Solar Module Export Hopes Rekindle on US-India Trade Agreement

Indian exports to the U.S. will now attract a tariff of 18% against 50% earlier

February 3, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The announcement of the U.S.-India trade deal, under which Indian exports will attract a 18% tariff instead of 25%, is expected to bring relief to Indian solar exporters.

U.S. President Donald Trump announced on social media that he had spoken with Indian Prime Minister Narendra Modi and that the two countries had agreed to a trade pact under which Indian exports would now be subject to 18% tariff.

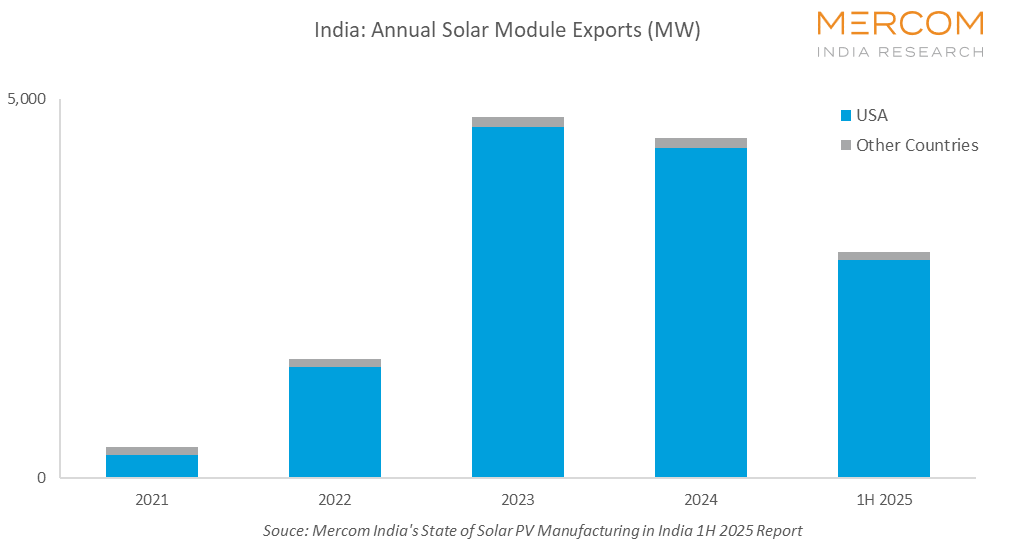

The solar industry welcomed the new reduced tariff, ending months of uncertainty. Indian solar manufacturers have traditionally relied on the U.S. as their largest market for solar cells and modules.

A senior executive at an integrated renewable energy solutions company said Indian manufacturers have enough capacity to set up a reliable non-Chinese alternative supply chain for solar modules and cells. He added it was also time for the U.S. to drop the antidumping/countervailing duty (AD/CVD) investigations initiated against Indian exporters.

“India must negotiate with the U.S. to ensure that the investigation is withdrawn, because there is no truth in the allegations that Indian companies are indulging in unfair trade practices.”

Prashant Mathur, CEO at Saatvik Green Energy, a solar module manufacturer, termed the U.S. as a strategic turning point for the solar sector, rather than just a routine policy change. “It alleviates long-standing concerns about Chinese producers circumventing tariffs and positions India as a credible and dependable alternative manufacturing base that aligns with U.S. trade and industrial objectives. For companies like Saatvik, this transforms the U.S. market from being high-risk to one full of opportunities.”

Amit Barve, CEO at Rayzon Solar, concurred. “There is immense demand in the U.S., and Indian companies can benefit because of the competitive advantage they enjoy.” He also hoped the U.S. would drop the AD/CVD investigations initiated against Indian exporters. “I believe no Indian company is selling below cost in the U.S.”

Solar companies said the U.S.-India trade deal strengthens India’s position as a reliable energy exporter and provides a powerful runway to scale exports.

According to Gynaesh Chaudhary, Chairman & Managing Director at Vikram Solar, “Indian energy and clean-tech exports to the U.S. have always played an instrumental role in the industry, and this agreement significantly enhances our global competitiveness by improving price efficiency, certainty of access, and long-term demand visibility.

Last August, concerns arose among Indian exporters after the Donald Trump administration first slapped a 25% tariff on Indian goods and then imposed a 25% punitive tariff for Indian purchases of Russian oil.

At an effective tariff of 50%, Indian exports became uncompetitive overnight. In contrast, other solar exporting nations – Vietnam, Thailand, Cambodia, and Malaysia – enjoyed tariffs of less than 20%. Solar exporters faced the prospect of losing their largest market.

Over the last two quarters, Indian cell and module manufacturers have trained their sights on alternative markets, such as Europe and the Middle East, to offset potential losses in the U.S. market. Indian companies were also exploring the UK as a destination for solar product exports. While they had the benefit of zero duty, the UK market is not big enough to absorb much of what they manufacture.

Adding to the uncertainty over exports, Trump’s tariff salvo coincided with trade petitions filed in the U.S. against Indian solar companies. Several American companies filed petitions seeking AD/CVD investigations into solar imports from India. They alleged that Indian companies were engaging in illegal trade practices by undercutting the U.S. solar manufacturing industry and flooding the market with cheaper imports.

Even so, the U.S. remained the top market for Indian solar manufacturers even as late as the third quarter of 2025, when the country accounted for 97% of exports.

The full details of the trade agreement announced by Trump and acknowledged by Indian Prime Minister Narendra Modi are not yet available beyond their social media posts. Trump has hinted that the deal is incumbent on India ending its purchases of Russian oil, slashing tariffs and non-tariff barriers to zero, and buying U.S. goods, including energy, worth $500 billion. India has been silent on these conditions.