Global Energy Transition Investments Rise to $2.3 Trillion in 2025: BNEF Report

Investments in the solar manufacturing sector saw a decline in the year

February 10, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

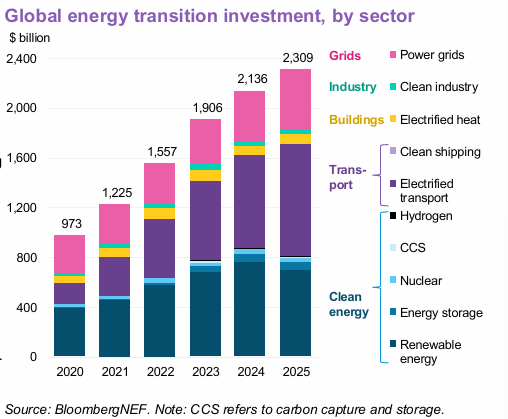

Global energy transition investment reached $2.3 trillion in 2025, up 8% from a year earlier, while investment in the clean energy supply chain rose to $127 billion, according to BloombergNEF’s (BNEF) Energy Transition Investment Trends 2026 report.

According to BNEF’s base-case scenario, investments in the energy transition are expected to rise by an average of 25% over 2026-2030, higher than last year’s projections.

The report stated that in 2025, investments in energy transition exceeded capital expenditure on fossil fuels.

Energy Transition Investment

Electrified transport accounted for the largest share of investments in the energy transition market, with $893 billion spent on purchasing electric vehicles and developing charging infrastructure in 2025, up 21%.

The electrified transport sector was followed by the renewable energy sector, which secured $690 billion in new investments, down 9.5% due to market reforms in China.

Investment in the grid sector rose by 17% to $483 billion as operators raced to strengthen networks.

Investment in energy storage reached $71 billion, while investment in the clean industry reached $34 billion.

An earlier BNEF report said global energy storage capacity additions were expected to grow by 35% in 2025 to 94 GW or 247 GWh.

According to the report, investments in data centers were around half a trillion dollars in 2025, surpassing solar investments.

China remained the largest market for energy transition investments but saw its first decline since 2013. The European Union shrugged off headwinds to grow 18% to $455 billion. The U.S. also increased its investments in the energy transition by 3.5% to $378 billion, despite the Trump administration’s efforts to slow it.

Supply Chain Investments

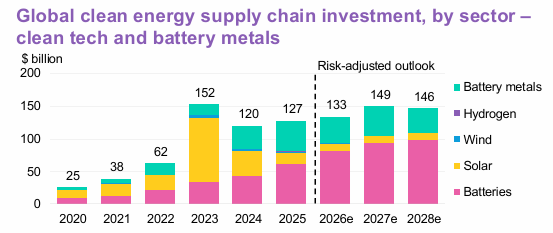

Clean energy supply chain investments, which include spending on new clean-tech product factories and battery metal production assets, grew 6% to $127 billion in 2025. Factory investment dipped slightly, while spending on battery metals rose slightly.

Overcapacity continued to weigh on all sectors of the clean energy supply chain, with market dynamics varying by technology.

Investments in the solar manufacturing sector declined sharply since 2023, while battery manufacturing continued to expand. The report said that with overall investment still rising, downward pressure on clean-tech product prices is expected to persist.

According to Mercom Capital Group’s 2025 Annual and Q4 Solar Funding and M&A Report, global corporate solar funding dropped by 16% year-over-year, with $22.2 billion raised in 175 deals, compared to $26.3 billion in 157 deals in 2024.

The BNEF Energy Transition Investment Trends 2026 report said China attracted the largest share of global clean-tech manufacturing investments.

While China’s dominance in the clean-tech sector is unlikely to diminish, its share of annual investment is gradually declining. Geographies including the U.S., EU, and India are continuing to onshore clean-tech supply chains despite challenges in operationalising manufacturing facilities.

The report also added that Chinese manufacturers are increasingly investing in overseas capacity to offset compressed margins at home.

Investments in the clean energy supply chain are expected to continue growing, but those in the wind manufacturing sector are likely to lag.

