Global Solar Sector Attracts $17.3 Billion Corporate Funding in 9M 2025, Down 22% YoY

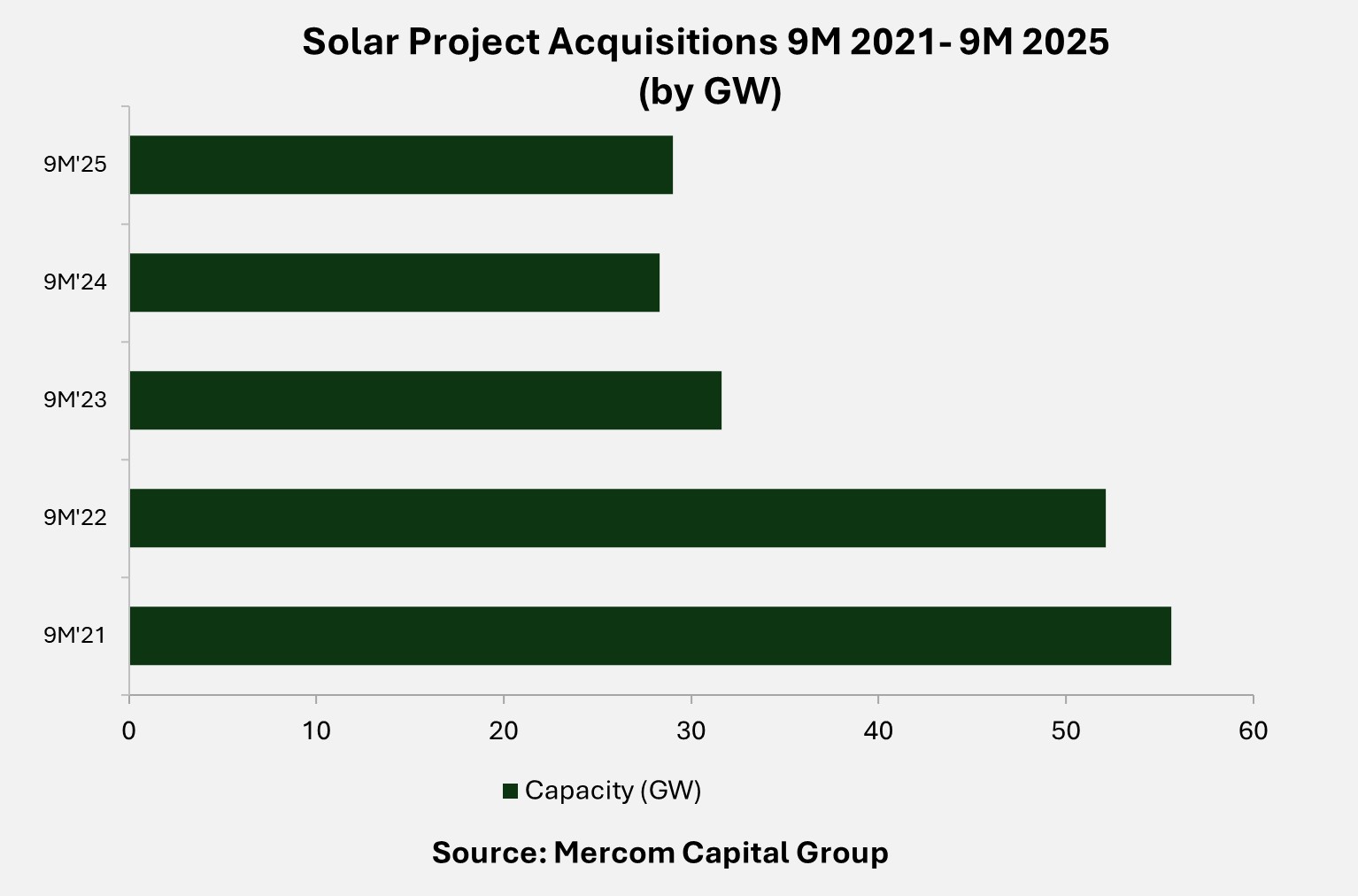

In all, 29 GW of solar projects were acquired in the first nine months of the year

