India Added 4.9 GW Rooftop Solar Capacity in 9M 2025

The country added 2.1 GW of rooftop solar systems during Q3 2025

November 25, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

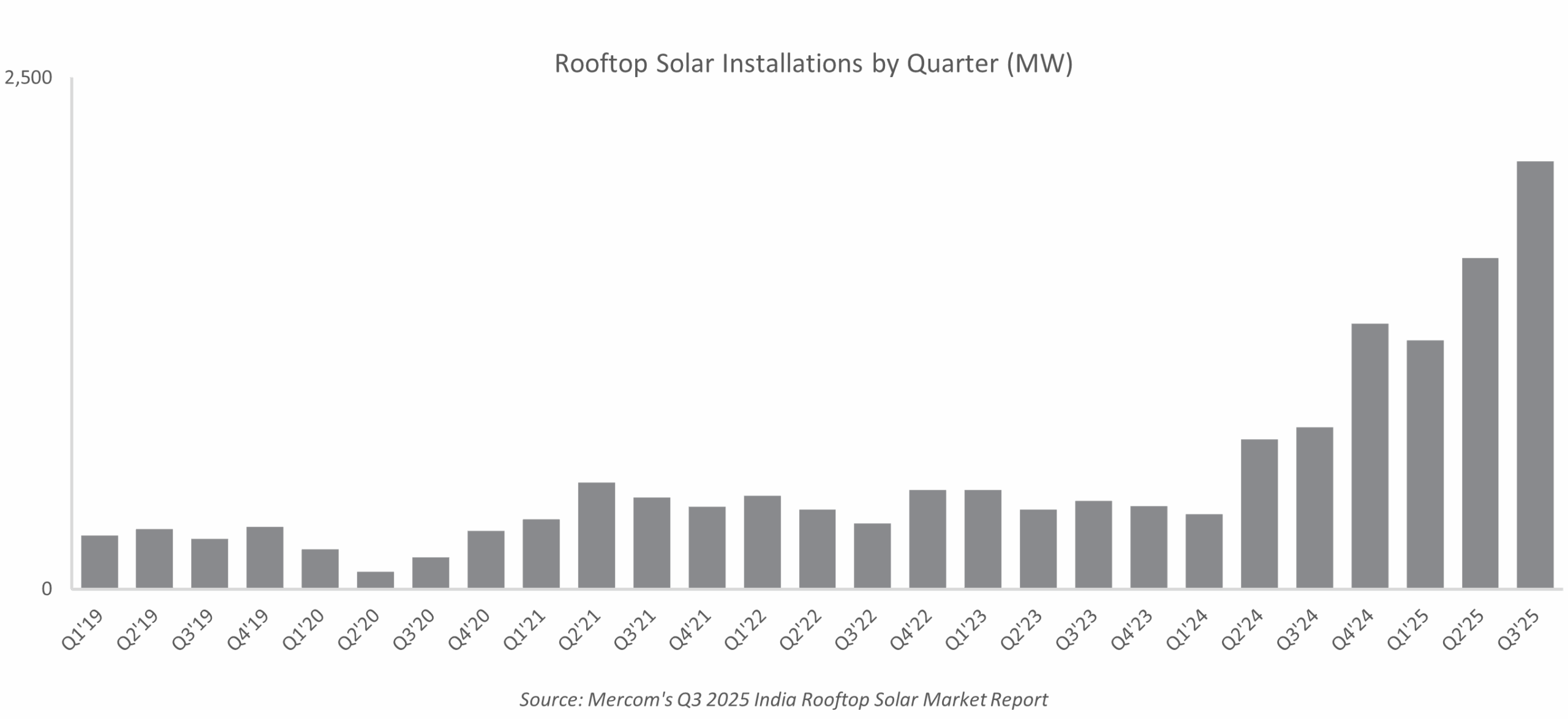

India added 4.9 GW of rooftop solar capacity in the first nine months (9M) of the calendar year 2025, compared to 1.9 GW in the previous year, a 161% year-over-year (YoY) increase, according to Mercom India’s newly released Q3 2025 India Rooftop Solar Market Report.