Equity Finance

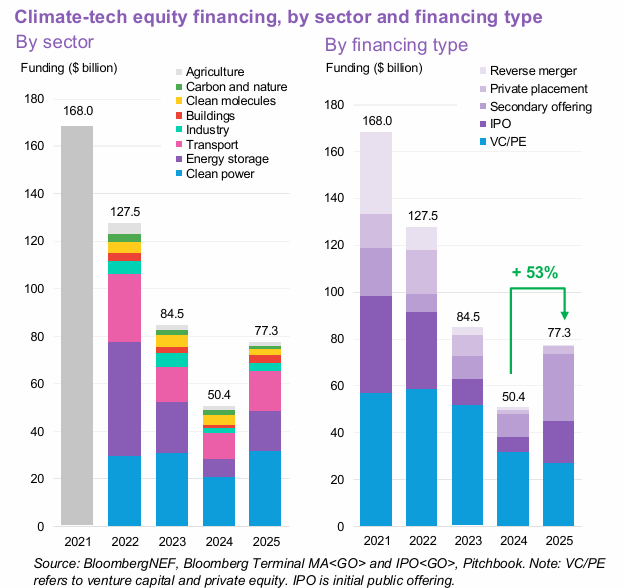

Climate-tech companies raised $77.3 billion in private and public equity in 2025, up 53% YoY, marking the first year of growth after three consecutive years of decline.

Clean power, energy storage, and low-carbon transport companies led fundraising, bringing in $64.9 billion.

Public market activity recovered in 2025, while venture funding for startups declined for the third year in a row. Secondary offerings from already-listed firms accounted for 36% of total investments. The initial public offering (IPO) market also saw a surge, tripling YoY after a low number of IPOs in 2024.

China led climate tech equity funding with $24.5 billion, followed by the U.S. with $21.9 billion, and the European Union in third place.

Mergers and acquisitions remained strong with $99.1 billion closed in 2025, a 37% YoY rise. More than half of the transaction volume came from the acquisition of companies in the clean power and buildings sector.

Debt Issuance

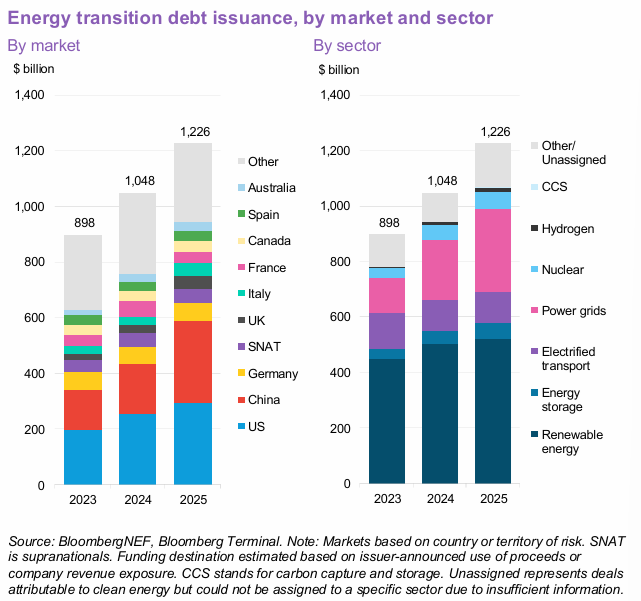

In 2025, $1.2 trillion in debt was issued for energy transition, up 17% YoY.

Corporate and project finance rose 20%, offsetting a dip in government debt sales as they scaled back labeled issuances earmarked for mature transition sectors.

Debt issuance by U.S. and Chinese energy transition companies totaled around $295 billion. Europe’s total debt issuance rose by 11% YoY to $359 billion, led by increased debt issuance in the UK, Italy, Spain, and the Netherlands.

Companies tied to mature energy transition sectors raised $989 billion in 2025, while those with exposure to emerging sectors, including nuclear and hydrogen, raised $77 billion. The power grid sector saw the biggest growth in debt issuance, up 41% from 2024.

Labeled sustainable debt accounted for just 47% of energy transition debt financing in 2025, down from 58% in 2023. The report said that dwindling pricing benefits associated with sustainable labels may have pushed issuers away from the market.