GWEC: Asia-Pacific to Lead as Global Wind Capacity Heads Toward 2 TW by 2030

GWEC projects record installations, rising investment, and regional shifts

January 23, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Asia-Pacific continues to drive global wind growth, led by China and India, as worldwide wind capacity is expected to surpass 2 TW by 2030, according to the Global Wind Energy Council’s (GWEC) Global Wind Market Outlook Q3 2025 Update.

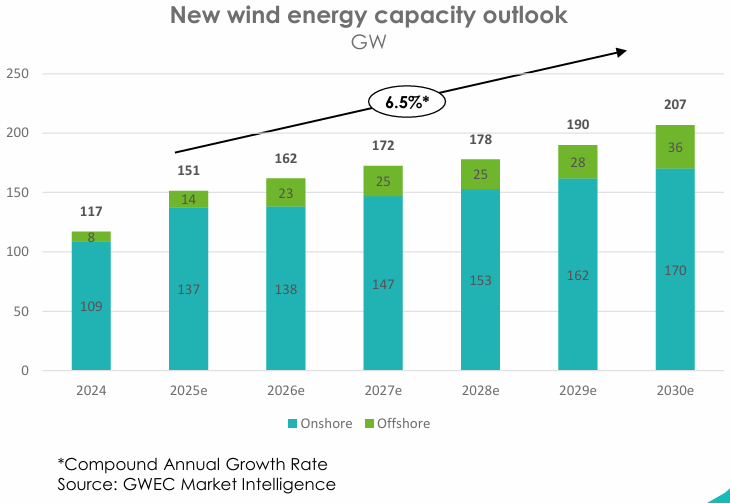

GWEC Market Intelligence revised its 2025 installation outlook upward by 8.8%, or 13.3 GW, reflecting faster-than-expected buildout across Asia. This follows a strong 2024, when 117 GW of new wind capacity was installed worldwide, raising cumulative capacity to 1,136 GW, representing 11% year-over-year growth.

The global wind market outlook for 2025–2030 remains positive, with installations projected to grow at a compound annual growth rate of 6.5%, translating into average annual additions of 176.7 GW over the period.

Between 2050 and 2030, GWEC now projects 1,060 GW of new wind capacity globally, an increase of 78 GW from its Q1 2025 forecast. Under this outlook, cumulative global wind capacity is expected to reach around 2,196 GW by the end of the decade, with average annual installations of 176.7 GW over the six years.

APAC Drives Global Expansion

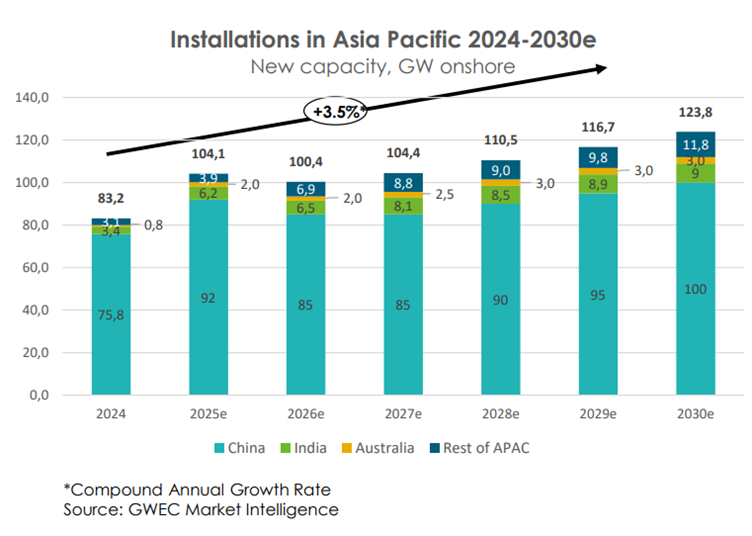

Asia-Pacific remains the central engine of global wind growth, led by China and India, with emerging markets outside China steadily increasing their share. China alone is expected to add approximately 547 GW of onshore wind capacity between 2025 and 2030.

