Solar Open Access to Gather Steam in Uttar Pradesh as Data Centers Mushroom

The state is also seeing a growing demand for solar plus storage solutions

December 5, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Driven by the rapid expansion of data centers in Uttar Pradesh, demand for solar open access in the state is expected to double over the next three years.

According to the Mercom India Solar Open Access Project Tracker, steel, metals, and mining units currently account for 16.9% of the state’s open access demand, followed by data centers at 8.9%. Nationally, data centers account for 13.6% of open-access power demand, second only to the steel industry, which leads with 33.2%.

In 2021, Uttar Pradesh rolled out its data center policy, aiming to attract investments of ₹200 billion (~$2.23 billion) to set up 250 MW of data centers. In 2024, the state enhanced its investment target to ₹300 billion (~$3.35 billion) to build eight data centers totaling 900 MW. Noida is emerging as a major data center hub in northern India, and according to datacenters.com, currently, there are 21 data centers in the state.

According to developers, favorable solar policies and the growth of new hard-to-abate sectors in Uttar Pradesh, such as data centers and electric consumer goods, are driving demand for open access power.

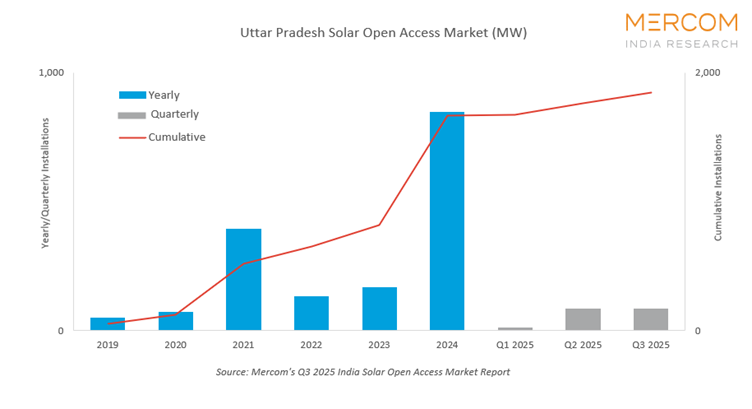

In the first nine months of 2025, Uttar Pradesh added 177.5 MW solar open access capacity, according to Mercom India’s Q3 2025 Solar Open Access Market Report.

Due to its geographic constraints, Uttar Pradesh has limited wind generation potential, leaving solar to dominate the state’s open access power market. However, developers say solar-plus-battery energy storage systems (BESS) are steadily gaining traction among commercial and industrial consumers.

Industries Driving the Growth

Open access project developers say that while the large power guzzlers, such as the cement, steel, and iron and steel industries, continue to drive demand, a few new power-intensive sectors, such as data centers and electronic consumer goods, are taking root in the state.

Kartikeya Narain Sharma, Chief Business Officer at Sunsure Energy, said that the largest share of demand will stem from data center parks coming up in Greater Noida, semiconductor manufacturing parks, which will create demand around 2027 and 2028, and the defense corridor, which is expected to generate demand between 2026 and 2027.

Sharma added that by the end of March 2026, Uttar Pradesh will have about 1 GW of solar open access projects, and Sunsure Energy will hold 30% of the market share, maintaining an annual run rate of 100 MW every year.

Developers also expect the launch of the new Noida International Airport in Jewar to strengthen the export ecosystem and the manufacturing sector, further driving demand for open access power in the state.

Peeyush Salwan, President at SolarWorld Energy Solutions, said the new industrial corridors coming up in Uttar Pradesh are also likely to add 2-4 GW of open-access projects each year. “However, it would depend on how the connectivity at 33 kV or 132 kV voltage level is built, and how quickly the state establishes 220 kV and 400 kV substations”.

Salwan added that large solar projects are coming up in the Bundelkhand area due to the government providing land for them. He noted that the area is seeing government agencies such as NHPC developing grid-connected solar projects of up to 1.2 GW, and some private developers building solar open access projects of up to 2 GW.

Uday Kiran Pragnapuram, Head – Business Development (North Region), Fourth Partner Energy, said that Uttar Pradesh’s open access power demand also comes from industries with low power consumption.