During the third quarter (Q3), the country added 2.1 GW of rooftop solar capacity, a 29% increase quarter-over-quarter (QoQ) from 1.6 GW and a 164% YoY rise from 791 MW.

Rooftop solar accounted for 24.1% of the country’s total solar additions during the quarter.

“Like utility scale, rooftop installations in the first nine months of the year have already surpassed all of last year’s additions. Residential installations, which made up only a third of rooftop solar three years ago, now account for 75% of the market. We expect this trend to continue until the PM Surya Ghar target is reached. The awareness created by the program is also likely to influence smaller C&I customers and encourage them to go solar. To keep this momentum on track, quality control in residential systems and persistent cost and supply challenges will need ongoing attention from the policymakers,” said Raj Prabhu, CEO of Mercom Capital Group.

Residential sector installations led with 1,526 MW, accounting for 73% of the total capacity added during the quarter, driven by the PM Surya Ghar: Muft Bijli Yojana.

The industrial segment contributed 413.5 MW, accounting for 19.8% of the quarter’s additions, followed by the commercial segment with 123.4 MW (5.9%) and government installations with 27.6 MW (1.3%).

The PM Surya Ghar program’s digital integration with the JanSamarth loan platform and continued improvements to the official portal enabled streamlined applications, faster approvals, and efficient subsidy disbursement.

Public sector banks had approved more than 579,000 loans by September 2025, and states such as Uttar Pradesh, Delhi, Odisha, Haryana, Assam, Andhra Pradesh, and Maharashtra offered incentives beyond central subsidies.

In Q3 2025, capacity additions under the capital expenditure (CAPEX) model reached 1,756 MW, representing 84% of total installations. Most CAPEX-based projects were completed under the PM Surya Ghar initiative, which is expected to retain its dominant share in upcoming quarters.

Priya Sanjay, Managing Director at Mercom India, said, “For rooftop solar to sustain long-term growth, savings must remain compelling. Project economics have shifted due to mandatory domestic content requirements (DCR) for modules. Smooth net-metering policies and timely approvals are critical for growth.”

