Price Arbitrage Remains Key Use Case for Battery Capacities: EIA

CAISO reported 11.7 GW and ERCOT 8.1 GW of battery capacity in 2024

September 24, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

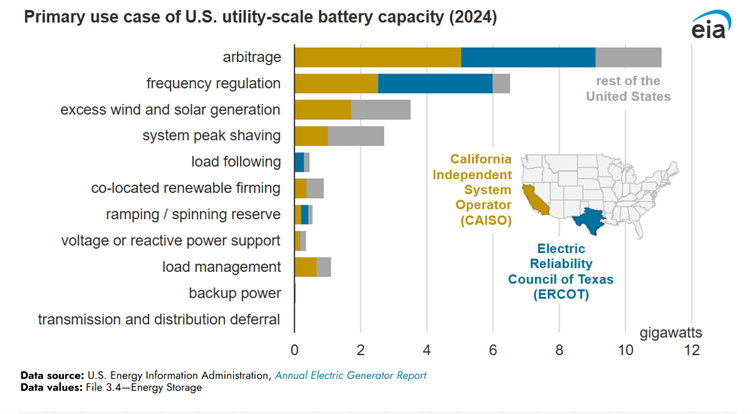

At the end of 2024, price arbitrage was the leading use of utility-scale batteries, accounting for 43% in the California Independent System Operator (CAISO) and about 50% in the Electric Reliability Council of Texas (ERCOT), according to the U.S. Energy Information Administration (EIA).

The survey was conducted between 2023 and 2024.

Most of the U.S.’ utility-scale battery capacity is in the two electricity markets that cover much of California and Texas.

By the end of 2024, CAISO had reported 11.7 GW and ERCOT had reported 8.1 GW of battery capacity.

In the U.S. EIA’s annual report, operators of utility-scale batteries were asked about the common use cases of their battery systems. Price arbitrage was the most common use case of battery systems. Other use cases include frequency regulation, management of excess wind and solar generation, system peak shaving, and load management.

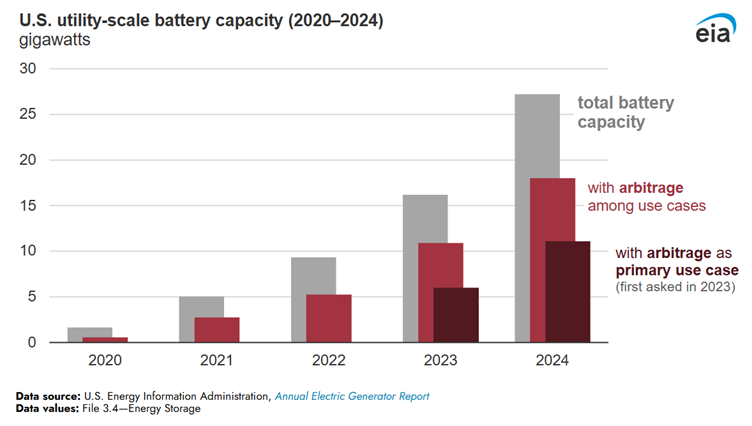

Arbitrage involves buying electricity when prices are relatively low and selling that electricity when prices are high. In previous years as well, batteries were primarily used for price arbitrage.

In the 2023 survey, operators reported that 66% of all utility-scale battery capacity had arbitrage among its uses, and 41% of the total battery capacity was primarily used for this purpose.

However, like previous years, frequency regulation remained the second common use case for battery capacity, accounting for 24% of the total. Frequency regulation involves maintaining the grid’s frequency of 60 cycles per second.

According to BloombergNEF’s (BNEF) latest outlook, the global energy storage capacity additions are expected to grow by 35% in 2025 to 94 GW or 247 GWh. BNEF forecasts a compound annual growth rate of 14.7% between 2025 and 2035, with yearly additions reaching 220 GW or 972 GWh by 2035. The growth will be driven by traditional markets and large-scale utility projects launched or under construction in countries such as Saudi Arabia, South Africa, Australia, the Netherlands, Chile, Canada, and the UK.

Signaling a growing energy storage market, the cost of four-hour lithium-ion battery systems could decline from $334/kWh in 2024 to as low as $108/kWh or remain as high as $307/kWh by 2050, according to the National Renewable Energy Laboratory.