US Community Solar Market Slowed 36% in 1H 2025: Report

The country’s new community solar capacity stood at 437 MW in 1H

October 3, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The U.S. community solar market slowed in the first half (1H) of 2025 after a record-breaking year in 2024, with 437 MW of new capacity installed, reducing 36% year-over-year (YoY), according to a report by Wood Mackenzie and the Coalition for Community Solar Access (CCSA).

Wood Mackenzie’s cumulative five-year outlook for the sector decreased by 8% compared to the one for the second quarter (Q2) of 2025 after the passage of the One Big Beautiful Bill Act (OBBBA) and related federal policy changes.

In Q2, the community solar segment installed 174 MW, a 52% YoY and a 34% QoQ decline, witnessing the lowest additions since Q1 2021, according to Wood Mackenzie and Solar Energy Industries Association’s US Solar Market Insight report.

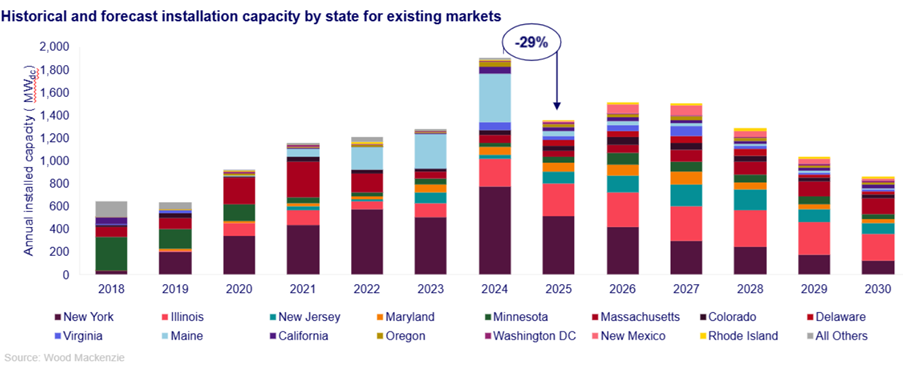

The report states that the OBBBA’s passage has fundamentally changed the long-term market landscape. It also slowed the growth in mature markets, specifically New York’s community solar program, contributing to a projected 29% national contraction in 2025.

Caitlin Connelly, Senior Analyst at Wood Mackenzie, and the report’s lead author, said, “Overall, we expect national installed community solar capacity will contract by an average of 12% annually through 2030. The final bill offers a crucial four-year window for projects already under development to come online and secure the Investment Tax Credit (ITC), supporting near-term buildout. As of mid-2025, there are over 9 GW of community solar projects under development, with over 1.4 GW known to be under construction.”

Challenges to Emerging and New Markets

The report stated that the market contraction in 1H 2025 was primarily caused by significant volume declines in New York and Maine, where current community solar programs had recently been overhauled.

Such programs are close to or at capacity in some of the major state markets. Additionally, multiple programs in states such as Massachusetts, New Jersey, and Maryland remain stalled between program iterations.

The report adds that new state markets can potentially add more capacity. However, there has been limited passage of community solar program legislation so far in 2025.

“The early expiration of the ITC will only add to this difficulty, given the window for any new projects to secure tax credits is so small. The passage of legislation in new markets could potentially add upwards of 1.1 GW through 2030,” said Connelly.

Jeff Cramer, President and CEO at CCSA, stated that the demand for community solar is the strongest yet, with states such as New Jersey and Massachusetts experiencing historic capacity additions of 300 MW and 900 MW, respectively. He said such additions show the possibilities when policymakers are on board with unlocking capacities.

“At the same time, this report makes clear the challenges ahead: from federal uncertainty to interconnection delays and program caps that must be addressed to realize the full potential of community solar and deliver the resilient, affordable power communities are asking for,” he said.

Subscriber Acquisition Costs and LMI Market Challenges

The report stated that the community solar subscriber acquisition costs reduced by 5% on average from 2H 2024. This decline was witnessed across all customer segments.

It added that corporate demand for community solar remains high and is driving the commercial solar sector’s share in the total community solar capacity to 53%. However, the report said developers and subscription management companies faced increasing challenges in subscribing low-to-moderate income (LMI) consumers.

The share of community solar capacity serving LMI subscribers declined to 9% due to the tough subscriber acquisition dynamics. The customer segment subscription costs were the most expensive, at $102/kW, compared to $72/kW for non-LMI residential consumers.

New Growth Avenues

Community solar developers are increasingly targeting alternative distributed solar programs for long-term growth, as new community solar programs face challenges taking off.

Connelly said, “Non-residential distributed solar, which typically encompasses projects sized between 2-20 MW, is extremely well-positioned for growth. Utilities are increasingly appreciating the value of community-scale resources because they can be deployed quickly, with storage, and close to customer load.”

Outlook

According to the report, cumulative community solar installations stand at 9.1 GW. These installations are expected to exceed 16 GW by 2030.

nder the high case, the report projected an 18% uplift for the next five years, adding 1.3 GW of capacity, driven by favorable state policy changes and efficient interconnection reform.

Under the low case, the report projected a 16% contraction, accompanied by a 1.2 GW decline, primarily due to complex tax credit qualification guidelines and limited state intervention.