Q3 2025 Sees Cost Drop in Large-Scale Solar Systems Across Module Types

Projects using DCR-compliant TOPCon modules recorded the highest CAPEX

November 27, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

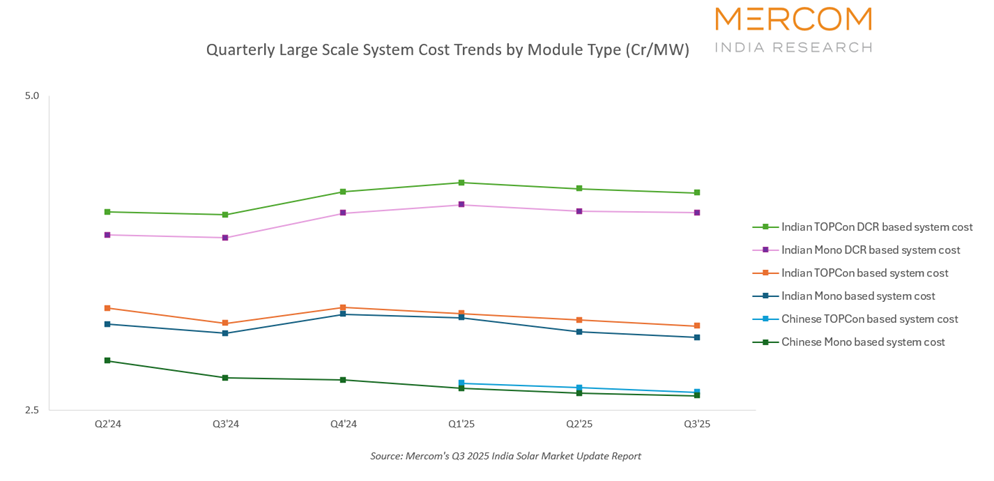

The average system cost of large-scale solar projects remained low in the third quarter of 2025, with cost reductions seen across all module technologies.

Projects using Indian TOPCon modules were the premium option in terms of cost, whereas projects using Chinese mono PERC modules remained the most economical.

Costs fell across module technologies during the quarter. Projects using Indian mono PERC and TOPCon modules recorded the steepest quarter-over-quarter (QoQ) drop of 1.4%. On a year-over-year (YoY) basis, these projects also saw declines of 0.7% and 0.3% in costs.

In a QoQ comparison, projects using domestic content requirement (DCR)-compliant modules saw a relatively modest decline. The cost of projects using DCR mono PERC modules fell by 0.28%, and those with DCR TOPCon modules declined by 0.8%. Compared with the same quarter of the preceding year, the cost of projects using DCR mono PERC modules rose by 5.6%, reflecting the cost premium associated with domestically sourced modules.

Chinese solar module-based projects continued to demonstrate a clear cost advantage through Q3 2025. Projects deploying mono PERC modules posted a 0.7% QoQ decline. In a YoY comparison, costs fell by a sharper 4.8%.

Projects using Chinese TOPCon modules showed a 1.3% QoQ decline.

Overall, QoQ project cost reductions across technologies ranged between 0.3% and 1.4%.

Chinese mono PERC modules accounted for the lowest share of the system cost at 39.5%, highlighting their competitive edge rooted in manufacturing scale and highly optimized production lines.

In contrast, Indian TOPCon DCR modules accounted for the highest cost share at 62.6%, reflecting higher domestic manufacturing costs, smaller production volumes, and the added premium associated with meeting DCR requirements.

Projects equipped with mono PERC DCR modules required roughly 24% more capital than those using non-DCR mono PERC modules. Installations built with TOPCon DCR modules were the costliest of all, with CAPEX running 37%–38% higher than projects using Chinese modules and slightly above the levels seen in mono PERC DCR deployments.

The recent cut in GST on solar cells and modules from 12% to 5% was expected to ease project costs, but the rollout of the ALMM-II policy pushed module base prices higher, largely erasing the anticipated savings. As a result, developers say the overall cost structure has barely shifted, with total EPC and project expenses remaining within the same band despite the tax reduction.

The cost of power conditioning units, primarily solar inverters, declined by 6.3% in Q3 2025, representing 4.2% to 6.8% of overall project costs. Inverters continue to attract a 5% GST, and pricing trends remained closely tied to movements in global semiconductor and electronic component markets.

Meanwhile, falling steel prices during the quarter drove a notable reduction in the cost of module mounting structures (MMS), one of the largest balance-of-system (BoS) components. Developers who placed MMS orders in this period were able to capitalize on the decline, with MMS costs dropping 12.5% and accounting for 5% to 8% of total project costs. Other BoS components remained unchanged, maintaining a relatively small share of 1.2% to 2% of overall system costs.

Supporting broader cost moderation trends, retail price inflation eased significantly. According to data from the Ministry of Statistics and Programme Implementation (MOSPI), India’s inflation rate fell to 1.54% in September 2025, down from 2.1% in June 2025.

These findings are from Mercom’s Q3 2025 India Solar Market Update, a 120-page report that provides an in-depth assessment of India’s solar sector, covering project costs and installations, supply-chain trends, policy developments, and market forecasts.

For the complete report, visit: https://www.mercomindia.com/product/q3-2025-india-solar-market-update