India Adds 7.8 GW of Solar Open Access Capacity in 2025

The open access capacity rose 0.5% YoY

February 19, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

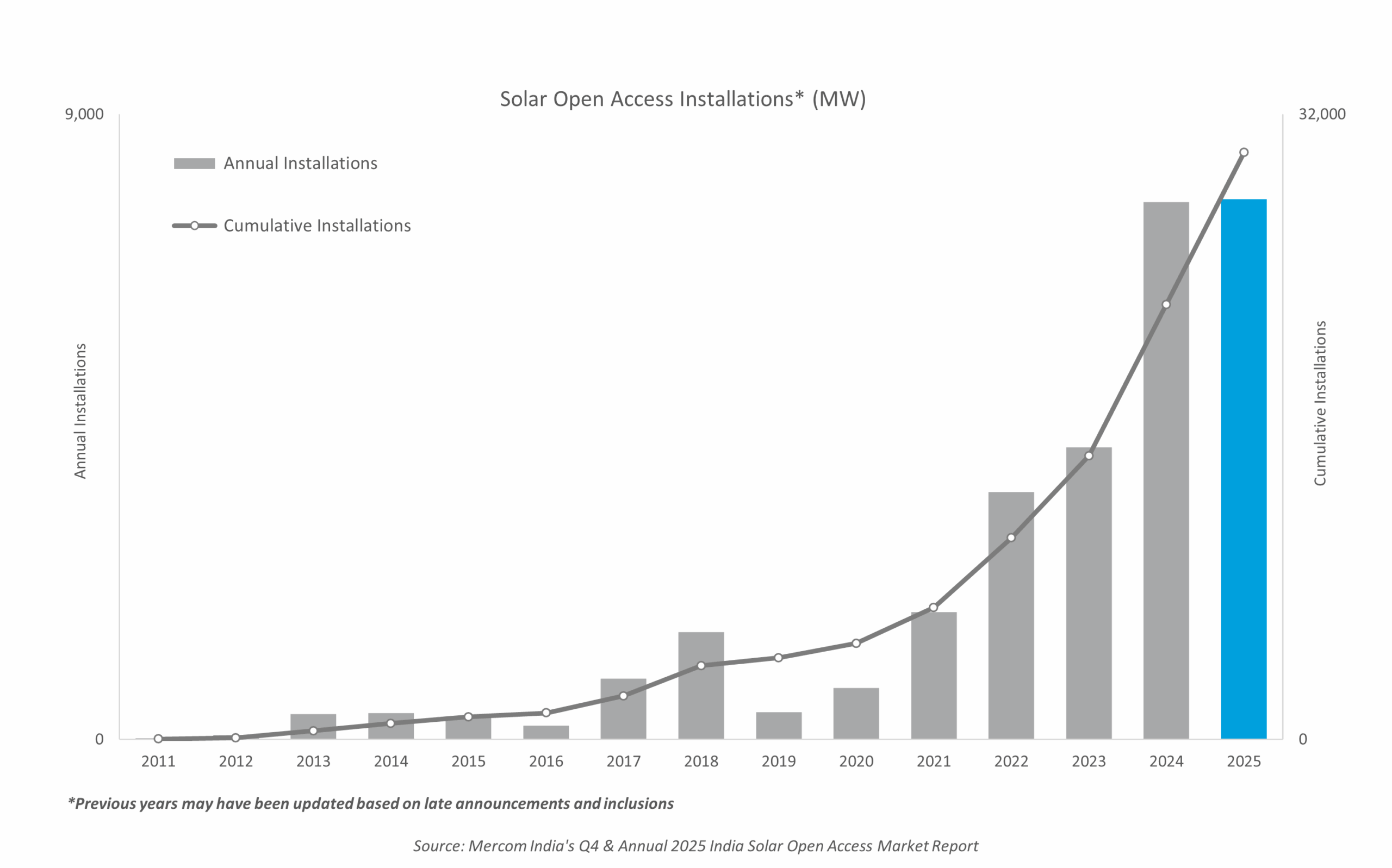

India added 7.8 GW of solar open access capacity in 2025, a largely flat 0.5% year-over-year (YoY) growth from 7.7 GW, according to Mercom’s Q4 & Annual 2025 India Solar Open Access Market Report.

