EU Solar Installations Fall to 65 GW in 2025, Ending a Decade of Yearly Growth

Utility-scale solar exceeded 50% of the total installations for the first time in 2025

January 5, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

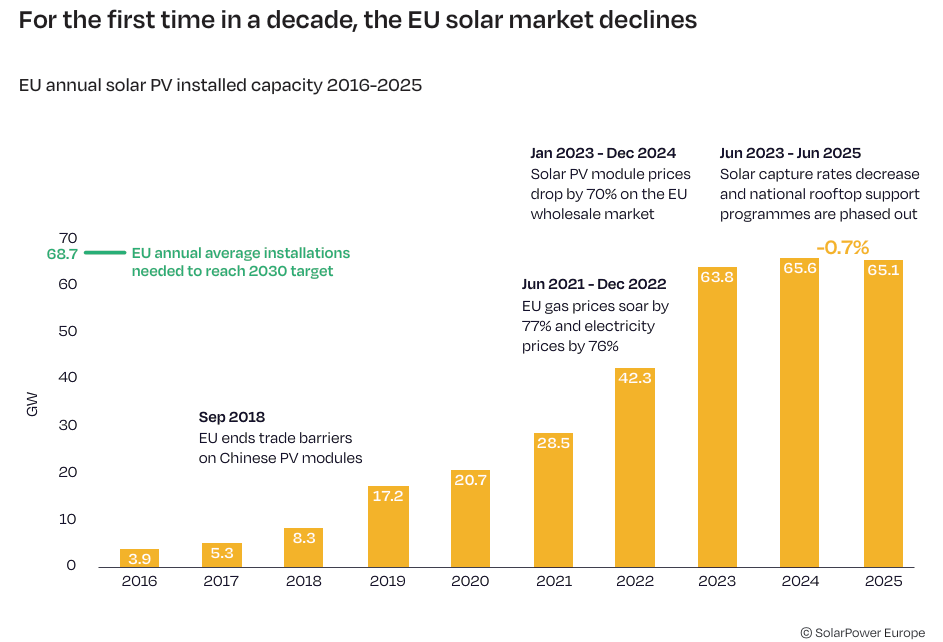

Solar capacity additions in the European Union (EU) in 2025 have dropped for the first time in a decade, with new installations of 65.1 GW, down 0.7% year-over-year (YoY) from 65.6 GW, according to the EU Solar Market Outlook 2025-2030 report by SolarPower Europe.

SolarPower Europe had earlier projected new EU solar installations at 64.2 GW in 2025, driven by the dip in residential rooftop solar installations.

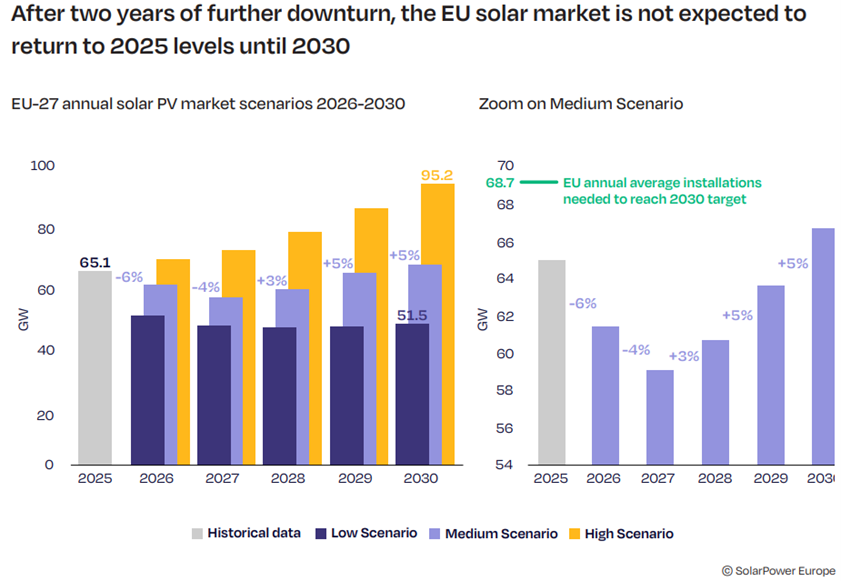

The report states that solar installations in the EU are expected to continue declining in 2026 and 2027, before recovering marginally by 2030.

