Eos Energy Posts Record Revenue in Q3, But Loss Widens

The company’s commercial opportunity pipeline increased by 59% YoY

November 12, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

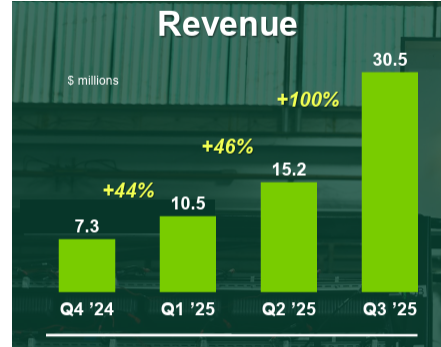

U.S.-based energy storage solutions provider Eos Energy Enterprises reported a record revenue of $30.51 million in the third quarter (Q3) of 2025, a 3,500% year-over-year (YoY) increase from $854,000.

The revenue reported in the quarter was the highest in the company’s history. However, the revenue fell short of analysts’ expectations by $9.03 million.

Its net loss widened to $641.39 million, increasing 87.05% from $342.88 million in the same quarter last year.

It posted an earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of $634 million, an 89.3% rise from the corresponding quarter last year, when it reported a loss of $334.8 million.

The company reported a loss per share of $4.91, compared with $1.77 in the same quarter last year.

The loss per share missed the analysts’ expectations by $2.63.

9M Results

In the first nine months (9M) of 2025, Eos reported a 573% YoY jump in revenue to $56.2 million from $8.35 million.

Net loss rose by 103% to $849.19 million from $417.75 million during the same period last year.

Its EBITDA loss also widened by 111.45% YoY to $823.61 million from $389.5 million.

The loss per share stood at $6.06 compared to a loss per share of $2.3 in 9M 2024.

Business Highlights

Eos Energy’s commercial opportunity pipeline increased by 59% YoY to $22.6 billion, and the order backlog stood at $644.4 million.

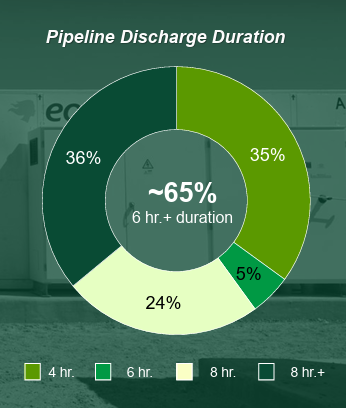

Nearly 22% of the pipeline demand came from data centers, with 64% of it at least 6-hour storage solutions.

During the quarter, Eos Energy Enterprises secured a 228 MWh order from Frontier Power to deploy its Eos Z3 energy storage systems across Frontier’s growing grid-reliability and energy storage portfolio.

The company signed a 750 MWh master supply agreement with MN8 Energy.

It also signed a collaboration with Talen Energy to develop multiple gigawatt-hours of storage capacity supporting data centers and AI infrastructure projects in Pennsylvania.

Eos was awarded $24 million in state and county incentives to support its ongoing manufacturing expansion and the establishment of a new software hub in the state.

The company introduced its DawnOS, a battery management, software, controls, and analytics platform.

The company also completed another sale of its production tax credits, monetizing $11.8 million of 45X credits generated in the first few quarters of this year.

Eos achieved the final cash receipt milestone under its Cerberus Capital Management Delayed Draw Term Loan agreement, resulting in $43 million in cash received in October.

In October, it shipped 179% more tubes than it did in the first month of Q3.

Eos said that it is beginning to see a significant increase in activity in the PJM Interconnection and the New York Independent System Operator region, along with the existing growth in the Southwest Power Pool and the Midcontinent Independent System Operator regions.

Outlook

Eos Energy Enterprises stated that it expects full-year revenue to be between $150 million and $160 million, in line with the lower end of its previously forecast range.

The company has also made progress on its subassembly automation at its Turtle Creek manufacturing facility, with all equipment now installed and 88% of its bipolar lines in commercial production.

It plans to scale production to an annualized rate of 2 GWh by the end of 2025 and to more than triple output in Q4.

In Q4, the company plans to ship three times as many batteries as in Q3.