India Added 6.1 GW of Solar Open Access Capacity in 9M 2025

The installations grew 13% from 9M 2024

December 2, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

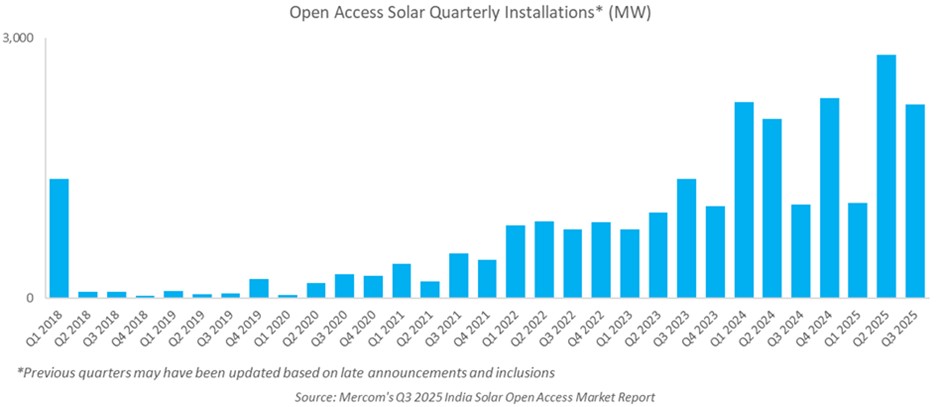

India added 6.1 GW of solar open access capacity in the first nine months (9M) of 2025, increasing over 13% year-over-year (YoY) from 5.4 GW, according to Mercom India’s Q3 2025 Solar Open Access Market Report.

The installation growth during this period was driven by increasing demand from commercial and industrial (C&I) consumers.

India added 2.2 GW of solar open access capacity in the third quarter (Q3) of 2025, a 20% decline from 2.8 GW installed in the previous quarter. However, installations increased nearly 108% YoY from 1.1 GW.

Capacity additions in Q3 2025 were affected by delays in grid-connectivity approvals, restricted substation access, and limited transmission evacuation capacity in states with weak grid infrastructure.

“Commercial and industrial units are pressing ahead with decarbonization, undeterred by execution challenges and rising costs. Though infrastructure and regulatory issues pose challenges, solar energy continues to thrive as the most affordable alternative to traditional power sources,” said Priya Sanjay, Managing Director at Mercom India.