The report states that solar installations in the EU are expected to continue declining in 2026 and 2027, before recovering marginally by 2030.

Reasons for Slowdown

According to SolarPower Europe, the decline in solar capacity follows the fading impact of the energy crisis that had earlier driven rooftop solar deployment.

Households and businesses are showing less urgency about installing solar, as rooftop support programs in many key markets have been phased out, even as gas and electricity prices remain elevated.

In the utility sector, corporate power purchase agreements (PPAs) and previous merchant projects continue supporting solar activity. However, grid congestion, rising negative price events, and adverse policies are affecting the bankability of solar systems.

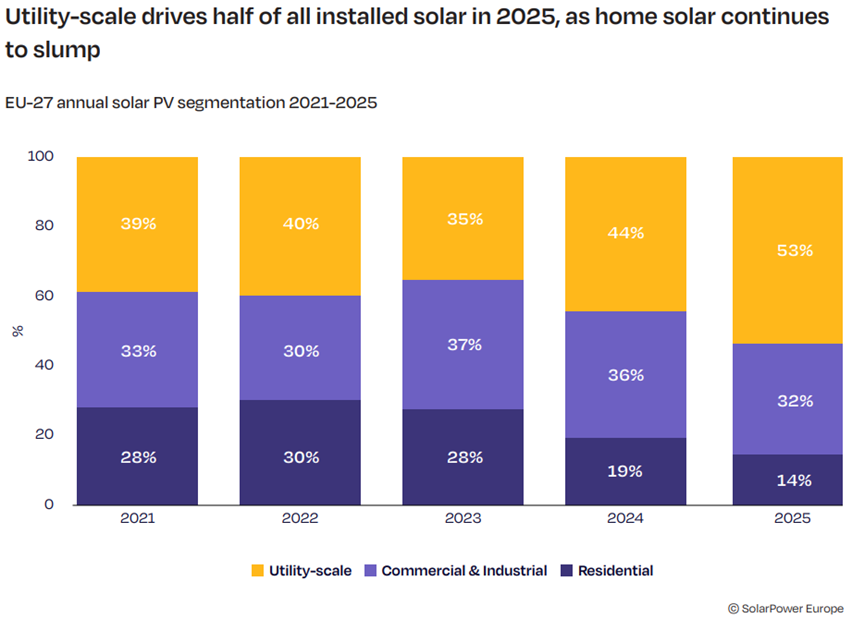

Utility-scale solar exceeded 50% of the total installations for the first time in 2025.

However, cumulatively, solar capacity remains mostly rooftop-based, with a 61% share, compared to utility-scale projects’ 39% share.

Compared to the previous year’s expectations of a 70 GW solar market, the report states that the updated 2025 figure is 7% lower.

The subdued expectations reflect the responsiveness of households and businesses to changing market conditions.

SolarPower Europe said this change is a warning for policymakers who aim to keep the EU on track to meet its 2030 goal of installing 750 GW of solar capacity.

