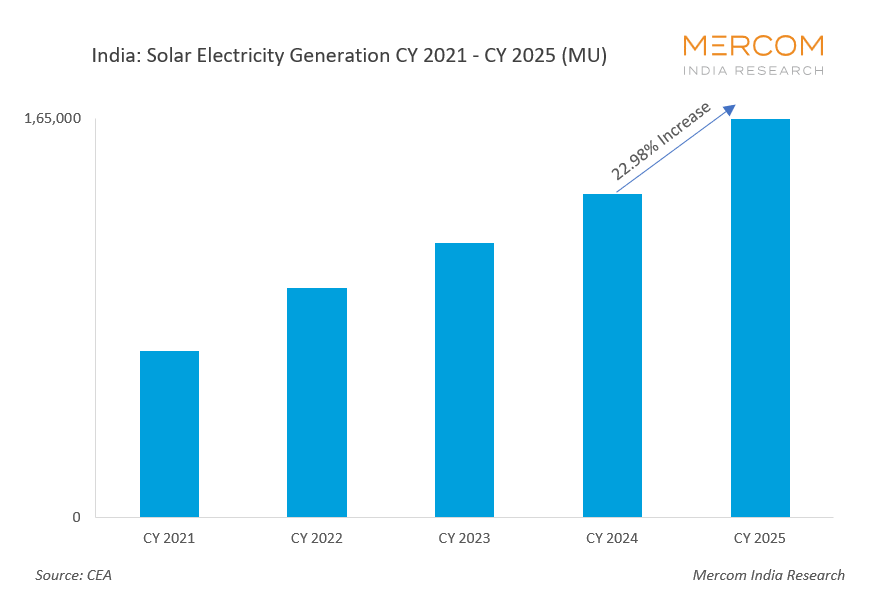

India’s Solar Power Generation Rises 22% YoY in 2025 on Project Commissioning Surge

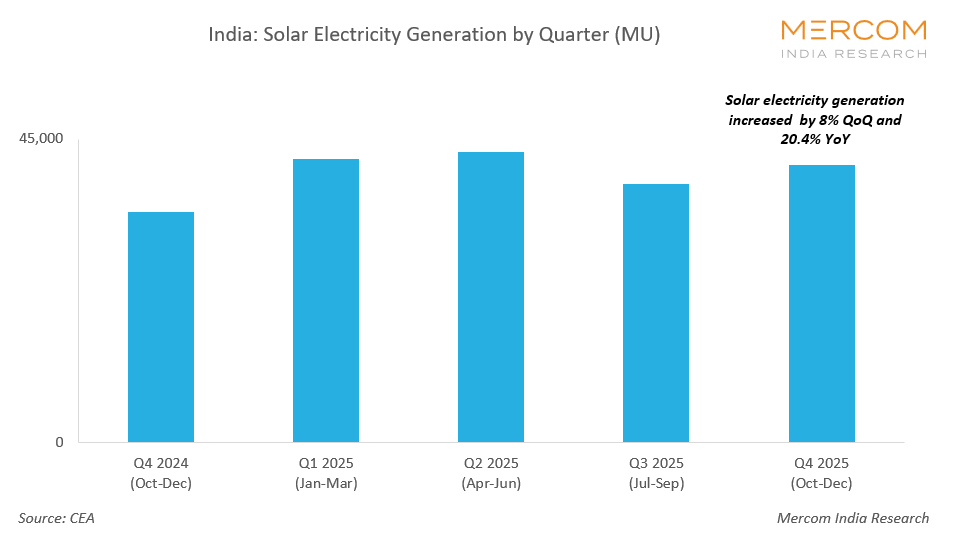

Solar generation rose 20.4% YoY to 41.2 BU in Q4 2025

February 5, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Solar power generation in India rose nearly 22% year-over-year (YoY) to 164.5 billion units (BU) in 2025, up from 133.7 BU, according to data published by the Central Electricity Authority (CEA).

Solar power generation growth in Q4 2025 was driven by the commissioning of multiple projects delayed from 2021 and 2022 due to uncertainties linked to the Great Indian Bustard (GIB) conservation case. These projects were implemented under the Central Public Sector Undertaking (CPSU), IREDA-backed, and other central government programs. Execution momentum picked up after the Supreme Court’s verdict eased blanket restrictions on renewable energy development in designated priority zones, providing regulatory clarity and allowing construction and transmission activities to resume.

Parallelly, developers accelerated execution and grid connectivity ahead of the expiry of the interstate transmission system (ISTS) charges waiver in June 2025, pushing several projects toward early or partial commissioning to retain transmission cost exemptions. Projects that achieved partial commissioning before the deadline were granted full ISTS charge exemptions for the entire approved capacity, further encouraging faster execution.

The combined impact of regulatory clarity on GIB-related constraints and the approaching ISTS waiver deadline led to a marked increase in commissioned capacity in Q4 2025, supporting higher solar power generation.

Q4 2025

Solar power generation during the fourth quarter (Q4) of 2025 reached 41.2 BU, up 8% from 38.2 BU in Q3 and 20.4% YoY from 34.2 BU in Q4 2024. The increase was driven by solar installations, which rose 8.8% quarter over quarter and 39.6% year over year, supporting generation growth.

The northern region generated the highest solar power during the quarter, with 15.6 BU, accounting for 38%. The southern and western regions followed with 13.2 BU and 11.7 BU, accounting for 32.2% and 28.5%, respectively. The eastern and northeastern regions generated 409.5 MU and 95.8 MU, accounting for 1% and 0.2%, respectively.

Rajasthan remained India’s leading solar power-producing state, generating 13.5 BU, followed by Gujarat and Karnataka, which generated 6.1 BU and 4.6 BU, respectively.

Solar generation in Rajasthan decreased by 5.5%, while in Gujarat and Karnataka it rose by 26.5% and 14.8% QoQ, respectively.

In Q4 2025, Rajasthan continued to experience curtailment, peaking at 51.5% between 10:30 am and 2:30 pm across around 4.3 GW of capacity, due to nearly 18 months of delays in Phase II transmission lines, including the Khetri–Narela corridor. This curtailment sharply reduced peak-hour solar generation, with about 8.1 GW of renewable energy zone output stranded due to limited general network access capacity of about 14 GW, compared with 22.5 GW of approved projects.

India’s renewable energy capacity, including large hydroelectric projects, reached 258.3 GW by the end of Q4 2025, accounting for 50.2% of the country’s total installed power capacity, based on data from the CEA, the Ministry of New and Renewable Energy, and Mercom’s India Solar Project Tracker.

Mercom’s India Solar Project Tracker provides access to the most comprehensive database of large-scale solar projects covering commissioned and under-development projects.