Rising Barriers and Costs: The Global Tug-of-War Over Cleantech Manufacturing

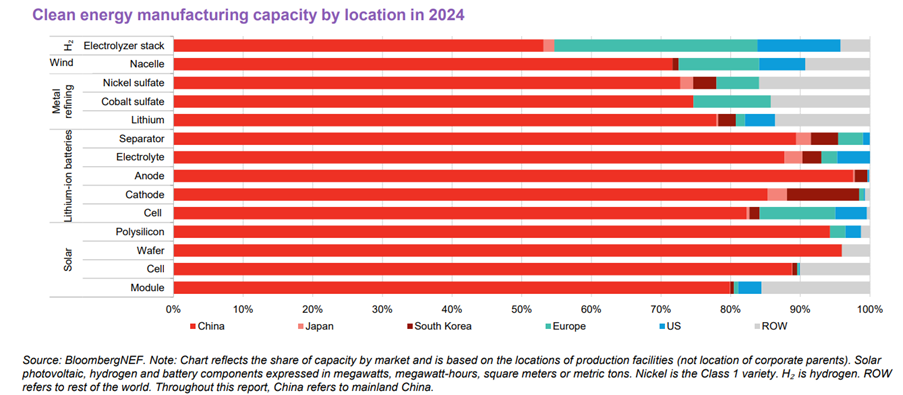

China hosts 80% of the global solar and battery manufacturing capacity

November 7, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Developed and emerging economies are expanding clean energy deployment while aiming to enhance domestic manufacturing of key technologies, according to BloombergNEF’s (BNEF) Clean Energy Trade and Emerging Markets report.

However, trade barriers are on the rise. Several prominent developing countries are considering or implementing higher import duties on cleantech products. These tariffs are driven by diverse motives: fostering local value creation, attracting foreign investment, diversifying supply chains, and addressing energy security concerns.

China’s Dominance

According to the report, China hosts at least 80% of the manufacturing capacity across major solar and battery supply chains. The country hosts over 70% of production capacity in all significant segments of clean tech equipment manufacturing except for one.

Countries including Japan, South Korea, the European Union (EU), and the U.S. comprise most of the remaining manufacturing capacity share.

Between 2022 and 2024, China’s share of global capacity increased by at least 5% across the value chain of six clean energy segments.

Steps by Developed and Emerging Countries

BNEF stated that developed nations have initiated multiple economic development strategies. Depending on the strategy, efforts to varying degrees have been focusing explicitly on building out clean-tech supply chains.

Emerging market economies, including China, have been focusing on creating domestic industrial policies to develop local cleantech manufacturing.

G20 Initiatives

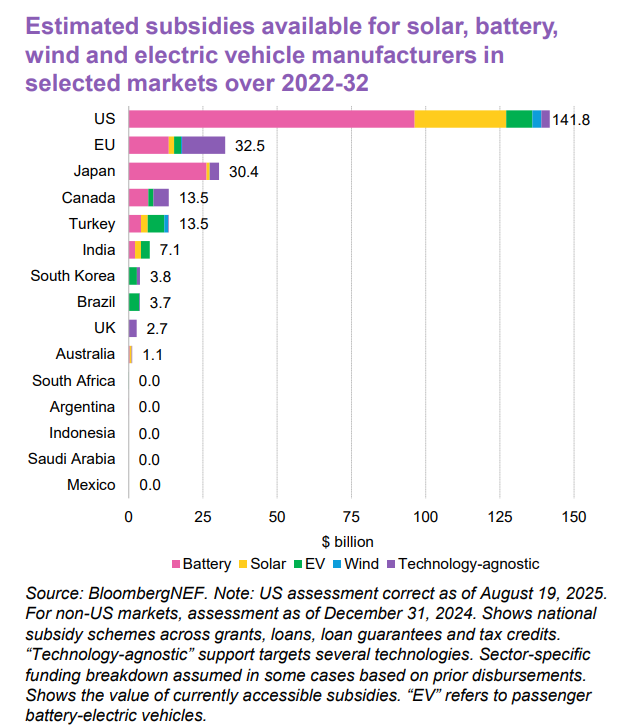

G20 countries have allocated $250 billion in subsidies for clean technology manufacturing.