“Earlier, industries with lower power demand, such as component manufacturers in Noida or Greater Noida, were unable to avail power via open access due to contractual demand restrictions; green energy open access rules have been a big boost to such manufacturing units,” said Pragnapuram.

Other sectors driving demand for solar open access in the state include information technology, automobiles, and chemicals.

Favourable Solar Policies

Sharma said that while Uttar Pradesh has lower solar potential than leading open-access states like Maharashtra and Karnataka, it has a better-structured policy that provides incentives for open-access project developers.

Developers say that, under the new Captive and Renewable Energy Generating Plants Regulations, 2024, open access projects can bank up to 100% of their generation within each 15-minute time block. The ease in banking provisions will be a big incentive for open access in the state, according to developers.

“Earlier, banking was limited to 25% of the generation; now, the ceiling has been removed completely. The new policy allows 100% annual banking on a 15-minute basis or 30% of the overall consumption, whichever is higher,” added Sharma.

Pragnapuram said that Uttar Pradesh is also providing government land on long-term lease at nominal rates to developers to set up projects.

Developers say that through UPNEDA, the state government is also creating dedicated land banks, particularly in regions like Bundelkhand, where developers will have ready access to government land on a lease or right-to-use basis at concessional rates.

Additionally, the state is promoting agrivoltaics to address land scarcity, benefiting both farmers and developers.

Developers say that while the government has started providing a list of substations available for connectivity, they should also provide information on available land within a 10 km-20 km radius of these substations.

Pragnapuram said that the new policy has also revised the time-of-day slots for winter and summer, which are likely to improve the offtake of solar energy.

Uttar Pradesh provides approvals within 90 days, resolving a major bottleneck that has been hindering open access growth in other states.

Solar Plus Battery Projects

Solar-plus-storage projects are gaining momentum in the state as consumers look to tap stored power during peak hours, when tariffs are typically at their highest.

Sharma said Uttar Pradesh is seeing a clear shift toward solar-plus-BESS solutions, adding that in the next 1 GW of solar open access capacity addition, 15–20% of the energy is expected to be delivered through battery storage.

Salwan added that among the storage projects coming up in Uttar Pradesh, solar-plus-storage and pumped-storage projects will see greater growth.

In 2025, Adani Green Energy and JSW Energy signed agreements to set up pumped-storage projects in the state.

However, Pragnapuram noted that with no dedicated state policy for BESS deployment, demand is likely to favor standalone solar projects over solar-plus-storage solutions.

Land and Transmission Challenges

Despite recent progress, several renewable-rich regions continue to face bottlenecks, including delays in land acquisition, right-of-way disputes, and slower implementation of transmission projects. Salwan noted that land acquisition remains a major hurdle, with developers often struggling to secure contiguous parcels. This, he said, makes land identification and registration a major challenge for project execution.

He suggested that the state government must focus on Bundelkhand, where there are larger land banks and more barren land.

Despite the uptick in the adoption of open access projects, developers are worried that grid infrastructure will not keep pace with growth.

Salwan said open-access developers in Uttar Pradesh have been struggling with inadequate transmission infrastructure for the past three to four years. “At the 33 kV and 132 kV levels, developers can secure connectivity, but the state has very few interstate transmission (ISTS) substations,” he noted. “The substations that do exist are located in city centers, such as Kanpur, or near major urban areas, which makes land acquisition even more difficult.”

He added that while the government has launched a green energy corridor and is building substations in the region, it should focus on developing more 220 kV and 400 kV substations.

The state is part of the multi-state Green Energy Corridor Phase-II initiative, with an allocation to build approximately 2,597 circuit kilometers of transmission lines and 15,280 MVA of transformation capacity. The aim is to evacuate approximately 4,000 MW of renewable power, with completion targeted for 2026.

Another open access developer said a dedicated transmission system for Bundelkhand is in progress, aimed at unlocking nearly 4 GW of solar and biomass generation potential in the region.

With growing power demand, favorable policies, and an uptick in solar-plus-storage solutions, open access projects are likely to see strong capacity additions in Uttar Pradesh in the coming years.