IREDA’s Revenue Up 28% in Q2 FY 2026 as Loan Book Swells

The company’s loan book expanded by 31%

October 14, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Government-owned lender, Indian Renewable Energy Development Agency (IREDA), has reported revenue from operations of ₹20.57 billion (~$239.2 million) in the second quarter (Q2) of the financial year (FY) 2026, a 28% year-over-year (YoY) increase from ₹16.30 billion (~$189.5 million).

This revenue growth can be attributed to the 31% expansion of IREDA’s loan book to ₹844.77 billion (~$9.82 billion), supported by approvals of ₹331.48 billion (~$3.85 billion) and disbursements of ₹150.43 billion (~$1.75 billion), which grew by 86% and 54%, respectively, compared to the previous year.

Profit after tax rose to ₹5.49 billion (~$63.8 million) from ₹3.88 billion (~$45.1 million) in the same quarter last year.

For the first half (1H) of FY 2026, IREDA reported a total income of ₹40.17 billion (~$467.1 million) and a profit after tax of ₹7.96 billion (~$92.5 million). Total expenses for 1H stood at ₹30.16 billion (~$350.7 million), mainly driven by finance costs of ₹24.31 billion (~$282.7 million) and impairment provisions of ₹4.33 billion (~$50.3 million).

As of September 30, 2025, IREDA’s total assets stood at ₹877.94 billion (~$10.21 billion), compared to ₹687.48 billion (~$7.99 billion) a year earlier. Its total loan assets increased to ₹826.23 billion (~$9.61 billion) from ₹637.19 billion (~$7.41 billion).

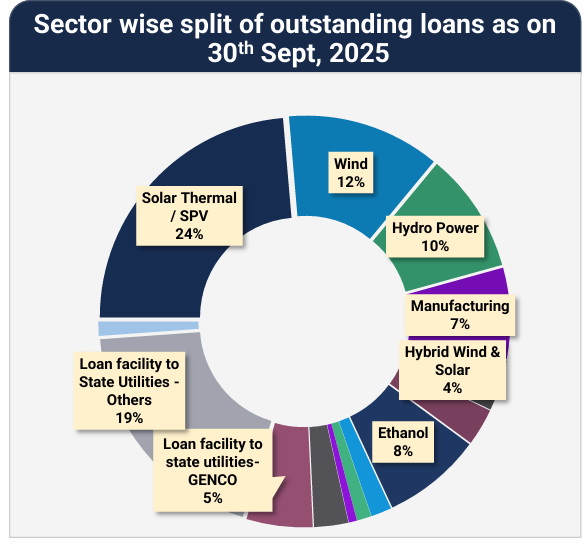

The company’s sector-wise portfolio comprised ₹199.73 billion (~$2.32 billion) in solar, ₹104.43 billion (~$1.21 billion) in wind, ₹81.91 billion (~$923.69 million) in hydro, and ₹67.56 billion (~$762.13 million) in ethanol projects. Manufacturing and emerging technologies, including smart meters, green hydrogen, and energy storage, accounted for ₹87.06 billion (~$1.01 billion).

IREDA achieved loan approvals of ₹331.48 billion (~$3.84 billion) in 1H, up 86% YoY. Its disbursements rose by 54% to ₹150.43 billion (~$1.75 billion) from ₹97.87 billion (~$1.13 billion) in 1H FY 2025. Total loans, recognized as financial assets on the balance sheet, stood at ₹826.23 billion (~$9.58 billion) as of September 30, 2025.

The total loan book of ₹844.77 billion (~$9.80 billion) is distributed across various segments, with solar leading at ₹199.73 billion (~$2.32 billion) (24%), and the wind energy sector at ₹104.43 billion (~$1.21 billion) (12%).

Other significant segments include hydropower at 10% and ethanol projects at 8%. Manufacturing, hybrid wind-solar, and emerging technologies such as transmission, smart meters, and green hydrogen collectively account for the remaining share.

In July this year, IREDA reported a consolidated revenue of ₹19.48 billion (~$226 million) for Q1 FY 2026, a 29% YoY increase from ₹15.1 billion (~$176 million).

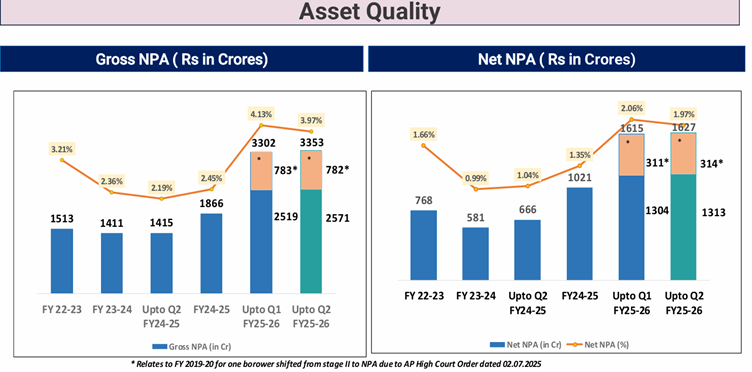

In April this year, IREDA reported a 49% YoY increase in profit after tax for the fourth quarter of the FY 2025 to ₹5.02 billion (~$56.6 million) from ₹3.37 billion (~$39.3 million). IREDA attributed the increase to a decline in NPAs.