Saatvik Green’s Q3 Earnings Up on Higher Solar Module Demand

In 9M FY 2026, the company’s revenue surged by 137.4%

February 5, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Haryana-based solar module manufacturer Saatvik Green Energy recorded a revenue of ₹12.57 billion (~$139.04 million) in the third quarter (Q3) of FY 2026, representing a 142.6% year-over-year (YoY) increase from ₹5.18 billion (~$57.32 million).

The company attributed the revenue increase to robust demand for solar modules, high capacity utilization, and continued traction from repeat customers.

Profit after tax (PAT) stood at ₹987.22 million (~$10.92 million), marking a 144% YoY jump from ₹404.53 million (~$4.48 million).

Earnings before interest, taxes, depreciation, and amortization (EBITDA) came in at ₹1.65 billion (~$18.26 million), a 134.5% growth from ₹702.63 million (~$7.77 million) in the same quarter of the previous year.

Earnings per share (EPS) came in at ₹8.39 (~$0.093), compared to an EPS of ₹3.61 (~$0.040) a year ago.

9M Results

In the first nine months (9M) of FY 2026, Saatvik Green Energy’s revenue rose to ₹29.41 billion (~$325.34 million) from ₹12.39 billion (~$137.07 million, a 137.4% YoY increase.

PAT stood at ₹3.01 billion (~$33.30 million) in 9M FY 2026, a 144.7% YoY rise from ₹1.23 billion (~$13.61 million).

EBITDA for the period stood at ₹4.69 billion (~$51.9 million), up 134.5% from ₹2 billion (~$22.13 million) in the same period of the previous year.

Earnings per share came in at ₹25.57 (~$0.283), compared with an EPS of ₹10.95 (~$0.121) in 9M FY 2025.

Business Highlights

As of December 2025, Saatvik Green Energy’s order book stood at 5.05 GW.

During the period, the company secured repeat domestic orders aggregating ₹9.63 billion (~$106.55 million) from leading independent power producers and engineering, procurement, and construction (EPC) companies.

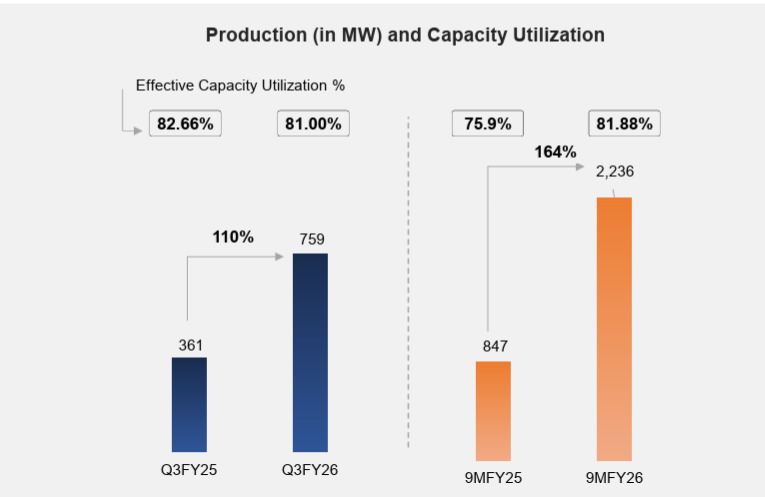

In Q3, Saatvik Green manufactured 759 MW of solar modules, a 110% YoY jump from 361 MW.

During the quarter, the company commissioned a 2 GW in-house EPE film manufacturing facility in Ambala.

Recently, it also secured solar pump orders totaling ₹302.4 million (~$3.35 million).

Saatvik Green said it operates a 4.8 GW module manufacturing facility and plans to add 4 GW of module manufacturing capacity in Odisha, with operations expected to be operational in FY 2026. The cell-module manufacturing facility is being developed at an estimated cost of ₹18.50 billion (~$204.69 million).

In addition, the company plans to set up a 4.8 GW solar cell manufacturing facility, targeted to become operational by FY 2027, with a projected development cost of ₹13.5 billion (~$149.36 million).

Prashant Mathur, CEO at Saatvik Green Energy, noted that 95% of the company’s revenue currently comes from module sales, but Saatvik Green aims to increase the contribution from EPC, solar pumps, and inverter businesses to 15%.

He highlighted that domestic content requirement orders currently account for only 3–4% of monthly sales.

During its Q3 earnings call for FY 2026, Saatvik Green said it plans to build an ingot and wafer manufacturing plant aligned with the upcoming Approved List of Models and Manufacturers for ingots and wafers. It also plans to establish a dedicated inverter manufacturing plant.

Impact on Module Prices

During the Q3 earnings call, Prashanth Mathur stated that due to volatility in prices, silver now accounts for 25% of module prices, up from 15% previously.

He welcomed the government’s decision to remove basic customs duty on the import of sodium antimonate used in glass manufacturing, noting that the tax relief is expected to lower glass prices and reduce module input costs.

Mathur also welcomed the U.S. decision to reduce tariffs to 18%. The company’s exports account for less than 1% of Saatvik Green’s total revenue. Saatvik is focused on geographies unaffected by U.S. tariffs. However, he confirmed that the company is actively exploring the U.S. market for solar modules and cells.

Regarding commodity price volatility, Mathur stated that the company is well-positioned to manage raw-material price fluctuations due to its large, secured inventory.

Commenting on India’s solar cell manufacturing capacity, he said it is expected to reach 50 GW by next year. He pointed out that of the existing 26 GW capacity, around 12 GW is Mono PERC technology, which is likely to become obsolete as newer technologies advance.