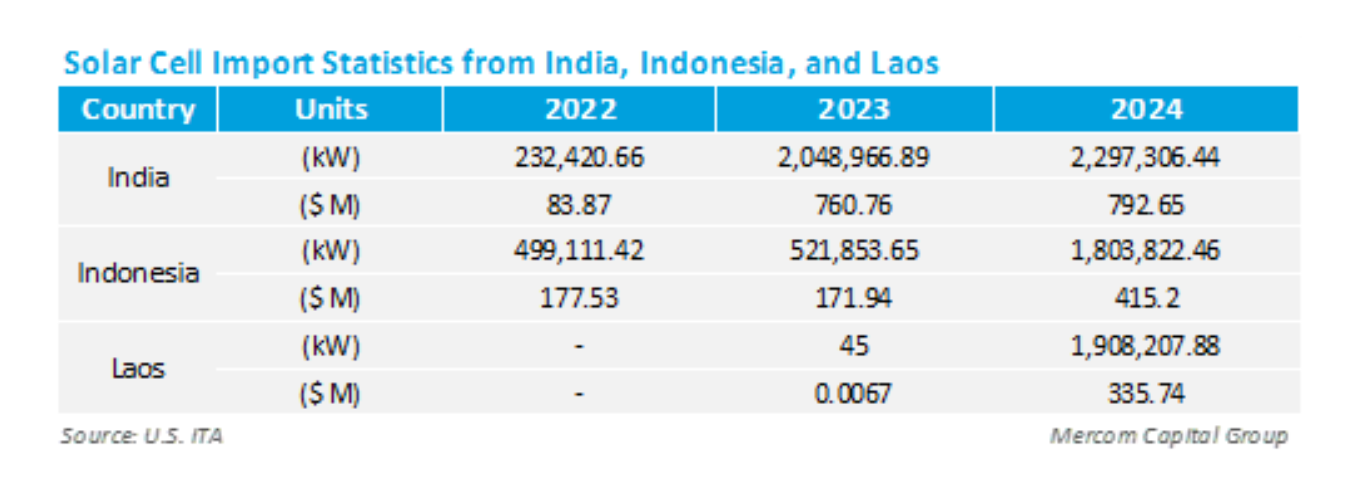

According to the Commerce factsheet, India exported 2.29 GW of crystalline cells/modules worth $792.64 million to the U.S. in 2024. Laos exported 1.9 GW worth $335.73 million, and Indonesia exported 1.8 GW of cells and modules worth $415.19 million.

According to the Commerce factsheet, India exported 2.29 GW of crystalline cells/modules worth $792.64 million to the U.S. in 2024. Laos exported 1.9 GW worth $335.73 million, and Indonesia exported 1.8 GW of cells and modules worth $415.19 million.

The U.S. International Trade Commission (USITC) is expected to release its preliminary determination by September 2, 2025.

The U.S. International Trade Commission (USITC) is expected to release its preliminary determination by September 2, 2025.

If USITC affirms the allegations, Commerce will announce its preliminary determination on the CVD investigation by October 13, 2025, and its preliminary determination on the AD investigation by December 26, 2025.

The petitions by the Alliance for American Solar Manufacturing and Trade alleged that companies based in India and largely Chinese-owned manufacturers operating in Indonesia and Laos were engaging in illegal trade practices by undercutting the U.S. solar manufacturing industry and flooding the market with cheaper imports.

Indian solar cell and module manufacturers have refuted allegations that they were receiving government subsidies or were selling below cost.

In the first quarter of 2025, the U.S. accounted for 99.5% of India’s total solar exports. According to Indian government data, solar modules and cells worth $1.5 billion were exported to various countries in 2024. Modules made up 97.7% of total shipments, and cells 2.3%.

The AD/CVD investigations come at a time when Indian solar exports to the U.S. are under threat following the imposition of 50% tariffs on Indian goods. The steep tariffs may force Indian solar manufacturers to tap markets other than the U.S.