US and Europe PPA Prices for Solar and Wind Stable in Q1 2025

PPA prices increased by 1% in Q1 2025 for wind and solar

May 16, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

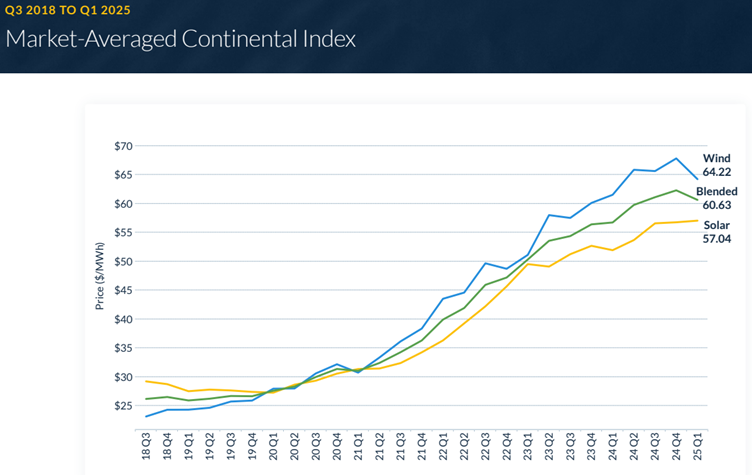

Power purchase agreement (PPA) prices for renewable energy remained largely stable across North America in the first quarter (Q1) of 2025, according to a report by LevelTen. The report said that PPA prices for solar energy increased marginally by 1%.

In North America, P25 prices remained largely stable among most independent system operators. P25 refers to the 25th percentile of PPA prices. Electric Reliability Council of Texas (ERCOT) continues to dominate as the most competitive and robust market due to increasing electricity demand. California Independent System Operator (CAISO), PJM Interconnection (PJM), and Alberta Electric System Operator (AESO) exhibited moderate price activity.

These results mark the third consecutive quarter of flat pricing, suggesting a maturing and stabilizing market after the volatility seen in previous years.

The report said that developers across these regions have recalibrated their capital expenditure (CapEx) expectations, leading to more consistent pricing offers and increased readiness to engage with buyers.

The stability in North America is driven by improved energy supply, normalization of economic expectations, and the anticipation of rising long-term electricity demand. The PPA price shows 339 offers from 287 renewable energy projects in eight markets throughout the U.S. and Canada.

ERCOT is expected to perform strongly in the U.S. PPA market due to increasing consumption and grid expansion. CAISO’s prices are influenced by solar buildout saturation, while PJM remains attractive for buyers due to its liquidity and project diversity.

In Canada’s AESO market, stable supply and improved permitting processes support a steady pricing trend.

Wind Prices Decline Amid Stable Demand

In Q1 2025, wind PPA also rose slightly by 1%.

LevelTen Energy’s Market-Averaged Continental Index reported a 5% drop in P25 wind PPA prices compared to the previous quarter. This downward trend was primarily driven by falling prices in the Midcontinent Independent System Operator (MISO) and Southwest Power Pool (SPP) regions.

Despite persistent policy uncertainty, the decline in wind PPA prices may appear counterintuitive, especially with demand for renewable energy remaining high. However, according to the report, the wind sector has recently re-established equilibrium, including inflation, rising interest rates, and supply chain disruptions after several years of economic pressures.

It said the unclear impacts of current and future policy developments may present a timely opportunity for buyers to secure favorable PPA deals.

Demand for wind energy continues to be robust, particularly from technology companies aiming to power expanding data center infrastructure. Wind energy’s higher capacity factors and attractive production profiles make it a viable option for these power-intensive operations.

In Q1 2025, wind PPA prices varied widely across regions, with PJM continuing to record the highest prices in North America, a trend that has persisted over the past year. While overall market prices remained relatively stable year-over-year, PJM faced several development challenges.