BNEF said it tracked subsidies for solar, battery, wind, and electric vehicle (EV) manufacturers. It said this limited its scope to national grants, low-interest loans, loan guarantees, and tax credits.

That excludes harder-to-track forms of support, such as cheap electricity or land.

Using this methodology, the U.S. has the highest commitment in all markets, despite the revised totals following the new administration’s curtailment of previous supportive provisions.

According to the report, the earlier subsidies drove a factory pipeline worth $108 billion. However, policy changes and uncertainty have frozen several projects.

The EU has pledged $32.5 billion in support of its clean energy manufacturing, despite its ambitious targets. Much of the funding comes from repurposed programs due to limited budget.

BNEF advises member states to draw from national funds to expand their local capacities. However, it acknowledges that cheap imports, low prices, and weak manufacturers limit any impact of such initiatives.

Japan is concentrating 86% of its $30.4 billion in expected support for its battery sector to help achieve its domestic manufacturing capacity target of 150 GWh by 2030. The report stated that this goal may be difficult.

The report stated that setting up battery factories is costlier than other clean technologies. This means that even considerable government support may not result in significant manufacturing growth. Low local demand is also adding to the growth challenges.

Clean-tech manufacturing support is limited elsewhere. Multiple factors cause these limitations:

- Clean-tech manufacturing often ranks low among policy priorities

- Tough market conditions

- High capital requirements for this segment

- Average higher prices of locally produced technology compared to high-quality, low-cost imports

BNEF stated that some countries are providing relatively large subsidies for the cleantech supply chain. For example, Turkey’s $13.5 billion subsidy made up 1% of the country’s GDP in 2024.

However, emerging markets are not making significant contributions to cleantech manufacturing subsidies. This has not precluded manufacturers in China from expanding into such regions, many times without considerable local incentives.

Global Clean Tech Trade Flows

According to the report, China is the single largest clean energy component exporter. On a dollar basis, it accounted for 47% of the global solar, wind, battery, and EV exports in 2024.

The country has integrated supply chains, significantly improved economies of scale, and has intense domestic competition.

China’s export share is specifically high in the solar and battery segments, accounting for approximately two-thirds of the global total. However, its EV exports comprise only 30% of the global exports, despite significant growth.

Southeast Asia and Latin America are emerging as key exporters due to Chinese firms relocating solar manufacturing to these regions and their expansion into EV and battery production.

The U.S. and the EU are major exporters but remain net importers. They imported 47% of the worldwide total in 2024, which BNEF said explains their increasing protectionist policies.

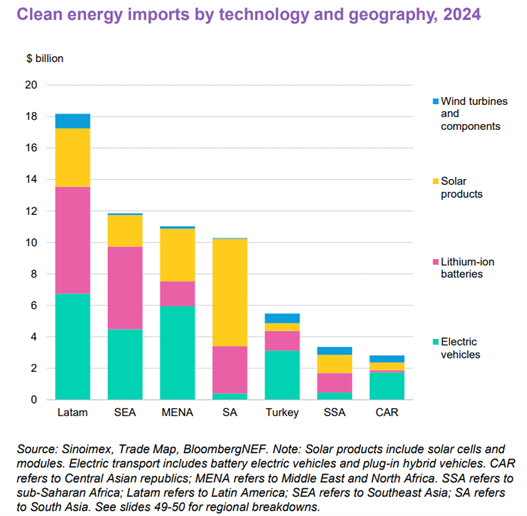

A growing number of regions have emerged as net clean tech importers. Solar products and batteries have significantly driven imports in the Middle East and North Africa (MENA)region, as well as South Asia.

Trade by Technology

Growth in trade of solar cells and modules, wind turbines and components, lithium-ion (Li-ion) batteries, EVs, and plug-in hybrids has risen steadily in the past six years, driven by growing electric transport and Li-ion battery shipments.