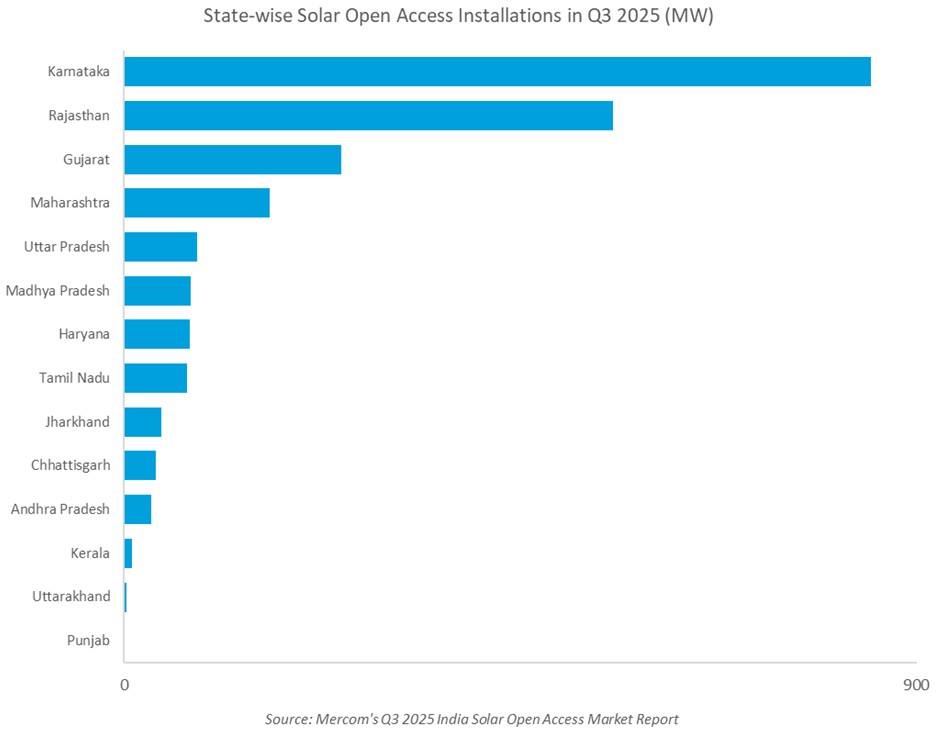

Karnataka recorded the highest solar open access capacity additions, accounting for nearly 38% of the installations, in Q3. It was followed by Rajasthan and Gujarat, which accounted for 25% and 11% of the additions.

As of September 2025, the cumulative solar open access capacity stood at 27.9 GW. Karnataka remained the leading state in cumulative installations, accounting for almost 25% of the total capacity. Maharashtra and Gujarat came in at second and third, with 17% and 12% of the total installations.

On Karnataka’s performance, Priya Sanjay, Managing Director at Mercom India, said, “Karnataka has always performed well when it comes to open access installations. It was one of the first states to adopt an open access policy. It also has comparatively seamless distribution company (DISCOM) approvals.”

She stated that the state has maintained a consistent open access policy. The state had tried to introduce a retrospective policy change once, which did not go through. Additionally, there has been considerable availability of project land, and its prices have been comparatively affordable. However, things have begun to change with large-scale deployment. DISCOMs have also been handling these projects well.

On the performance of other states, she said, “Each state is different. For example, Rajasthan will probably pick up because it now has a policy in place, it has good banking regulations, and the state has always been the best for solar projects. Land is also affordable there. In Andhra Pradesh and Telangana, the policies were not very clear, and DISCOM approvals were even worse. Land acquisition has also been a problem to a certain extent.”

Maharashtra’s performance is improving, according to Sanjay. However, it did not have a good policy for a long time. “One may assume Maharashtra is an excellent market because the power tariffs for the C&I sectors are high, and there is also a significant availability of land.” However, DISCOM approvals are an issue in Maharashtra. Additionally, until the interstate transmission system charges waivers for open access projects came into effect, it was difficult to wheel power out of Maharashtra or to transfer energy into the state due to the high interstate transmission charges.

Recently, Maharashtra introduced changes to banking rules and time-of-day tariffs.

While Gujarat’s policy is favorable to open access, the state has leaned towards hybrid projects rather than approving standalone projects, she said.

Open access installations depend on synchronized factors, including conducive policies, land availability and affordability, and ground-level approvals from various departments. Consumer demand also played an important role.

Adani Green Energy was the leading seller in the green day-ahead market (G-DAM), accounting for roughly 44% of the electricity sold.

Odisha was the leading procurer from G-DAM, contributing to 449.7 million units (MU) of electricity purchased.

The cleared volume of renewable energy certificates traded on the Indian Energy Exchange (IEX) decreased by 16% quarter-over-quarter.

Electricity traded on the IEX in the green term-ahead market totaled 92.7 MU in April, 73.9 MU in May, and 30.3 MU in June.

The Q3 2025 India Solar Open Access Market Report by Mercom India is 74 pages long and provides vital market data.

Sanjay is optimistic about the growth of open access projects. She stated that there is a growing number of public sector undertaking setting up captive projects. These have land availability and energy consumption obligations. Many multinational companies and micro, small, and medium enterprises are also opting for open access installations.

She also highlighted the greater availability of loans for open access projects, including from state banks and private lenders, with quick disbursements and, in some cases, no collateral.

For the complete report, visit: https://www.mercomindia.com/product/q3-2025-mercom-india-solar-open-access-market-report