State policies like those in Ohio allow local jurisdictions considerable authority to block project development, increasing uncertainty. Additionally, limited land availability and a congested interconnection queue contribute to higher regional development costs.

Although recent reforms to PJM’s queue-study process show signs of alleviating grid access bottlenecks, the long-term effectiveness of these changes remains to be seen.

Meanwhile, MISO witnessed another drop in wind PPA prices this quarter.

LevelTen’s Q1 PPA Price Index dataset reveals that several new PPA offers with commercial operation dates in 2029 entered the market this quarter. These offers, priced at the lower end, significantly drove the continued downward trend in MISO’s wind PPA prices.

European Market

The European wind and solar PPA markets remained stable in Q1 2025. Solar PPA prices in the Market-Averaged Continental Index rose by just 1% from the previous quarter, while wind PPA prices increased by 1%. Europe’s renewable energy sector has entered a pricing maturity and predictability phase.

Solar PPA activity continues to be strong in established markets like Spain, Germany, and Italy. However, emerging markets such as Poland, Romania, and Finland are making notable progress.

Poland’s expanding solar capacity has increased market competition, leading to localized price reductions. Ireland also showed growing solar PPA offers, highlighting development to support its growing data center industry.

The wind sector in Sweden remains competitive, offering some of the lowest P25 PPA prices across Europe. Poland’s wind market is seeing renewed momentum due to regulatory reforms, including reducing turbine setback requirements from 700 to 500 meters, freeing up over 30,000 sq. km of land for new wind projects.

Spain, France, and Poland are also actively expanding their offshore wind segments, with auctions and incentives supporting the trend.

Despite past volatility, the wind and solar PPA markets have stabilized significantly. Developers have adapted to evolving capital expenditure conditions and are ready to contract with qualified buyers. The report encourages buyers to act quickly to secure favorable terms, as rising demand for PPAs could tighten availability.

Regulatory and Political Drivers

Regulatory developments such as the European Commission’s Clean Industrial Deal and the Affordable Energy Action Plan create favorable conditions for PPA buyers. These initiatives support permitting reforms, flexible consumption mechanisms, and financial hedging instruments.

Political uncertainty, especially in France, with the AREHN program ending and the RE100 requirement changing, has pushed corporate buyers toward fixed-price PPAs. In 2024, France recorded its highest PPA procurement activity to date, and experts anticipate continued growth in 2025 as firms seek to avoid wholesale market exposure.

In Germany, volatility in wholesale prices, three times higher than in 2010, has driven corporates toward PPAs for price certainty, according to Norway-based consultancy Ecohz.

The report emphasizes the importance of acting during this stability window. Mitchell Reay, Principal Analyst, LevelTen Energy, said, “The P25 Continental Index provides a snapshot of the lowest 25% of competitive PPA offers and accurately reflects current market conditions.”

The report noted that the alignment of buyer expectations and stable CapEx is critical to the pricing plateau. Advisors such as South Pole and developers like Avangrid in the U.S. have highlighted the growing interest in hybrid PPAs, although storage integration remains financially complex.

In Europe, Ecohz reports that buyers increasingly seek additionality and long-term stability, driven by rising market volatility and EU decarbonization mandates.

Future of Clean Energy in North America and Europe

In North America, rising demand forecasts, state-level renewable mandates, and corporate environmental, social, and governance goals are expected to drive growth in solar and wind capacity, particularly in ERCOT and MISO.

In Europe, the phasing out of legacy subsidy programs and increasing political and regulatory support are accelerating private sector engagement. Offshore wind, hybrid storage projects, and transmission grid upgrades will play a central role in Europe’s clean energy expansion.

The report said that market participants on both continents are expected to focus more on structured PPAs, long-term hedging, and integration of flexible energy products as the clean energy economy matures.

PPA prices in the U.S. rose by a modest 0.3% quarter-over-quarter in the fourth quarter of 2024, according to LevelTen’s Market-Averaged Continental Index.