Maharashtra Issues Draft Deviation Settlement Mechanism Regulations

The proposed regulations cover deviation charges and financial mechanisms

August 7, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The Maharashtra Electricity Regulatory Commission (MERC) has released the Draft Deviation Settlement Mechanism (DSM) and Related Matters Regulations, 2025, proposing significant changes to deviation accounting, scheduling, despatch, and financial settlements in the state’s power sector.

Applicability

These regulations will apply to all generating stations connected to the intrastate transmission and distribution system, including conventional power generators, solar and wind generating stations, bagasse/biomass-based cogeneration plants, captive generators, buyers, including distribution licensees and open access consumers, and all entities engaged in wheeling, banking, or self-consumption of electricity.

The regulations extend to all transactions using short, medium, or long-term open access and those involving power exchanges. Generating stations whose scheduling is managed by the state load despatch centre (SLDC), as well as users of the state grid engaging in cross-border or inter/intra-state transactions that affect the Maharashtra grid, are also covered.

Wind and solar generators will remain under the existing MERC (Forecasting, Scheduling and Deviation Settlement for Solar and Wind Generation) Regulations, 2018, unless amended.

Deviation Computation

Deviation will be computed as the difference between actual injection or drawal and the scheduled injection or drawal in MWh for each 15-minute time block. The computation is applicable at the generating station level, the pooling station level (for renewable energy generators), and the buyer level.

The computation will involve the difference between the actual injection or withdrawal and the. The formula for general sellers is Deviation (MWh) = Actual Injection – Scheduled Generation. The deviation percentage will be calculated as 100 × (Actual – Scheduled)/Scheduled.

The same formula applies for buyers, replacing injection with drawal. In case of intra-state hydroelectric projects, deviation will be computed based on actual generation instead of scheduled generation, unless grid constraints arise.

Special energy meter readings must support deviation data in accordance with Central Electricity Authority (CEA) norms. The SLDC will be responsible for providing weekly deviation statements based on meter reading instrument data.

Errors in scheduling caused by transmission constraints or force majeure events may be revised accordingly. The deviation must also adhere to the technical limits of the generator to maintain grid stability.