In 2025, China is on course to exceed 100 GW of new wind installations, with 89 GW already installed by the end of November. China operates an estimated 225,000 wind turbines generating over 1.2 TWh of electricity, contributing to a reduction in thermal power generation even as national energy consumption reaches new highs.

India recorded its highest-ever annual wind installations in 2025, adding 6.3 GW of new capacity as rapidly rising electricity demand is met through a combination of wind and large-scale solar additions.

GWEC attributes India’s improving outlook to annual 10 GW wind auctions, a defined Wind Renewable Purchase Obligation trajectory, and progress in transmission planning.

Across the Asia-Pacific region excluding China, markets such as Vietnam, Australia, South Korea, and the Philippines are expected to scale wind capacity to support industrial growth, urbanization, and electrification.

By 2030, Asia-Pacific markets outside China are forecast to account for around 12% of global wind installations.

Europe and US

Europe remains a key contributor to global wind growth, delivering 16.5 GW of new capacity in 2025, around 5 GW more than in 2024. GWEC projects approximately 142 GW of onshore wind additions in Europe between 2025 and 2030, supported by streamlined permitting, higher auction tariff ceilings, and policy stability.

Germany, Spain, Turkey, France, and the UK are expected to lead regional growth. In the UK, the record-breaking Allocation Round 7 auction is projected to mobilize £22 billion (~$27.94 billion) in private investment, reinforcing wind energy’s role in long-term power sector planning.

In contrast, the outlook for North America has been downgraded. While the U.S. is expected to install more than 7 GW of new wind capacity in 2025, its onshore wind forecast for 2025–2030 has been reduced by around 16 GW.

GWEC cites regulatory uncertainty, permitting delays, tax credit phase-outs, and compliance risks related to Foreign Entity of Concerns as key constraints. Latin America is expected to experience slower growth in the near term due to grid curtailment and weak electricity demand, with a recovery anticipated after 2028, led primarily by Brazil.

Africa and the Middle East are projected to add around 27.7 GW of onshore wind capacity by 2030, driven by state-led procurement in markets such as Saudi Arabia, South Africa, and Egypt.

Onshore and Offshore Technology

Onshore wind remains the backbone of global deployment, accounting for approximately 908 GW of new capacity between 2025 and 2030, with average annual installations of around 151 GW.

China represents roughly 52% of global onshore additions, followed by Europe at around 142 GW and Asia-Pacific excluding China at approximately 113 GW. The U.S. contribution is comparatively modest at around 39 GW over the period.

Offshore wind is projected to add about 152 GW globally between 2025 and 2030, with a compound annual growth rate of 20.5%, despite near-term economic and supply chain challenges. Offshore wind’s share of annual installations is expected to rise from 7% in 2024 to around 18% by 2030, concentrated mainly in China and Europe.

No offshore wind installations are expected in Africa and the Middle East during the forecast period.

A GWEC report last year said offshore wind energy capacity additions reached 8 GW at the end of 2024, a 26% decrease from the previous year. By the end of 2024, a total of 83 GW of offshore wind power projects had been installed worldwide.

Investment Flows

Investment momentum remains strongest in markets with long-term policy clarity, including China, India, Germany, and the UK. Auctions and contracts for difference continue to underpin deployment in Europe and India, while private offtake and corporate power purchase agreements are gaining importance in Europe, South Africa, and parts of the Middle East.

Chinese original equipment manufacturers dominate turbine supply in Africa and the Middle East, supported by local manufacturing investments.

Offshore wind investment faces pressure from inflation, higher capital costs, supply chain bottlenecks, and constraints related to ports, vessels, and grid connections, leading in some markets to delayed final investment decisions or project cancellations.

Economic Growth Linkages

GWEC highlights that GDP growth and wind energy deployment are increasingly interconnected. China is expected to record GDP growth of around 5% in 2025, while the International Monetary Fund forecasts growth of around 6% for India, 7% for Vietnam, and 6% for the Philippines.

Emerging and developing economies account for over 80% of global energy demand growth, and Asia-Pacific’s 4.75 billion people currently consume about half of global energy, with consumption projected to rise by 60% by 2040.

Grid bottlenecks, permitting delays, policy reversals, financing conditions, and supply chain resilience remain key risks that could affect the pace of future deployment.