Indian Solar Exporters Eye Alternative Markets Post Trump’s 50% Tariff

The country’s solar products are likely to become less competitive in the US market

August 11, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

India’s rising solar export sector has been dealt a severe blow with the U.S. imposing 50% import tariffs.

The U.S. has been the prime destination for Indian solar cell and module manufacturers, but that could soon change. Taking the cue from global trade and geopolitical developments, Indian exporters appear ready to look at other markets.

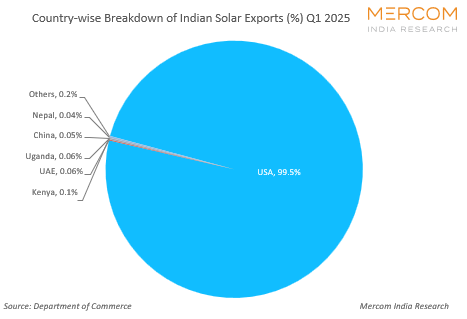

In the first quarter of 2025, the U.S. accounted for 99.5% of the total exports of solar cells and modules. The quarter saw exports rise 26.1% from the previous three months to touch $267.6 million (~₹23.1 billion). According to the Indian government data, solar modules and cells worth $1.5 billion were exported to various countries in 2024. Modules made up 97.7% of total shipments, with cells accounting for 2.3%. By an executive order published by the White House, U.S. President Donald Trump imposed a penalty of 25% on top of the reciprocal tariff of 25% for Indian purchases of Russian oil.

By an executive order published by the White House, U.S. President Donald Trump imposed a penalty of 25% on top of the reciprocal tariff of 25% for Indian purchases of Russian oil.

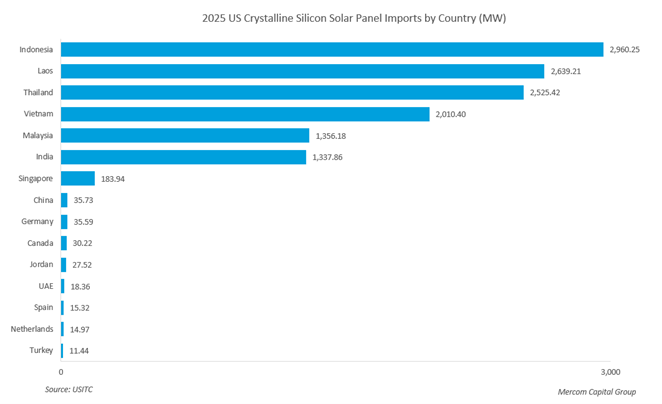

At 50% tariffs, Indian solar products will lose their cost arbitrage and become more expensive than those imported from Vietnam, Thailand, Malaysia, and Cambodia.

These Southeast Asian nations are subjected to tariffs of less than 20%.

Leading solar module exporters will have to rejig their plans and look at new markets. In the near term, their revenue calculations will also be impacted.

Days before the 50% tariffs were announced, Amit Paithankar, CEO at Waaree Energies, acknowledged that the U.S. was the primary export destination for the company. He, however, spoke about diversifying into other markets like Europe.

“As far as the European Union is concerned, we are constantly studying incentives available in various geographies, which include Germany and Italy. From an engineering, procurement, and construction perspective, we have seen the Middle East and Africa offering us substantial potentialities to grow,” he said.

About the likely impact of the impending tariffs, Paithankar stated that while in some cases there is a possibility of going back to the customers and renegotiating the terms, in others such a possibility does not exist, “So, it is going to be a mixed bag.”

Tata Power Solar had said earlier this year that it was looking at exporting 1 GW of solar modules out of approximately 5 GW of its manufacturing capacity.

Indian companies also have the opportunity to export to the UK at zero duty following the conclusion of the recent trade deal between the two countries, but the market is fairly small.

The 50% U.S. tariff will kick in on August 27. Trade talks between the two countries were set to resume this month, but Trump has frozen negotiations for now.

Trump’s tariff salvo comes at a time when trade petitions have been filed in the U.S. against Indian solar imports. Several American companies, part of the Alliance for American Solar Manufacturing and Trade, filed petitions seeking anti-dumping and countervailing duty investigations into solar imports from India.

These petitions allege that companies based in India were engaging in illegal trade practices by undercutting the U.S. solar manufacturing industry and flooding the market with cheaper imports. India faces a high dumping margin of 213.96%.