Renewable Energy Jobs Hit Record, But Growth Slows Amid Automation

IRENA-ILO report flags job concentration, skills gaps, and inclusion risks

January 14, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

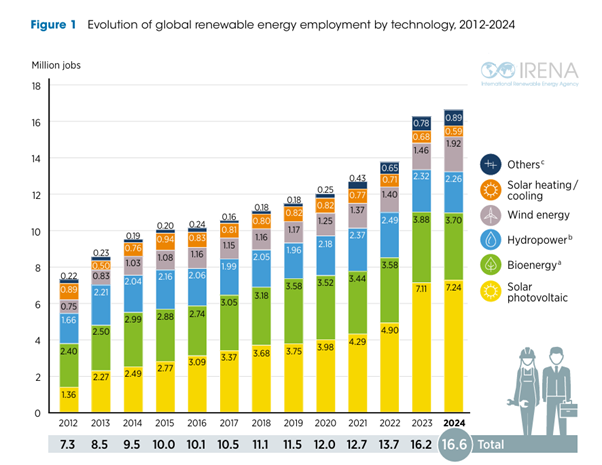

Global renewable energy sector employment stood at 16.6 million in 2024, up 2.3% from 2023, even as global renewable power capacity expanded to 4,443 GW, with a record 582 GW added during the year, according to the Renewable Energy and Jobs – Annual Review 2025 released by the International Renewable Energy Agency (IRENA) and the International Labor Organization (ILO).

The report attributes the divergence between capacity growth and employment to declining job intensity driven by automation, productivity gains, economies of scale, and the rapid expansion of utility-scale projects, particularly in China.

An IRENA report from October 2024 said that the global renewable energy workforce grew to 16.2 million in 2023 from 13.7 million in 2022.

Slowing Employment Growth

The report identifies the current phase of the energy transition as one where employment outcomes are no longer automatically linked to capacity expansion. Automation, artificial intelligence, robotics, and increasingly standardized project designs have reduced the number of workers required per MW installed.

The trend is most pronounced in large, integrated manufacturing hubs, especially in China, where productivity gains have been substantial. Solar and wind together accounted for 97.5% of all net renewable capacity additions in 2024, but the employment impact of these additions varied significantly across regions and technologies.

China remained the dominant global player in both renewable deployment and manufacturing, accounting for nearly two-thirds of global renewable capacity additions in 2024 and creating an estimated 7.3 million renewable energy jobs, representing 44% of the global total. The European Union followed with 1.8 million jobs, unchanged from 2023, while Brazil employed around 1.4 million workers in the renewables sector.

India’s renewable energy employment grew modestly to around 1.3 million jobs, while the U.S.’s rose to 1.1 million.

The report highlights that while several regions are expanding renewable capacity, they are capturing fewer manufacturing and high-quality jobs due to concentrated global supply chains.

Solar Dominates Employment

By technology, solar remained the largest renewable energy employer globally, with 7.2-7.3 million jobs in 2024. Employment spans manufacturing modules, cells, and components, as well as project development, construction, installation, operations, and maintenance.

Asia accounted for approximately 75% of global solar jobs, with China alone accounting for about 4.2 million. Rooftop solar systems were found to be significantly more labor-intensive than utility-scale projects, supporting higher employment per megawatt installed.

Liquid biofuels ranked second, providing about 2.6 million jobs globally, with strong employment linkages to agriculture and feedstock supply chains. Nearly half of these jobs were located in Asia, while Brazil and Southeast Asia recorded notable employment growth.

Hydropower followed with around 2.26–2.3 million direct jobs, concentrated mainly in operations, maintenance, and large-scale project management. China and India together accounted for over half of global hydropower employment, at around 30% and 22% respectively.

Wind energy employed about 1.9 million people globally, with job growth moderated by manufacturing overcapacity, supply-chain consolidation, and intense price competition.

Employment Volatility

The report notes that global overcapacity in solar, wind, and battery manufacturing has triggered price wars and margin compression, favoring large, established manufacturers and raising entry barriers for new players.

While this has reduced equipment costs and supported deployment, it has also increased employment volatility, particularly in manufacturing. Trade and industrial policies, including tariffs and local-content requirements, are increasingly used to build domestic supply chains, but the report cautions that poorly designed measures could slow deployment and disrupt global collaboration.

In the U.S., manufacturing investment has been driven by incentives under the Inflation Reduction Act, though the report flags uncertainty about long-term policy stability. In contrast, the European Union has set ambitious manufacturing targets but lacks binding funding mechanisms to fully support them.

Africa continued to record modest capacity additions and employment growth in absolute terms, with decentralized systems and hydropower playing an important role in rural livelihoods.

India’s Employment Dynamics

Solar employment in India spans manufacturing, project development, installation, and operations, supported by industrial policies, subsidies, and tariffs aimed at expanding domestic manufacturing.

However, the report notes that India remains dependent on imported solar cells, primarily from China, exposing the sector to global price competition and supply-chain volatility. Rooftop solar and decentralized systems in India remain labor-intensive, supporting job creation in installation and operations.

Inclusion, Skills, and Job Quality Challenges

Beyond employment numbers, the report places strong emphasis on workforce quality, skills development, and inclusion. Women hold only 32% of full-time renewable energy jobs globally, compared to a global workforce average of 43.4%, and are concentrated in administrative and non-science, technology, engineering, and mathematics (STEM) roles.

Women account for just 28% of STEM-related roles and 22% of medium-skilled jobs such as installation and construction. Persons with disabilities continue to face structural barriers to hiring and advancement, despite skills and experience.

The report calls for accessible education and training systems, inclusive hiring practices, and workplaces designed to accommodate diverse needs. It stresses that underinvestment in training and outdated curricula are contributing to skills mismatches, particularly as demand shifts toward digital, technical, and system-integration skills.

Without deliberate and coordinated policy action, the report warns that automation, geopolitical tensions, and fragmented supply chains could further slow employment growth and widen inequalities.

In 2025, Mercom highlighted that a shortage of skilled workers is threatening India’s ambitious bid to lead the global renewable energy transition. Industry leaders say this talent gap is driving up costs, delaying projects, and reducing productivity

Outlook

Under a 1.5°C-aligned pathway, IRENA modelling suggests that global renewable energy employment could rise to around 30 million jobs by 2030 and nearly 40 million by 2050.

Achieving these outcomes will require accelerated renewable deployment, large-scale investment in skills and reskilling, coherent industrial and labor policies, and the integration of inclusion objectives into energy and climate strategies.

The report concludes that future employment gains in renewables will depend less on the pace of capacity growth and more on the quality of policies that shape where projects are built, how supply chains are structured, and who participates in the workforce.