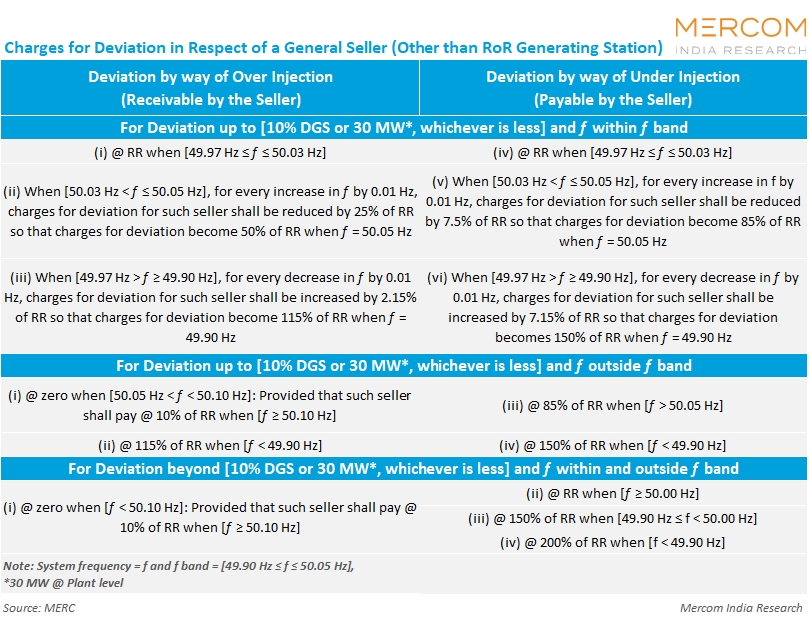

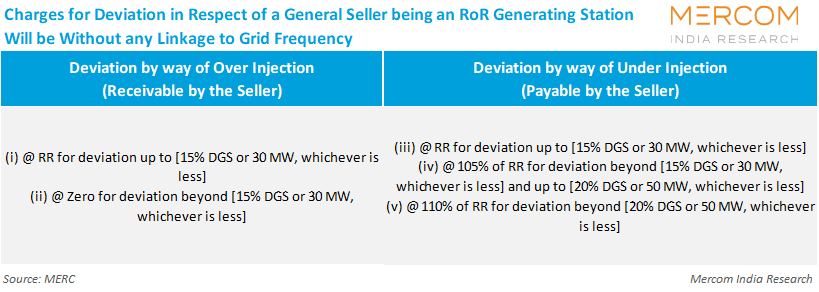

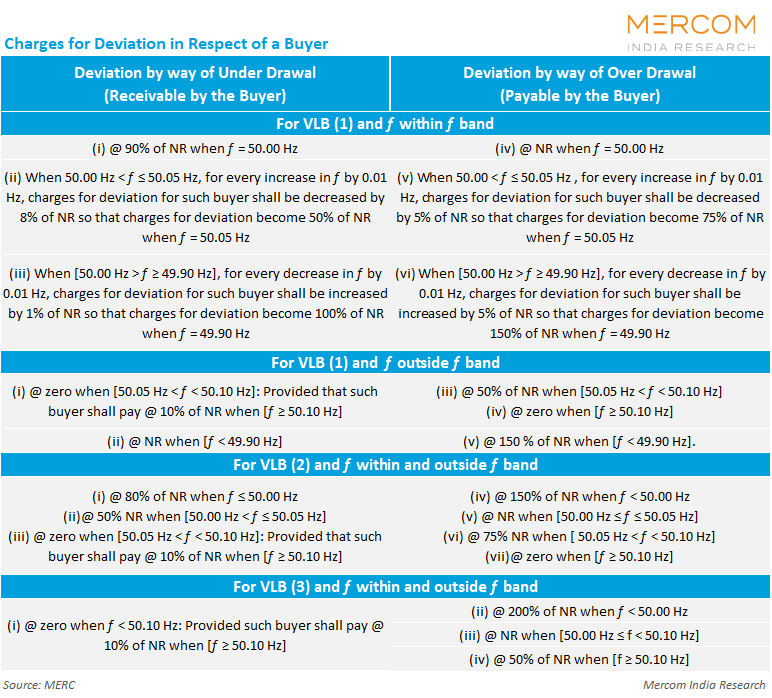

Category-Wise Deviation Charges

Deviation charges differ based on the type of generator or consumer. They are frequency-linked for conventional power generators and buyers. For instance, if the grid frequency drops below 49.85 Hz, the deviation charge will be 150% of the normal rate.

Between 49.85 Hz and 50.05 Hz, the charges will follow a DSM rate table specified by the Commission. When the frequency exceeds 50.05 Hz, the rate will become zero or negative to discourage over-injection.

Renewable energy generators (wind and solar) with a capacity greater than 1 MW will be allowed a ±10% deviation band. No charges will be applied within this band. Deviations beyond 10% but less than or equal to 15% will be penalized at ₹0.5 (~$0.0057)/kWh, between 15% and 20% at ₹1 (~$0.011)/kWh, and above 20% at ₹1.5 (~$0.017)/kWh.

Deviations will be settled at the power purchase agreement rate. Captive renewable energy generators that consume their own generated electricity will be exempted from deviation charges.

Pooling stations for renewable energy will be treated as a single entity. Deviations at this level will be computed collectively, and costs will be allocated proportionally to generators based on their contribution to the deviation. Standalone energy storage systems will be treated like general sellers. In charging mode, overdrawal will be considered under-injection and underdrawal as over-injection.

For buyers, three volume limit bands are proposed, based on deviation severity and peak demand. If the grid frequency falls below 49.90 Hz, charges can go up to 200% of the normal rate. If the frequency exceeds 50.10 Hz, charges will reduce to zero or 10% of the normal rate.