October 24, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

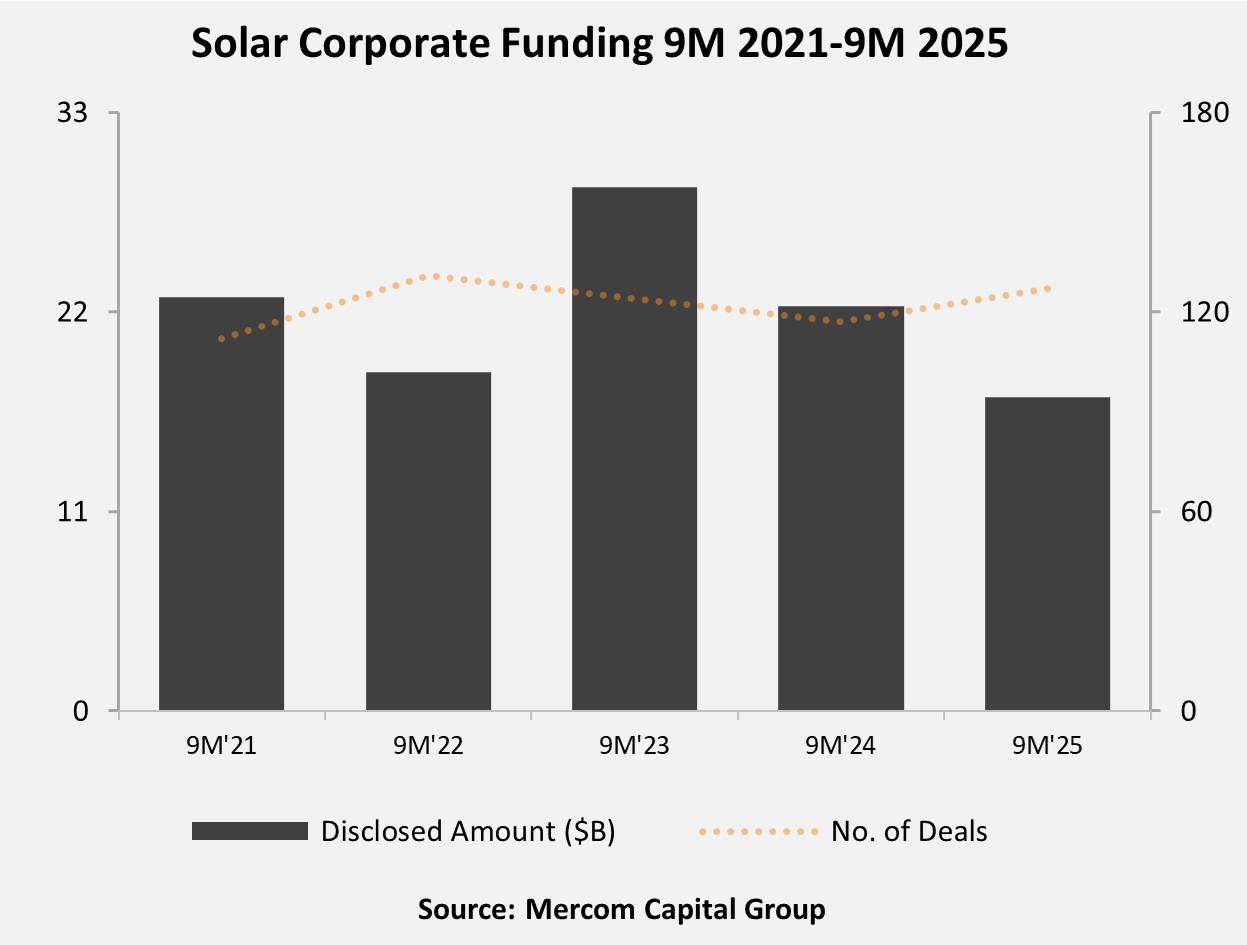

Total corporate funding, including venture capital funding, public market, and debt financing, for the solar sector globally, stood at $17.3 billion in the first nine months (9M) of 2025, 22% lower than the $22.3 billion raised in 9M 2024.