India’s cumulative installed solar open access capacity exceeded 30 GW as of December 2025.

In the fourth quarter (Q4) of 2025, the country added open access solar capacity of 1.6 GW, down approximately 29% from 2.2 GW in Q3 and over 32% YoY from 2.3 GW.

Many projects initially scheduled for commissioning in the second half of the year were completed ahead of schedule due to the phasing out of the interstate transmission system (ISTS) charge waiver, which expired in June. These early project commissionings led to lower project execution in the latter part of 2025, including in Q4.

Over 45 GW of open access projects were under development and in the pre-construction phase at the end of Q4 2025.

“Solar open access demand remains strong, particularly from large industrial users and data centers seeking long-term tariff certainty while meeting sustainability goals. We expect installations to grow faster in 2026, but the market is evolving. Developers are prioritizing projects with clear regulatory visibility, stable load profiles, and credible offtakers. Rising costs, tighter compliance requirements, and execution constraints will influence the pace of additions in the near term. However, the underlying drivers remain solid, and as infrastructure and regulatory clarity improve, open access is positioned for sustained growth,” said Raj Prabhu, CEO of Mercom Capital Group.

Solar open access faces challenges despite its continued annual growth.

Priya Sanjay, Managing Director, Mercom India, said challenges for solar open access included the mandate under the Approved List of Models and Manufacturers (ALMM)-II to use modules with cells manufactured in India from June 2026.

She added that land acquisition is becoming a problem because project developers must obtain approval from multiple government agencies. Securing connectivity is another challenge.

State-Wise Installations

Karnataka led India’s solar open access market in 2025, accounting for more than 24% of installations. It was followed by Maharashtra and Rajasthan, contributing over 20% and 18%, respectively, to the capacity additions.

