Energy Storage Funding Declines Sharply in Q1 2025

Corporate funding decreases by 81% and 47% YoY across both sectors

April 25, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Corporate funding for energy storage companies, including venture capital (VC), debt, and public market financing, totaled $2.2 billion across 31 deals in Q1 2025, according to Mercom Capital Group’s newly released Q1 2025 Funding and M&A Report for Energy Storage.

This represents an 81% year-over-year (YoY) drop from the $11.7 billion raised in 29 deals in Q1 2024.

Raj Prabhu, CEO of Mercom Capital Group, commented, “Last year, we had a couple of huge deals that amounted to almost $10 billion, which was an anomaly. So, in comparison, the year-over-year dollars raised look low this quarter.”

Prabhu emphasized that ongoing geopolitical and policy uncertainties are driving the downturn. “Since the elections and the new administration taking office, there’s been significant uncertainty around key policies, especially regarding the continuation of subsidies for the battery storage and EV sectors. On top of that, steep import tariffs have been imposed on China and several other countries.”

“All of this is disrupting the supply chain and driving up costs. As a result, there’s a lot of uncertainty about what comes next,” he added.

VC funding for energy storage declined moderately by 8% YoY, with $1.1 billion raised in 18 deals, compared to $1.2 billion raised in 23 deals a year ago. Companies in the Materials & Components category secured the largest portion of funding, followed by those in the Energy Storage Downstream segment and Battery Recycling, Software, and Lithium-based Battery companies.

Top VC funding rounds in Q1 2025 included KoBold Metals with $537 million, green flexibility with $411 million, Equilibrium Energy with $28 million, Sonocharge Energy with $24 million, and ACCURE Battery Intelligence with $16 million. These top five deals comprised the bulk of the sector’s VC investment.

Debt and public market financing activity in the energy storage sector saw a 90% YoY decline, with $1.1 billion raised from 13 deals in Q1 2025, compared to $10.5 billion from six deals in Q1 2024.

Corporate M&A activity also dropped significantly. Only one company acquisition was reported in Q1 2025, down from eight in the same quarter last year.

However, energy storage project mergers and acquisitions (M&A) activity showed positive growth, with 15 projects acquired in Q1 2025, compared to just six in Q1 2024.

Smart Grid

Corporate funding for smart grid companies decreased by 23% YoY, with $530 million in 21 deals in Q1 2025 compared to $686 million raised in 14 deals during Q1 2024, according to Mercom Capital Group’s Q1 2025 Funding and M&A Report for Smart Grid.

VC funding in the smart grid segment fell sharply by 47% YoY, with companies securing $346 million across 18 deals, compared to $656 million in 12 deals in the same quarter last year.

Smart charging companies drew the most VC investment within the segment during the quarter, underscoring continued interest in electric mobility infrastructure.

Other key segments attracting funding included Grid Optimization, Data Analytics, Demand Response, Distributed Generation and Integration, and Smart Grid Communications.

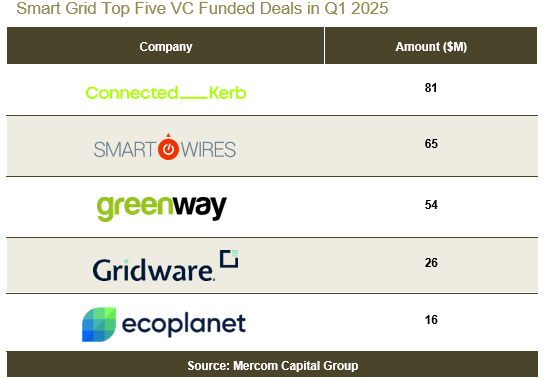

The largest smart grid VC deal in Q1 2025 was Connected Kerb’s $81 million raise. This was followed by Smart Wires with $65 million, GreenWay with $54 million, Gridware with $26 million, and ecoplanet with $16 million. These top five deals accounted for over 70% of total smart grid VC funding during the quarter.

In the area of debt and public market financing, smart grid companies raised $184 million from three deals in Q1 2025, significantly higher than the $30 million raised from two deals in Q1 2024.

On the M&A front, three undisclosed transactions were reported in Q1 2025. This marked an increase from the single undisclosed M&A transaction reported in Q1 2024.

On the outlook for the coming quarters, Prabhu noted, “Everything hinges on government action. Once trade deals are negotiated and tariffs are finalized, companies will have the clarity they need to move forward. Until then, the market remains in a wait-and-see mode.”

He added that uncertainty around the U.S. Inflation Reduction Act (IRA) and possible changes to investment tax credits are also fueling investor hesitation. “If those subsidies are reduced or removed, many projects simply won’t be viable. The market needs clarity before companies can commit to deals and move ahead.”

To learn more about the energy storage report, visit: https://mercomcapital.com/product/q1-2025-funding-ma-report-energy-storage/

To learn more about the smart grid report, visit: https://mercomcapital.com/product/q1-2025-funding-ma-report-smart-grid/