However, financing picked up in the third quarter (Q3) of 2025, totaling $6.5 billion across 49 deals —a 38% year-over-year (YoY) increase from $4.7 billion across 29 deals in Q3 2024. Quarter-over-quarter, funding rose 8% from $6 billion in 39 deals in Q2 2025.

These figures were revealed in Mercom Capital Group’s newly released 9M and Q3 2025 Solar Funding and M&A Report.

The early-year slowdown stemmed largely from policy uncertainty following the U.S. elections. “After the elections, everyone knew policy changes were coming, but no one was sure how they would take shape,” explained Raj Prabhu, CEO of Mercom Capital Group. “That uncertainty drove investors to pause.”

By Q2, markets had a clearer sense of direction with the Big Beautiful Bill Act, which, despite cutting incentives, provided visibility to the market. “Once the finer details like FEOC definitions and timelines were clarified by Q3, the market gained confidence,” Prabhu said. “That’s when investment activity picked up.”

He noted that Q3’s rebound reflected both policy certainty and improved investor sentiment. “By the third quarter, the industry and investment community were very clear about the policy framework. That’s what drove funding higher even though the overall nine-month total still looked subdued.”

The number of deals increased by 9% YoY, from 117 in 9M 2024 to 127 in 9M 2025.

VC funding in 9M 2025 slipped 17% YoY to $2.9 billion across 55 deals, versus $3.5 billion across 39 deals in 9M 2024.

Solar downstream companies led the way with 40 deals totaling $2.5 billion in 9M 2025.

The top VC deals in 9M 2025 were: $1 billion raised by Origis Energy, $500 million raised by Silicon Ranch, $130 million raised by Terabase Energy, $129 million raised by Enpal, and $124 million raised by Aukera.

In total, 161 VC investors participated in solar financings during 9M 2025.

Public market solar financing totaled $1.7 billion across 12 deals in 9M 2025, 19% below $2.1 billion across 10 deals in 9M 2024.

Announced solar debt financing activity in 9M 2025 totaled $12.7 billion in 60 deals, 24% lower than 9M 2024, when $16.7 billion was raised in 68 deals.

There were seven securitizations totaling $3.1 billion in 9M 2025, down 18% YoY from $3.8 billion across 12 deals in 9M 2024.