Infirm power injected before the completion of the trial run will be capped at ₹2.86 (~$0.033)/kWh. After a successful trial run, charges will be per the general seller category. Start-up power will be billed at the reference rate, the weighted average clearing price (ACP), or the contract rate, whichever is applicable.

Normal Rate for Deviations

The normal rate for deviation charges in a time block is determined as the highest among three calculated values:

- Weighted average ACP (in paise/kWh) of the integrated day-ahead market (I-DAM) segment across all power exchanges

- Weighted average ACP of the real-time market (RTM) segments of all power exchanges

- An aggregate value derived by summing one-third of the weighted average ACP from I-DAM, one-third from RTM, and one-third of the ancillary service charges

Ancillary service charges will be calculated based on the total quantum of secondary reserve ancillary services and tertiary reserve ancillary services deployed and the net charges payable to the ancillary service providers.

Deviation Charges

Scheduling and Despatch Framework

Scheduling will be conducted in 96 time blocks per day (15 minutes each). The SLDC can revise the block size via notification. The scheduling framework must comply with the MERC State Grid Code 2020 and the Indian Electricity Grid Code.

Renewable energy generators will follow the 2018 DSM regulations applicable to wind and solar generation.

Day-ahead and intraday schedules will be allowed under the regulations. Revisions will be permitted with the following conditions: conventional generators must provide two hours of prior notice, while renewable energy generators will be allowed for up to 16 schedule revisions per day.

The SLDC will make real-time despatch decisions based on merit order despatch, technical feasibility, congestion, and economic efficiency.

It will have curtailment powers in emergencies, congestion, or voltage and frequency deviation scenarios. All curtailments must be logged, and weekly reports on SLDC interventions must be published, along with time-block-wise settlement details based on energy charge rates.

DSM Charges Settlement

All deviation charges will be settled through a State Deviation Pool Account maintained by SLDC. The deviation settlement will be carried out weekly, and payments are based on the deviation volume and applicable rate.

State energy accounts will be prepared monthly by the SLDC, covering injection, drawal, and reactive energy charges. Distribution licensees must separately bill partial open-access consumers. These accounts will be subject to a third-party audit annually.

The regulations introduced the concept of a virtual state entity as a counterparty for SLDC’s real-time interventions. When real-time changes are made, the revised schedule will be assigned to the generator directly and not to the original beneficiary.

Payments to and from the virtual state entity will be routed through the Deviation Pool Account and settled at the prevailing energy charge rate.

All deviation-related dues must be settled within 10 days of the receipt of SLDC’s deviation statement. A late payment interest of 0.05% per day will be applicable if payment is not made within 12 days.

The SLDC must disburse receivables within two working days after receiving funds into the pool account. In case of underpayment, SLDC can deduct the due amount from ongoing transactions or invoke bank guarantees.

Financial Provisions and Security Mechanisms

The State Deviation Pool Account will be utilized for settling deviation payments, reactive energy compensation, and funding grid reliability projects, system studies, and capacity building exercises. Any shortfall in the pool account will be recovered proportionally from state entities through supplementary bills.

A letter of credit (LC) is mandatory for entities in default and must be equivalent to 110% of their average weekly liability. If an entity’s weekly deviation exceeds 50% of its historical average, the LC value will be revised upwards.

The SLDC can also demand a bank guarantee amounting to two weeks of deviation liability from entities with prior defaults. The Maharashtra SLDC (MSLDC) fees and charges for managing DSM will be paid in advance by state entities.

Existing fees under the 2019 DSM Regulations will remain applicable until a new fee structure is finalized. The DSM Pool Account will undergo an annual audit by an independent chartered accountant firm to ensure transparency and compliance.

In 2021, MERC passed an order to resolve multiple issues relating to the commercial implementation of the Deviation Settlement MDSM Regulations.

Subscribe to Mercom’s real-time Regulatory Updates to ensure you don’t miss any critical updates from the renewable industry.