India Installs 387 MW of Rooftop Solar Capacity in Q2, a 20% QoQ Drop

Rooftop solar installations comprised 23% of the total solar installations in Q2 2023

August 31, 2023

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

India added 387 MW of rooftop solar capacity in the second quarter (Q2) of 2023, down 20% from 485 MW in Q1.

According to the newly released Q2 2023 Mercom India Rooftop Solar Market Report, rooftop installations dropped 0.5% year-over-year.

Priya Sanjay, Managing Director of Mercom India said, “The downward trajectory of costs began in the quarter, and to see the tangible impact of this shift will require time. Effects of the cost reduction are anticipated to manifest more prominently in the upcoming quarters.”

Rooftop solar installations accounted for almost 23% of total solar installations in Q2 2023.

During the quarter, residential users accounted for 54% of the capacity, industrial users 25%, and commercial users accounted for 21%.

India’s cumulative rooftop solar capacity reached 9.6 GW at the end of Q2 2023.

In Q2 2023, the average cost of a rooftop solar system fell by 2.7% QoQ and 4.2% YoY.

Between January and June 2023, 872 MW of solar rooftop capacity was installed, marking a modest 3.2% growth from the 845 MW added in the first half (1H) of 2022.

“Rooftop solar did not meet expectations in the first half of the year, even with falling component prices and growing demand. We could see a much stronger second half as installers holding out for better margins start ramping up installations and fulfilling demand faster,” said Raj Prabhu, CEO of Mercom Capital Group.

In Q2 2023, rooftop solar tenders dropped by 56% from the previous quarter to 148.7 MW, and compared to Q1 2022, the tendered capacity was down by 43.4% to 262.4 MW.

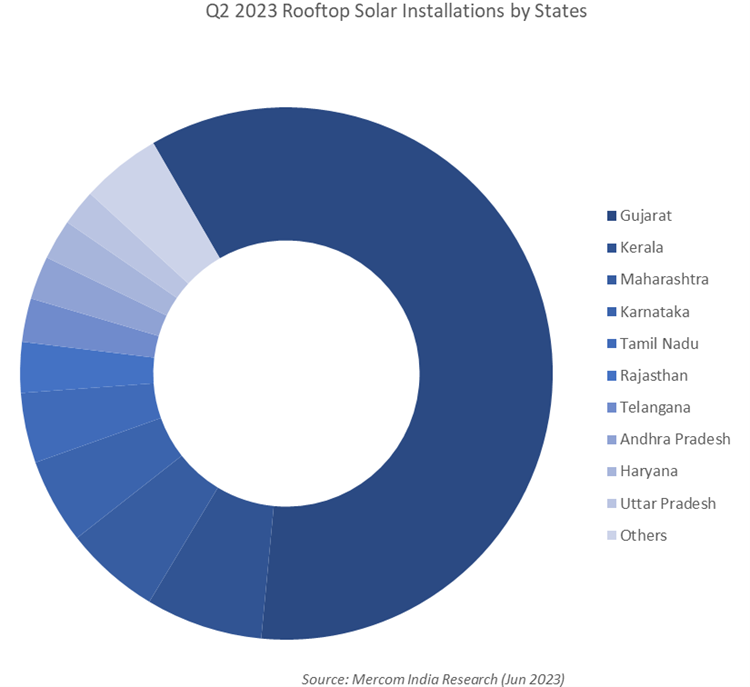

During the quarter, the highest rooftop solar capacity increments were recorded in Gujarat, Kerala, and Maharashtra, constituting almost 73% of the total added capacity.

Gujarat remained the leading state, adding 232 MW. This impressive figure constituted 59.8% of the total installations in the quarter.

The involvement of state distribution companies (DISCOMs) in promoting solar adoption is essential to drive rooftop solar initiatives.

“The diversity in installation rates also stems from variations in state electricity tariffs and usage patterns. States with considerably lower DISCOM tariffs dampen the incentive for rooftop adoption due to negligible savings,” explained Sanjay.

Agricultural and residential consumers enjoy subsidized electricity tariffs, draining DISCOM’s bottom lines. These revenue losses are often compensated by levying cross-subsidy surcharges on commercial and industrial (C&I) consumers.

In Gujarat, DISCOMs have strategically promoted agricultural and residential consumers to adopt solar, reducing their power demand from DISCOMs, making it easier for them to serve mostly their high paying consumers.

“For many (C&I) consumers, a single rooftop can accommodate systems ranging from 100 kW to 1 MW. However, DISCOMs are reluctant due to fears about losing consumers and delay approvals.”

Looking at long-term goals, Sanjay said, “With the government pushing for manufacturing in India across industries, DISCOMs should adopt a broader perspective. Discouraging small C&I consumers from going solar could hinder long-term benefits. Enabling an environment for C&I consumers might even turn states into manufacturing hubs, similar to Gujarat’s approach, and create higher power demand.”

The Mercom India Rooftop Solar Report Q2 2023 is 56 pages long and covers all facets of India’s rooftop solar market. For the complete report, visit: https://www.mercomindia.com/product/rooftop-solar-market-report-q2-2023