Solar Generation

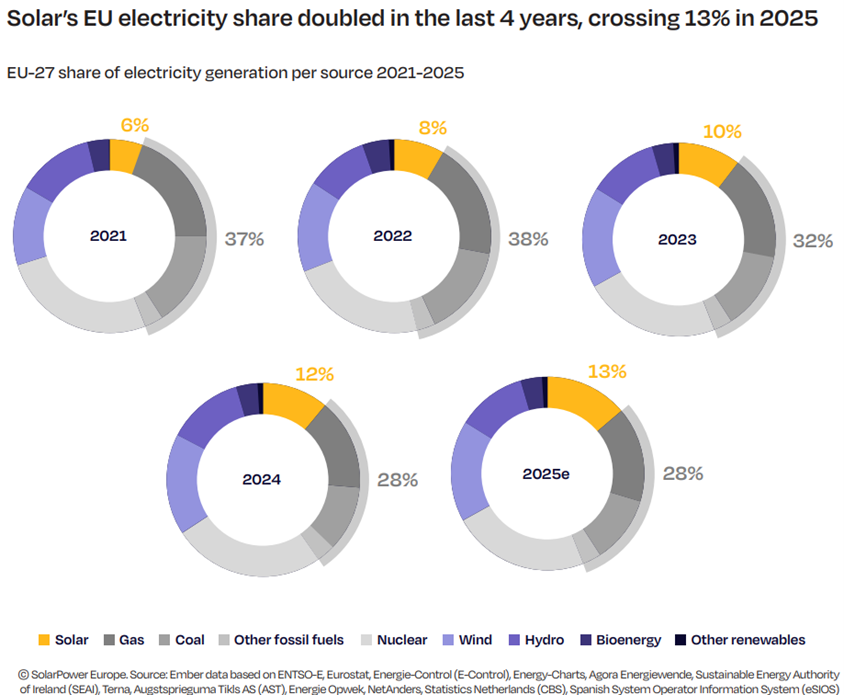

Solar installations are projected to supply 13.4% of the EU’s electricity in 2025, rising from 11.6% in 2024 and 9.7% in 2023. This increase marks the doubling of solar energy’s share since 2021.

The report states that the gas share in the EU’s power mix declined from 19% to 15.3% between 2021 and 2024. The share of coal reduced to 9.9% from 14.7% over the same duration.

Rooftop and Utility-Scale Solar

Residential solar installations in the EU declined the most in 2025, with 19 markets contracting during the year. The residential annual additions share fell to 14%, half of the 2023 levels.

This sector was affected by the limited expansion of rooftop solar beyond the early-adopter households and the phaseout of support programs in multiple mature markets.

The report highlights that new plug-in/balcony solar installations are gaining popularity wherever legal in the EU. This is driven by the low upfront investment, the possibility of ‘do-it-yourself’ installations, and the simple grid connection process.

The commercial and industrial (C&I) segment is more stable. However, the number of declining markets is rising again, with the segment’s share falling from 37% in 2023 to approximately 32% in 2025. The growth is increasingly concentrated in a few countries.

Utility-scale solar projects, despite progressively tougher project economics, remain the most resilient segment of the solar industry. This performance is supported by public auctions and PPA commitments made during the strong 2022 to 2024 period, which are now reaching completion.

Future Projection

SolarPower Europe’s high scenario projects continuous growth through 2030.

The medium scenario demonstrates a U-shaped trajectory, with a two-year single-digit contraction followed by a slow rebound, returning annual additions to growth, albeit at single-digit levels. Annual installations are forecasted to reach 67 GW by 2030.

The low scenario has projected installations settling near the 50 GW level.

Residential and small-commercial installations are forecast to face downturns between 2026 and 2027, due to the phaseout of support programs, slow development of self-consumption enablers, and lower retail electricity prices, which reduce urgency.

Installation will stabilize starting in 2027, driven by accelerating electrification, expanding energy-sharing frameworks, and new rooftop requirements.

The near-term projections are also affected by grid constraints and limited flexibility. Project bankability will be affected by congestion, negative price periods, and curtailment. Additionally, storage deployment, smart-meter rollout, and aggregator access remain insufficient to enable higher levels of solar integration.

The report states that investment in the solar segment is being further dampened by slow electrification. However, rising energy demand from electric vehicles (EVs), heat pumps, and data centers is forecasted to help strengthen the market starting in 2028.

Missed Target

Prevailing conditions, such as lower rooftop demand, insufficient flexibility, regulatory uncertainty, and ongoing land-use and permitting constraints, will limit the pace of new capacity additions in the second half of the decade.