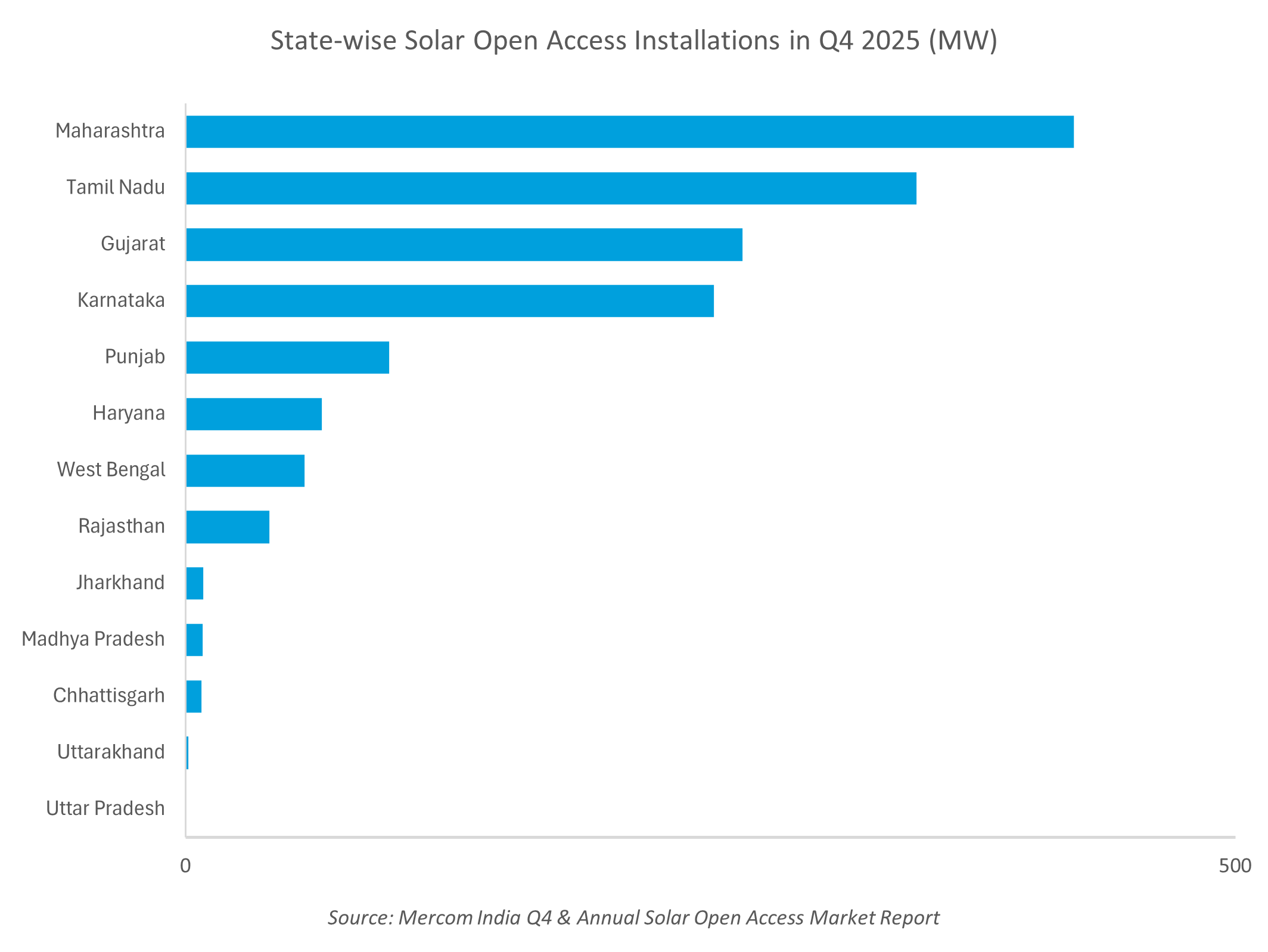

Maharashtra, Tamil Nadu, and Gujarat led solar open access installations in Q4, contributing approximately 27%, over 22%, and nearly 17%, respectively, to the total capacity additions.

Commenting on the reasons for Karnataka’s performance, Sanjay said, “Karnataka has always had consistent policies. The state has many IT companies and other large power consumers, which creates an inherent open-access power demand. Even the state DISCOMs have been giving approvals fairly quickly.”

Installations in Maharashtra could have been higher if not for the regulatory uncertainty. Data centers coming up in Karnataka and Maharashtra are driving demand for open access in these states.

Sanjay believes India’s commercial and industrial (C&I) segment would benefit from greater awareness of the long-term advantages of solar and other renewable energy sources. Many C&I entities currently focus on immediate savings or payback periods when evaluating solar. However, they often overlook that the financial benefits can extend over 25 to 30 years.

India’s Green Day-Ahead Market (G-DAM) experienced a nearly 18% growth quarter-over-quarter (QoQ).

Adani Green Energy retained its position as the top seller in G-DAM from the previous year, accounting for approximately 38% of the traded electricity.

Odisha procured the largest volume of electricity at G-DAM, accounting for more than 23% of the total traded electricity.

The cleared volume of Renewable Energy Certificates traded on the Indian Energy Exchange (IEX) fell nearly 58% QoQ.

The volume traded in the Green Term-Ahead Market on IEX reduced by over 32% from the previous quarter.

Sanjay expects greater solar open access growth if states such as Maharashtra overcome their policy issues.

The report provides a detailed analysis of the solar open access market, retail electricity tariffs, and other open access charges and costs across 15 states.

The Q4 & Annual 2025 Mercom India Solar Open Access Market Report is 82 pages long and provides comprehensive market data and analysis. For the complete report, visit: https://www.mercomindia.com/product/q4-2025-mercom-india-solar-open-access-market-report