Is Aggressive Bidding Distorting the Economics of Energy Storage Projects in India?

Only 50% of BESS projects in India show positive project economics

January 13, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Only 50% of the standalone battery energy storage system (BESS) projects evaluated in a new industry survey showed positive project economics and economic viability under modeled assumptions, highlighting the continuing cost challenges facing the industry sector, according to the ‘Levelized Cost of Storage (LCOS) and Bidding Trends in Indian Energy Storage Projects’ report released by Mercom India Research.

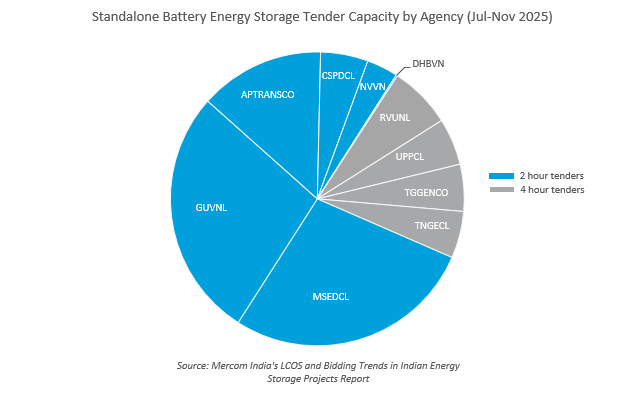

The report assessed projects auctioned between July and November 2025.

The report examined the actual cost of energy storage, the market’s current state, and bidding trends in relation to the underlying project economics. It evaluates both standalone battery storage projects and solar-with-storage projects using LCOS-based analysis.

“Aggressive bidding, often by developers with limited experience in developing energy storage projects, raises serious questions about the realism of underlying cost assumptions. When auction tariffs are not aligned with the actual levelized cost of storage projects, the gap between bid prices and actual project costs widens, increasing the risk of delays, stalled projects, and weakening investor confidence in the auction framework,” said Raj Prabhu, chief executive officer of Mercom Capital Group.

“There is growing concern across the industry that some of the lowest bids winning energy storage auctions are not economically sustainable,” Prabhu added.

The report states that cell costs, project scale, storage duration, cycling profile, and contract tenure are driving factors of storage-delivered energy costs.

Energy storage has moved from the periphery and has become an integral component of India’s clean energy initiative, but with aggressive bidding, there are still serious questions about the economic viability of these projects.

The report states that longer-duration energy storage delivers the lowest LCOS in Indian tenders.

Between July and November 2025, 24 GWh of storage tenders were issued, while 25.6 GWh were auctioned. They included standalone battery energy storage systems and solar-plus-storage systems.

This gradual uptick in tendering activity has led to greater price convergence, with tariffs settling in the range of ₹150,000 (~$1,707)/MW/month to ₹185,000 (~$2,106)/MW/month under the Viability Gap Funding (VGF)-linked program.

As of June 2025, cumulative installed battery storage capacity stood at 490 MWh, with solar-plus-storage projects accounting for the majority of deployments. The pipeline continues to expand rapidly, with nearly 74.8 GW of storage-linked capacity under various stages of tendering by mid-2025.

Mercom India’s ‘LCOS and Bidding Trends in Indian Energy Storage Projects Report’ analyzes cost trends, project design assumptions, economic viability, and LCOS dynamics across energy storage projects auctioned in July and November 2025. The report also focuses on bid viability, highlighting the wide disparity between aggressively priced auction tariffs and project cost fundamentals.

By comparing auction outcomes with the LCOS-based economic benchmarks, the report highlights growing cost pressure on the energy storage market. For more information, visit: https://mercomindia.com/research/

Mercom’s ‘LCOS and Bidding Trends in Indian Energy Storage Projects Report’ is 47 pages long and provides detailed LCOS analysis for battery energy storage projects auctioned between July and November 2025.

For the complete report, Visit: https://www.mercomindia.com/product/indian-energy-storage-projects