India Adds 44 GW of Solar Module Capacity in 1H 2025

The country added a solar cell capacity of 7.5 GW

September 30, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

India added 44.2 GW of solar module capacity and 7.5 GW of solar cell capacity in the first half (1H) of 2025, according to the recently released Mercom India research report, “State of Solar PV Manufacturing in India 1H 2025.”

The manufacturing capacity additions in 1H 2025 were primarily driven by strong demand from the large-scale solar project pipeline of 186 GW between 2025 and 2027.

Module manufacturing capacity also increased due to the 2030 solar installation targets and policy-driven domestic demand for solar modules compliant with the Approved List of Models and Manufacturers (ALMM).

Indian manufacturers currently have 182 GW of solar module capacity and 86 GW of cell capacity under construction, expected to be commissioned by 2027.

“Although companies have announced large manufacturing capacities, actual operational capacities can be 30% to 40% lower. New module lines typically take several months to stabilize before reaching full utilization, while smaller facilities continue to operate at lower levels, constrained by outdated technologies, lack of scale, and lower-wattage modules that are no longer in demand. This has led to fewer orders and accelerated consolidation, with only larger manufacturers that possess scale, efficiency, and credibility remaining competitive. DCR module shortages will persist until domestic cell capacity increases,” commented Raj Prabhu, CEO at Mercom Capital Group.

As of June 2025, 91.5 GW of module production capacity across various technologies and wattages had received ALMM certification. Of the cumulative installed cell production capacity, 13.1 GW was listed under ALMM List-II, as per the MNRE’s order issued on July 31, 2025. ALMM-certified capacities provide a more accurate reflection of supply, although wattage breakdowns are not disclosed in the ALMM list.

As of the release of this report, the cumulative capacity of modules under the ALMM List-I stood at 109.5 GW, and the cumulative cell capacity of ALMM List-II stood at nearly 17.9 GW.

The top 10 manufacturers accounted for 49.9% of the solar module and 99.2% of solar cell production capacity as of June 2025.

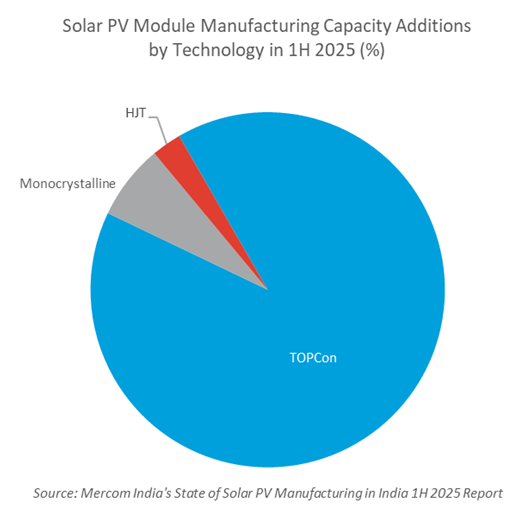

Tunnel oxide passivated contact (TOPCon) module led manufacturing capacity additions in 1H 2025 accounted for over 90%, followed by monocrystalline modules, which accounted for almost 7%. For the first time, heterojunction (HJT) module capacity was added in the country, contributing nearly 3%.

There were no additions to integrated solar wafer/ingot or polysilicon production capacities in 1H 2025.

As of June 2025, monocrystalline technology accounted for 54.5% of the solar cell production capacity, followed by TOPCon (41.5%) and polycrystalline (4%).

Priya Sanjay, Managing Director at Mercom India, stated that with ALMM-II in effect, module manufacturers must either establish their own cell plants or form partnerships with existing cell manufacturers. “All modules must now use ALMM-compliant cells, meaning even established module makers cannot sell without having captive cell capacity. Larger companies are already building plants, while smaller manufacturers with capacities below 500 MW remain in a wait-and-see mode.”

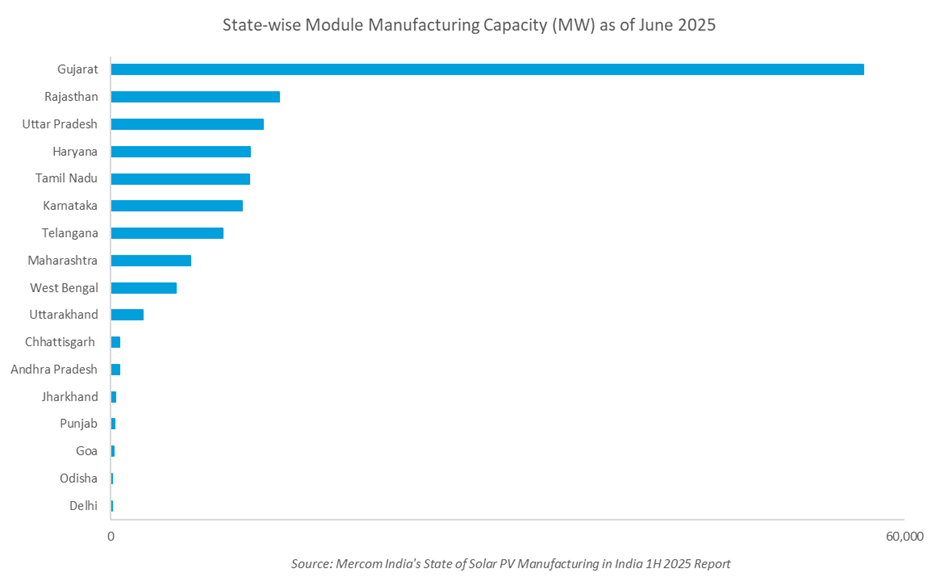

Gujarat was the most favoured location for solar module manufacturing, accounting for 41.6% of the solar module production capacity as of June 2025. Rajasthan and Uttar Pradesh followed with solar module production capacities of 12.8 GW and 11.5 GW, respectively.

Gujarat was also the state holding the largest annual solar cell production capacity at 47.3%. Tamil Nadu and Karnataka followed as other top states, with capacities of 4.3 GW and 3.6 GW, respectively.

Tenders issued by various public sector and government entities to procure solar modules in 1H 2025 dropped by 88.7% year-over-year, totaling 860 MW.

India imported a total of 44.6 GW of solar modules and cells in 1H 2025. Solar modules accounted for 34% of the imports, and solar cells accounted for 66% imports in 1H 2025.

Domestic manufacturers exported nearly 3 GW of solar modules and 83 MW of solar cells in 1H 2025, primarily to the U.S.

“Exports have also been hit hard. Shipments to the United States, which accounted for more than 95% of Indian module exports, have come to a halt after the recent 50 percent tariff,” added Prabhu.

Sanjay expects to see a temporary supply crunch in the future due to the imposition of ALMM-II.

“Demand for cells will spike by June 2026, but most new cell capacities won’t be ready within the next few quarters. Some manufacturing lines are expected to come online by mid-2026, but a temporary supply crunch is likely to persist until additional capacity is commissioned,” added Sanjay.

She noted that the industry is also waiting to see whether the government will extend the compliance deadline for ALMM cells.

Mercom’s State of Solar PV Manufacturing in India 1H 2025 Report is 111 pages long and covers all facets of India’s solar PV manufacturing market, including demand and supply overview, top manufacturers, market outlook and projections, and manufacturing trends, among other details.

For the complete report, visit: https://www.mercomindia.com/product/state-solar-manufacturing-india-1h-2025