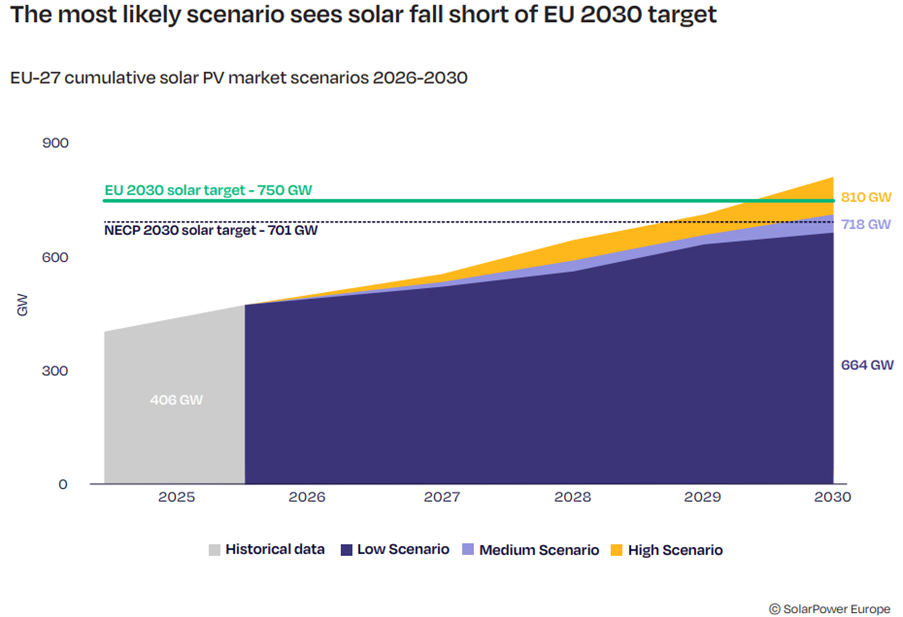

According to the report, the EU will meet its 2030 750 GW solar capacity target only under the high scenario, reaching 810 GW. In the medium and most likely scenario, the region will achieve 718 GW, while under the low scenario, it will install 664 GW.

Rooftop and utility-scale solar capacity will continue to grow between 2026 and 2030, albeit at different rates. Between 2025 and 2030, rooftop installations are projected to rise from 247 GW to 397 GW. A wide base of residential and C&I users will support its growth.

Utility-scale projects will grow more quickly during this period, rising from 159 GW to 321 GW, driven by recently awarded large project pipelines and the ongoing materialization of PPA cycles as grid conditions, flexibility solutions, and permitting frameworks gradually improve.

The report expects market concentration in solar capacity to remain high through 2030. Approximately 80% of the new additions between 2026 and 2030 are expected to come from 10 member states.

The number of annual gigawatt-level EU markets has declined by two to 14. Approximately a quarter of the member states are expected to miss their own 2030 solar capacity targets under the current market and policy conditions.

Ten EU member states exceed 1 kW of solar energy per person in 2025. The EU per-capita average stands at slightly over 900 W. This average would rise to 1.6 kW per person, or three average-sized rooftop solar modules per EU citizen, by 2030 if all NCEPs are met.

Policy Recommendations

SolarPower Europe offers multiple suggestions to EU policymakers to unlock solar power’s full potential.

To address grid congestion, the report calls for adopting a flexibility-first approach to grid development, taking measures to unlock the full demand-response potential, and developing an action plan of battery energy storage system (BESS) deployment, safety, quality, and supply chains.

The EU installed 18.5 GWh of battery storage in 2024, bringing total capacity to 49.1 GWh. BESS installations in 2025 are forecasted to have grown by nearly 40% to reach 25.7 GWh. The total capacity is projected to reach 400 GWh by 2029. However, this capacity falls below the 780 GWh required by 2030 to meet the flexibility needs of a renewable energy-based system.

To address the permitting issues, the report advocates that national governments implement the provisions under the Renewable Energy Directive framework effectively for permit granting, digitalization of processes, establishment of one-stop shops, and overriding public interest.

The report recommends actively supporting the implementation of the rooftop standard in the EU’s Energy Performance of Buildings Directive and the energy-sharing provisions in the Electricity Market Design legislation.

It proposes that the EU should build its own solar supply chains, diversify production, fund manufacturing, apply fair EU preference, avoid mixing rules, and improve recycling and circularity across Europe.

In September this year, the European Solar Manufacturing Council and SolarPower Europe requested the EC to include ‘make-in-Europe’ provisions in public procurements to stimulate demand for the solar manufacturing sector.