Annual global imports witnessed a 126% growth between 2021 and 2024. Global Li-ion battery imports increased 96% during the same period.

Trade in such products peaked in 2023, reducing 4% to $290 billion in the following year. According to the report, this decline reflects lower equipment and EV prices instead of weaker volumes. Imports measured in unit terms rose in most cases.

However, trade in clean energy products continued to expand, contrasting the rising sentiments of protectionism and deglobalization.

Batteries and EVs make up 80% of the global clean tech value. A steep drop in module prices resulted in solar modules comprising just 18% of the total.

The report stated that shipments of wind equipment are limited. Turbine components are typically costly to transport, and a considerable amount of value addition occurs close to the demand location.

BNEF stated that solar cell and module prices have been declining due to overcapacity, particularly over the last two years. Solar cell prices dropped nearly 60% in the last year. Module prices in this period fell 44% due to extreme competition, driven by overcapacity in China, affecting the manufacturers’ margins.

In 2024, the steep price decline contributed significantly to the value of global solar shipments. However, trade of these components increased in gigawatt terms. Imports of solar modules increased 36% and those of cells rose 70% on a capacity basis.

According to the report, governments have been introducing a mix of subsidies, local content rules, and trade barriers to promote solar manufacturing. However, solar cell manufacturing takes more time to scale because it is more capital-intensive than module assemble.

EV battery prices reduced 20% over the last year. Prices for Chinese wind turbines declined 15%.

Focus on Emerging Markets

In 2025, half of China’s solar exports were destined for emerging markets. After expanding production capacity in recent years, the country’s manufacturers are increasingly targeting overseas markets to absorb their surplus output.

According to the report, defensive trade policies such as those being implemented by the U.S. could amplify these shifts.

The share of Li-ion batteries, battery EVs, solar modules, and wind turbines, described by the World Bank as “low” to “upper-middle” income, increased 27% in 2024 from 23% in 2022, reaching 31% by August 2025.

Latin America accounted for nearly 30% of emerging market clean-tech imports. It was followed by Southeast Asia, MENA, and South Asia.

Trade Barriers

According to the report, trade in emerging markets has so far been unencumbered by major tariffs.

Of the 14 markets analyzed by BNEF, the simple average import tariff on six key products in the G20, excluding the U.S., China, and Russia, as well as the African Union, was at just 9.4%.

Solar modules have the highest likelihood for exemption from tariffs, with most markets allowing duty-free imports. Effects are limited even in markets implementing tariffs. For example, Chinese modules made up 93% of the imports in Indonesia, where they qualify for exemptions.

Importers in South Africa can claim refunds on the 10% solar module duty when the South African Customs Union’s member manufacturers fall short of demand. The company has 0.7 GW of solar module manufacturing capacity, compared to 2.2 GW of new solar generation capacity added in the previous year.

For Li-ion batteries, import tariffs usually range up to 10%. Argentina, India, and Turkey are exceptions to this. Turkey’s 33% tariff on non-EV batteries is the highest. However, the tariffs’ impact is limited as components for most energy storage projects in the country are exempted from import duties.

Imports from China typically face higher tariffs in the U.S., Canada, and the EU. The implementing governments justify these tariffs by invoking the need to protect domestic industries from what they describe as excessive subsidization and unfair trade practices by Chinese firms.

BNEF stated that in the U.S., the Trump administration’s frequent tariff changes have caused sharp swings in solar products and non-EV batteries. Rates have risen under multiple measures over the last nine months.

These measures include the 10% blanket reciprocal tariff introduced on April 5, the higher market-specific reciprocal tariffs implemented on August 6 after repeated delays, and a series of country-specific actions targeting China, Canada, Mexico, Brazil, and India since the year’s beginning.

The new measures add to an existing list of tariffs implemented in earlier administrations, starting from 2012, when the first duties were imposed on solar products from China.

The global energy transition is falling behind as the world drifts further from its climate goals, according to Wood Mackenzie’s Energy Transition Outlook 2025–26. It warned that achieving net-zero targets is unlikely before 2060.