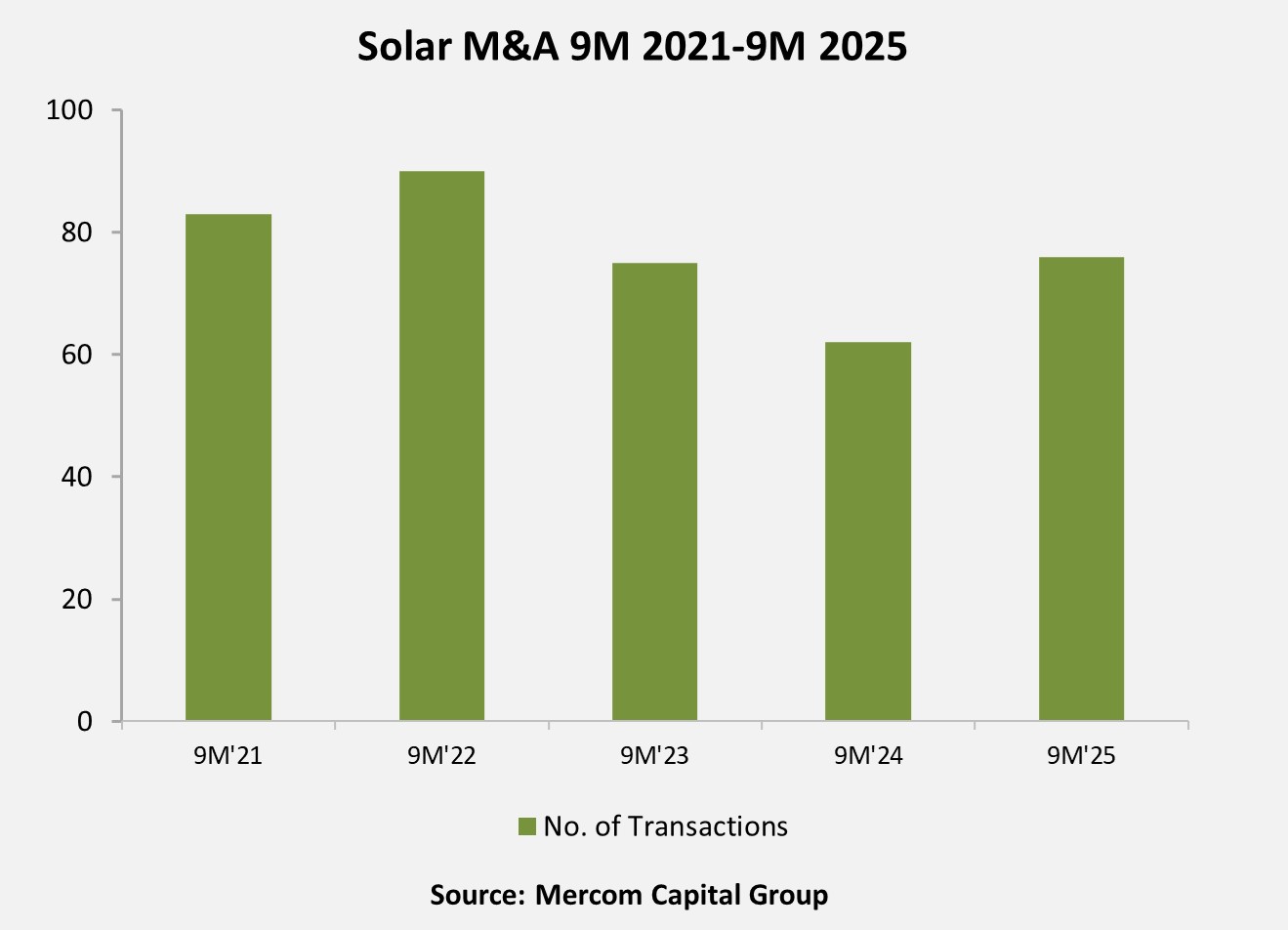

In 9M 2025, 76 solar M&A transactions were executed compared to 62 in 9M 2024. The largest transaction was by ONGC NTPC Green, a joint venture between ONGC Green and NTPC Green Energy, which signed a share purchase agreement to acquire a 100% equity stake in Ayana Renewable Power for $2.3 billion.

“M&A has bucked the trend throughout the year,” Prabhu said. “When markets were uncertain in Q1 and Q2, valuations were low, and investors found great deals. By Q3, as clarity improved, that momentum continued.”

He added that consolidation and restructuring also fueled activity as stronger players acquired companies.

Project acquisitions totaled 165 transactions covering 29 GW in 9M 2025, versus 166 transactions totaling 28.3 GW in 9M 2024.

Project developers and independent power producers were the most active acquirers of solar projects in Q3 2025, picking up 5.4 GW, followed by Investment firms with 1.7 GW. Other companies (insurance providers, pension funds, energy trading companies, industrial conglomerates, and IT firms) acquired 1.1 GW, followed by oil and gas companies with 623 MW, and utilities with 320 MW.

Looking ahead, Prabhu expects the sector’s momentum to carry into the final quarter but warned of isolated headwinds. “Some U.S. projects approved under the previous administration are being canceled, which has created a bit of uncertainty,” he said. “It’s unclear whether that will have a lasting effect.”

Still, he remains optimistic. “The industry knows the start-of-construction deadline for next year, so solar companies should be operating at full speed,” he said. “If we see additional interest rate cuts this quarter, that could further support the sector.”

To learn more about the report, visit: https://mercomcapital.com/product/9m-q3-2025-solar-funding-ma-report/