Solar PPA Prices Rise 9% YoY in North America While Europe Falls 8%

In both Europe and the U.S., storage is emerging as a preferred corporate alternative

February 4, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The corporate renewable power purchase agreement (PPA) market in the U.S. and Europe is diverging on price trends but converging on structure.

According to LevelTen Energy’s Q4 2025 PPA Price Index, Europe continues to see falling prices, while the U.S. is experiencing sustained price increases, reflecting very different power-market fundamentals and policy risks.

Yet in both regions, the data clearly shows a shift toward hybrid projects and storage-backed PPAs as buyers and developers respond to volatility and value erosion.

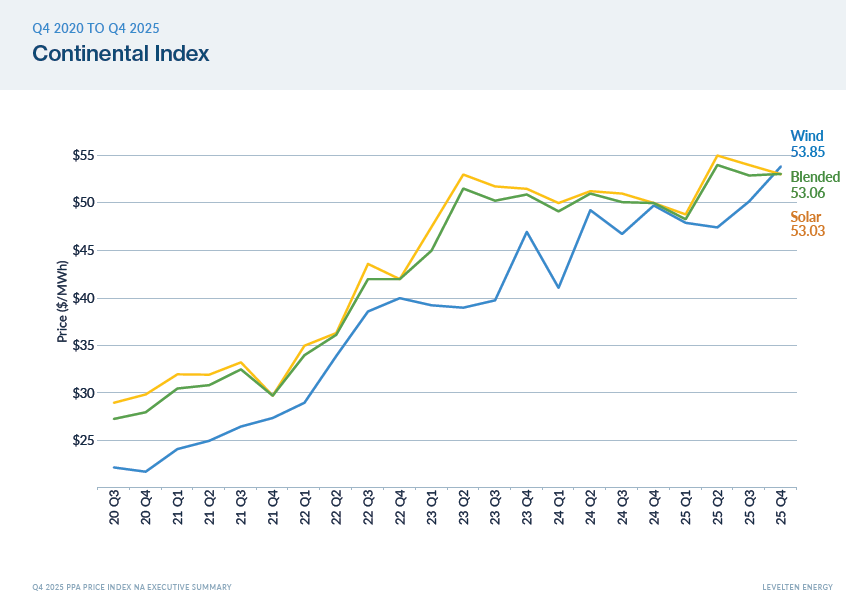

PPA Prices in North America

North America — led by the U.S. —has seen PPA prices rise sharply. Market-averaged P25 solar PPA prices reached $53.03/MWh, increasing about 3.2% quarter-over-quarter (QoQ) and nearly 9% year-over-year (YoY).

Wind prices showed more volatility, dipping QoQ slightly, but still stood at $53.85/MWh, up roughly 9% year-on-year, with a blended PPA price of $53.06/MWh.

At the same time, structural demand growth, especially from data centers, has strengthened price support, with markets like the Electricity Reliability Council of Texas (ERCOT) seeing wind PPA prices rise by over 19% YoY.

Uncertainties related to the ongoing Section 232 tariffs investigation are adding to development costs, and harsh new federal-level permitting procedures have stalled substantial development across the U.S.

In July last year, U.S. President Donald Trump signed an executive order directing the Secretary of the Treasury to terminate the clean electricity production and investment tax credits for wind and solar facilities and to implement the enhanced foreign entity-of-concern restrictions identified in the ‘One Big Beautiful Bill’ Act.

Despite these opposing price trajectories, corporate buyer priorities are aligning across regions. In Europe, falling capture prices are pushing buyers to seek storage and hybrid projects, while in the U.S., concerns around deliverability, grid congestion, and potential changes to Greenhouse Gas Protocol Scope 2 standards, which are expected to be finalized in 2027 and phased in beginning in 2028, are driving similar behavior.

In both cases, storage is increasingly valued not just as an add-on, but as a core component of corporate procurement strategies.

The report suggests that the next phase of corporate renewable procurement in both Europe and the U.S. will be defined less by headline PPA prices and more by who can deliver reliable and stable clean power at scale.

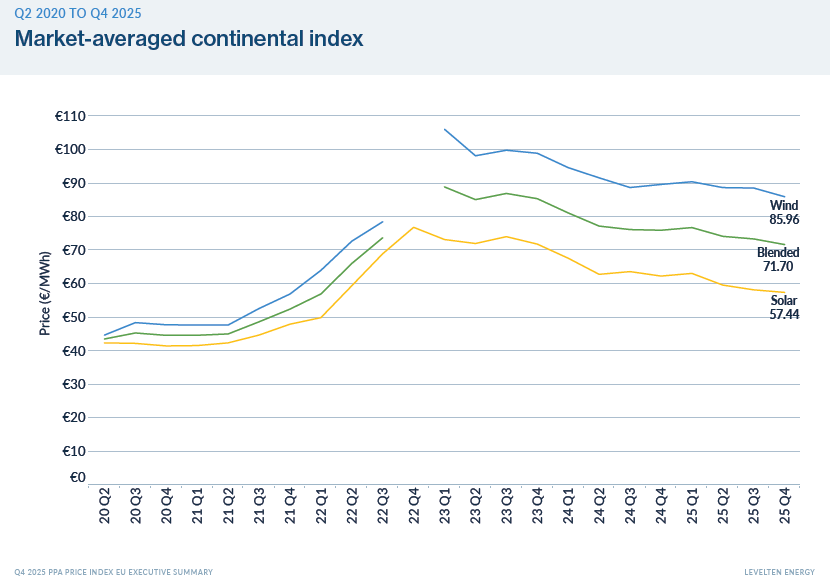

PPA Prices in Europe

In Europe, solar PPA prices declined for the third consecutive quarter, with the market-averaged P25 solar price at €57.44 (~$68.06)/MWh, down roughly 8% YoY. Wind prices also softened, with P25 wind PPAs at €85.96 (~$101.85)/MWh, falling about 3% QoQ.

In Q3, solar PPA prices had declined 2.4% QoQ.

The blended European PPA price settled around €71.70 (~$84.96)/MWh. This downward pressure is primarily driven by low and frequently negative wholesale power prices, particularly in high-renewables markets such as Germany and Spain, where solar cannibalisation has significantly reduced capture prices.

As a result, developers are lowering PPA offers while simultaneously turning to solar-plus-storage and wind-plus-storage configurations to restore project economics and hedge merchant risk.

In December, the European Commission unveiled its ‘Grids Package,’ a wide-ranging initiative aimed at modernizing Europe’s electricity infrastructure and expanding grid planning beyond national boundaries to improve efficiency and cross-border coordination.

The package streamlines approvals by exempting certain grid-upgrade and energy storage projects from parts of the environmental review process, while also proposing a shift to ‘first-ready’ interconnection queues to ease congestion and reduce delays caused by speculative projects.