tax

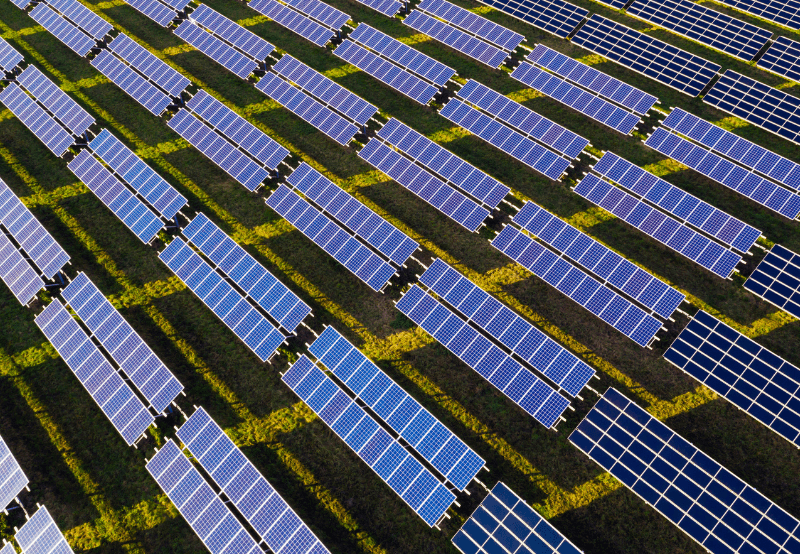

U.S.-based residential solar firm Sunnova Energy reported a 21% narrower net loss for the second quarter of 2024 at $79.7 million, an improvement from the $100.8 million...

China’s Ministry of Finance, the State Administration of Taxation, and the Ministry of Industry and Information Technology have jointly announced the continuation of the...

The Ministry of Power has asked all state governments and union territories to withdraw any tax or duty on electricity generation, especially from hydropower projects,...

Many ‘Change in Law’ petitions on safeguard duty filed in 2018 are still pending disposal DISCOMs drag on litigations for years Unresolved petitions restrict cash flow...

In a significant development, President Joe Biden signed the ‘Inflation Reduction Act of 2022,’ which the U.S. House of Representatives and the Senate had...

The United States Congress has passed a bill providing a two-year extension on its solar investment tax credit (ITC) facility, allowing solar power projects across the...

The Solar Energy Industries Association (SEIA) of the United States announced that it has prepared a legislative and executive agenda for 2021. SEIA asked...

The Ministry of Finance of the People’s Republic of China has issued a notice on ways to promote financial subsidies for new electric vehicles. The ministry said it had...

The Republic of Mali, a country in West Africa, has announced that it will exempt renewable energy equipment from value-added taxes (VAT), duties, and other taxes to...

Basic customs duty (BCD) on the import of solar cells and modules was announced at 20% in the Union Budget for 2020-21. While the exemption on this duty remains in place,...

The Ministry of New and Renewable Energy (MNRE) has notified the new benchmark costs for grid-connected rooftop solar power projects for the financial year (FY) 2019-20....

1

...

1