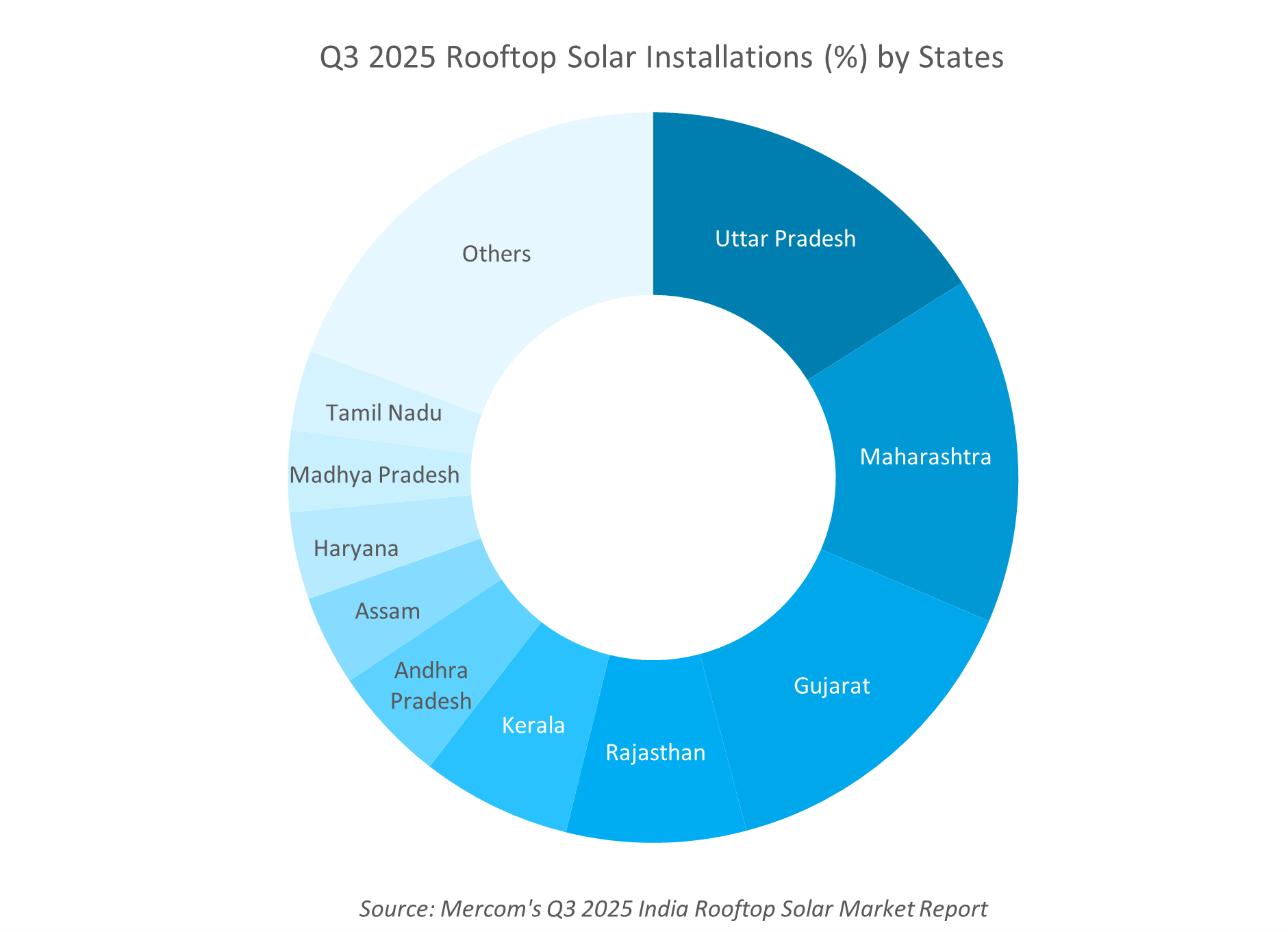

Uttar Pradesh led rooftop solar installations during Q3 2025 with 335.3 MW, followed by Maharashtra with 321.7 MW and Gujarat with 302.1 MW, accounting for 16%, 15.4% and 14.5% of additions, respectively. Rajasthan and Kerala followed with 166.4 MW and 138.9 MW.

The top five states accounted for 60.5% of total installations during the quarter.

In cumulative terms, installations reached 18.6 GW as of September 2025, with Gujarat leading at 4.8 GW, followed by Maharashtra at 2.8 GW and Rajasthan at 1.33 GW. Kerala and Uttar Pradesh followed with 1.30 GW and 1.29 GW, respectively.

Assam recorded the highest compounded quarterly growth rate at 35.3% between Q3 2024 and Q3 2025, followed by Uttar Pradesh at 22.1% and Andhra Pradesh at 15.8%.

Sanjay explained that emerging regions grew rapidly due to limitations related to large-scale solar development. “States like Assam and Kerala do not have land availability for utility-scale solar. So they focus heavily on rooftop adoption,” she said. However, she cautioned that growth in such states can fluctuate based on short-term subsidy programs.

In Q3 2025, more than 1.5 GW of rooftop solar tenders were issued, an 18.6% increase from 1.27 GW in Q2 2025 and a 311% rise YoY from 366 MW. However, only 6.3 MW were auctioned, representing an 87% decline from 49 MW in Q2 2025 and a 200% increase from 2.1 MW in Q3 2024.

The Q3 2025 Mercom India Rooftop Solar Report is 120 pages long and covers all facets of India’s rooftop solar market. For the complete report, visit: https://www.mercomindia.com/product/rooftop-solar-market-report-q3-2025