Energy Banking Curbs, New ToD Tariffs Slow Maharashtra’s Solar Open Access Market

Regulatory volatility pushes developers toward smaller, load-matched PPAs

December 10, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

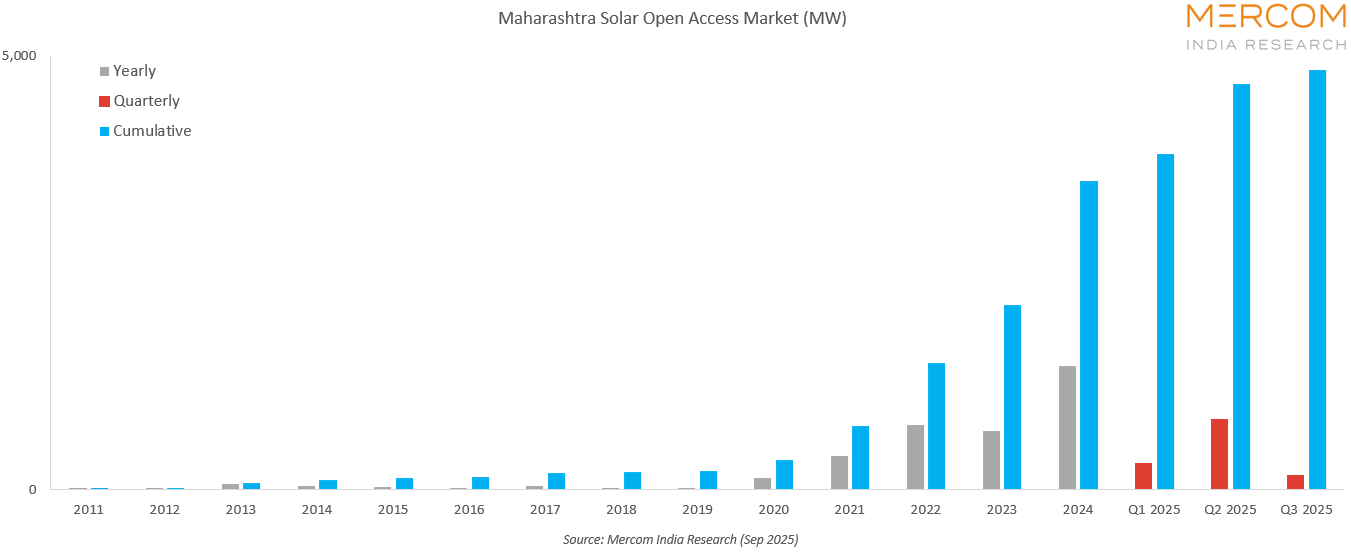

India’s cumulative solar open access capacity reached 27.9 GW in September 2025, with Maharashtra contributing about 17%, the second-largest share after Karnataka, according to Mercom’s Q3 2025 Solar Open Access Market Report.

Despite this strong base, Maharashtra has struggled due to regulatory uncertainty, leading developers and commercial and industrial (C&I) consumers to scale back investments due to energy banking limits, adverse time-of-day (ToD) tariffs, and open access charges.

The quarterly installations in Q3 fell to 165 MW, an 80% quarter-over-quarter and 43% year-over-year decline.

Under the earlier framework, renewable generators could bank surplus energy and withdraw it later, subject to a 2% charge (revised to 8% in November 2023). Any unused energy after the monthly settlement would either lapse or be converted to Renewable Energy Certificates (RECs).

The banked energy could be used during most ToD slots except peak hours, allowing daytime solar to offset evening consumption. This flexibility was critical for matching variable solar generation with C&I load profiles.

New Banking Rules, ToD Tariffs Shrink Savings

The Maharashtra Electricity Regulatory Commission’s (MERC) new multi-year tariff order and subsequent clarifications changed both the ToD structure and the way banking works for MSEDCL consumers. The revised provisions restrict the energy stored during the ‘normal’ ToD slots (00:00 – 06:00 and 06:00 – 09:00) to be utilized in the same slot or during solar hours (09:00 – 17:00), and energy banked during solar hours (09:00 – 17:00) may be drawn in the same ToD slot only.

The state’s new seasonal ToD design offers 20-30% discounts during solar hours and about 25% surcharges during peak hours. With cheaper grid power during solar hours and time-slot-restricted banking, the economic value of surplus solar has fallen sharply, creating an effective ‘no-banking’ scenario for energy generated between 09:00 and 17:00.

Delivered Cost Up

Open access consumers also face a cross-subsidy surcharge of roughly ₹2 (~$0.022)/kVAh or approximately ₹1.8 (~$0.02)/kWh, wheeling charges, transmission losses, apart from the 8% banking charges, which together raise the delivered cost of open access power close to or above DISCOM tariffs during key time blocks, squeezing the business case for new projects.

Shift towards Smaller PPAs

Mercom’s analysis indicates that banking restrictions may reduce savings by at least 10% for many C&I consumers. Companies are downsizing projects and aligning PPAs to daytime demand to avoid generating surplus that may lapse.

Furthermore, higher charges and procedural delays push smaller MSMEs towards short-term grid power, leading to delays or cancellations of renewable procurement plans. Battery energy storage systems (BESS) could mitigate ToD price gaps, but will involve additional investments.

Regulatory Unpredictability

The Bombay High Court quashed MERC’s review of the MYT order and stayed MSEDCL’s attempt to confine banked energy usage to solar hours, restoring the earlier rule allowing withdrawal in any non-peak slot. Petitioners argued the new restrictions were retrospective and inconsistent with rules for other Mumbai DISCOMs. Although the ruling temporarily restored flexibility, it reinforced concerns about regulatory unpredictability.

C&I Procurement Strategies

Not only in Maharashtra but also across other states in India, sharper ToD pricing and higher fixed charges are narrowing the gap between DISCOM and open access tariffs.

Declining retail tariffs and rising fixed charges are limiting potential savings, while steep solar‑hour discounts make grid power attractive when solar production is highest. C&I consumers in the state are increasingly considering hybrid projects, storage-backed PPAs, and DISCOM-supplied green tariffs paired with smaller captive or on-site systems to fulfil their green targets.

Policy Stability is Key

Maharashtra remains a key market due to its large C&I base, but recent policy shifts underscore the need for stable, consultative regulation. Market participants are watching upcoming decisions on banking rules, the trajectory of CSS and grid support charges, and the role of storage and new contracting tools such as virtual PPAs and contracts for differences. Until clearer signals emerge, stakeholders expect Maharashtra’s open access growth to trail its underlying demand, as developers and consumers factor in higher regulatory risk and favor flexible procurement models.