Solar Module Prices Up 3.7% as US Safe Harbor Deadline Nears: Report

The prices of Mono PERC rose by 10% to $0.275/W

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

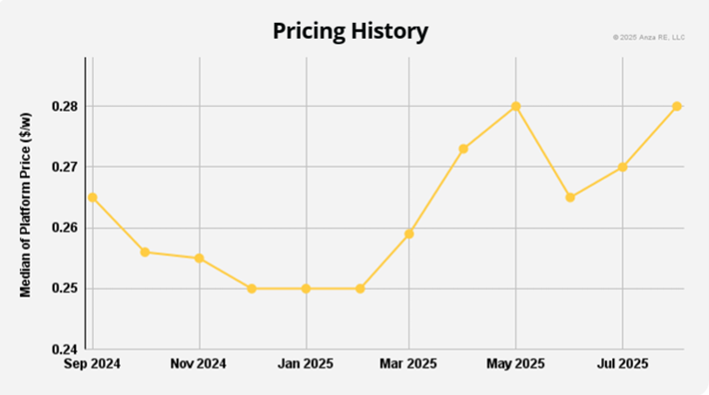

Solar module prices for distributed generation projects in the U.S. increased by 3.7% to $0.28/W in the third quarter (Q3) of 2025, according to Anza Renewables.

The rise in prices was influenced by the rush to start projects exceeding 1.5 MW to claim the investment tax credits under the 5% safe harbor.

The upward trajectory is consistent with the industry trend of developers locking in module prices and protecting themselves against the current and expected increase in tariffs and duties.

It was also fueled by the developer’s interest in trade-compliant bill of materials.

According to its earlier report, the median platform prices for U.S. solar cells and modules experienced a modest decline by 2% to $0.49/W by the end of July.

The price of the foreign entity of concern (FEOC)-non-compliant modules also increased by 9.2% from June to August. In August, the prices of FEOC-compliant modules rose by 4.9%, reflecting a growing reliance on established suppliers.

Among module technologies, the prices of monocrystalline passivated emitter and rear cell (Mono PERC) rose by 10% to $0.275/W, followed by tunnel oxide passivated contact (TOPCon), which grew by 3.7% to $0.28/W.

The prices of heterojunction modules rose by 2.6% to $0.39/W from June to August.

US consumers preferred Mono PERC modules, as project developers leaned on a mature supply chain to meet safe harbor timelines.

However, modules utilizing PERC technology remained the lowest-priced mainstream option.

Anza also suggested that U.S. suppliers may be prioritizing PERC manufacturing domestically, possibly reflecting concerns about intellectual property related to TOPCon modules.

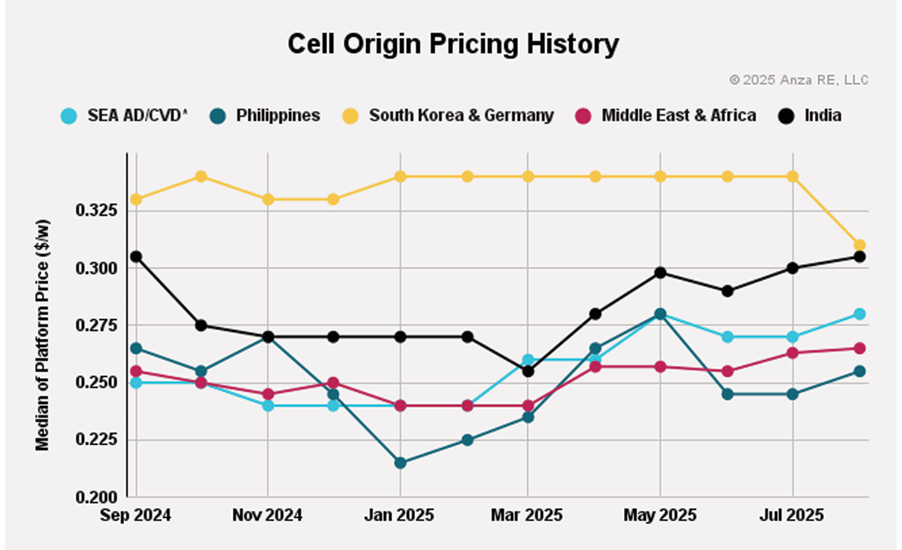

Prices of solar cells also jumped by 5.7% to $0.46/W in the U.S., and in India, solar cell prices increased by 5.2% to $0.3/W.

Additionally, prices of solar cells from Southeast Asian countries increased by 3.7% to $0.305/W due to exposure to anti-dumping and countervailing duties from the U.S.

In the Philippines, the only Southeast Asian country not exposed to anti-dumping duties and countervailing duties from the U.S., the module prices rose by 4.1% to $0.28/W. The report said that significant manufacturing capacity is being shifted to the Philippines.

The price of modules from the Middle East and Africa also increased by 3.9% to $0.265/W. In South Korea and Germany, solar modules were priced at $0.31/W.

Outlook

In the coming quarters, pricing trends are expected to be shaped by supplier origin strategies, ongoing trade actions, and compliance efforts.

The upcoming anti-dumping and countervailing duty determinations on India, Indonesia, and Laos, along with the potential imposition of a Section 232 tariff on polysilicon and its derivatives, could exert significant upward pressure on solar module costs in Q4.

The Section 232 tariffs refer to trade restrictions that the U.S. government can impose on imports deemed to pose a threat to national security.

In August 2025, the U.S. Department of Commerce initiated anti-dumping duty and countervailing duty investigations against imports of crystalline silicon photovoltaic cells, whether or not assembled into modules, from India, Indonesia, and Laos.

The upcoming rise in module prices will also depend on whether the Section 232 tariff on polysilicon and its derivatives is applied broadly rather than limited to select countries.