China Export Rebate Cuts May Raise India Solar, BESS Prices

China will remove VAT export rebates for solar components from April 1, 2026

February 16, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

China’s recent decision to cancel value-added tax (VAT) rebates on exports of solar and related products from April 1, 2026, is likely to increase project costs for India’s solar and battery energy storage system (BESS) developers.

The export VAT rebate rate for battery products will be reduced from 9% to 6% from April 1 to December 31, 2026, China’s Ministry of Finance and State Taxation Administration announced in January. These rebates will be cancelled from January 1, 2027.

This development should worry India’s BESS developers, who rely significantly on imports from China, as well as module manufacturers who use Chinese solar cells.

Increasing Component Prices

During the third quarter (Q3) of 2025, India imported solar cells and modules valued at $837.5 million (₹73.1 billion), a 0.2% quarter-over-quarter (QoQ) decline. Solar imports decreased by 15.1% YoY. Despite the drop, imports remain at a significant level.

Developers expect increased tariff pressure across standalone solar and solar-plus-storage projects after the rebate cancellations.

Keyur Gajera, Director at solar engineering, procurement, and construction company Earthwave Solar and module manufacturing company Veda Solar, said module prices could rise 14% from $0.086/W in late 2025 to $0.098/W by Q4 2026 after China canceled VAT export rebates on solar components. The prices could reach as high as $0.094/W when China’s rebate ends in April 2026.

“A 10% module cost increase adds up to ₹0.2 (~$0.0022)/kWh to tender prices, severely pressuring economics. The market can accommodate only 10% to 15% cost increases before facing developer and distribution company (DISCOM) resistance,” he added.

He stated that every $0.01/W increase will add ₹0.06 (~$0.00066)/kWh to ₹0.07 (~$0.00077)/kWh to the electricity tariff.

“With India’s 132.7 GW project pipeline and state DISCOMs’ reluctance to pay above ₹2.8 (~$0.031)/kWh, higher module costs threaten project viability and could trigger cancellations of the 42 GW of awarded capacity awaiting firm agreements,” Gajera said.

Nikhil More, General Manager (Management) at PIXON Green Energy, concurred.

He said solar panel prices in India could climb by 10% to 20% in early 2026, driven by China’s rebate cuts. The costs will also be affected by price volatility in silver and other materials, such as aluminum, copper, and silicon. This could lead to module price increases of $0.02/W to $0.04/W.”

Supply Chain and Capacity Constraints

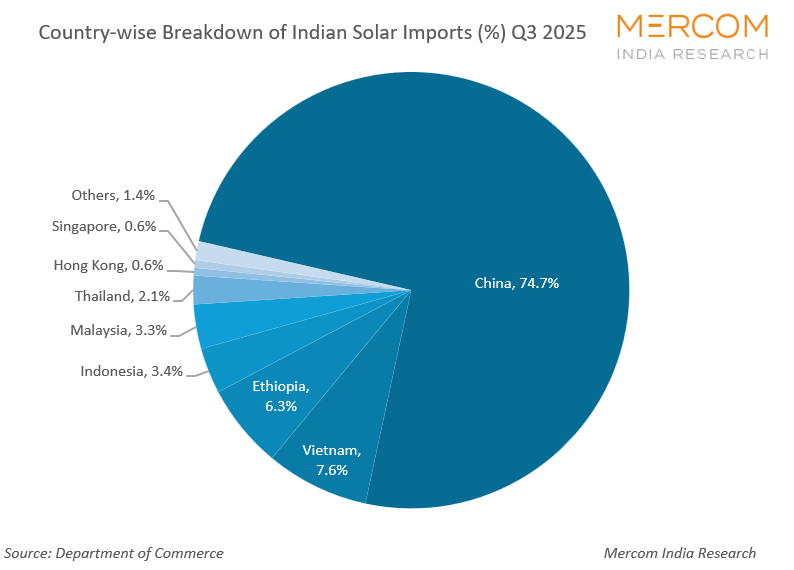

Despite India’s reduced dependence on solar module imports, it still relies heavily on solar cells from China. Chinese solar cells made up 74.7% of imports, up 6.4% from the previous quarter.

“India, reliant on Chinese wafers and polysilicon, will see cell/module costs rise, potentially straining uncontracted projects,” said More.

Gajera added, “India’s critical cell production bottlenecks persist at only 29.3 GW, forcing cell imports to double from 11 GW to 21 GW in 1H 2025. Mono PERC technology dominates (57.2% expected by 2026), though Chinese firms maintain leads in high-efficiency TOPCon and heterojunction technologies, with developers facing shortages of domestic content requirement-compliant modules, and the June 2026 ALMM (List-II) cell mandate further tests supply readiness against limited upstream polysilicon and wafer production.”

The Indian government introduced the ALMM List-II in December 2024 to promote domestic solar cell manufacturing, mandating that all solar projects using modules covered under the ALMM List-I must incorporate solar cells compliant with List-II.

However, solar developers have expressed some concerns over these mandates. They claim that the limited availability of local solar cells during the initial phases could create procurement bottlenecks, escalating costs, worsening supply constraints, and increasing execution risks.

Higher Impact on BESS Costs

While solar components will experience immediate pricing pressure, the impact on storage projects could be more pronounced.

Anurag Mathur, Founder at EnerCube, a BESS producer and supplier, stated that the cost of storage projects will rise as Indian BESS developers depend almost completely on China for components.

Weighing in on the effects of China’s reduction of VAT rebates on storage projects, Mathur expects battery prices to increase by 20%. India is increasingly transitioning to solar plus BESS projects, with the majority (56%) of the newly added storage capacity coming from such projects in the first half of 2025.

According to Mathur, prices of solar plus storage systems can increase by 15%.

Growth Prospects for Domestic Manufacturers

In the short term, solar module manufacturing remains the only segment in which Indian companies are positioned to benefit from the cancellation of China’s export rebates.

As of the first half (1H) of 2025, India’s solar module manufacturing capacity increased due to the 2030 solar installation targets and policy-driven domestic demand for solar modules compliant with the ALMM. Indian manufacturers currently have approximately 182 GW of solar module capacity in the pipeline.

China’s cancellation of export VAT rebates can further increase demand for Indian solar modules.

More expects India’s growing localization of solar module manufacturing to mitigate the broader impacts of higher costs following China’s rebate cancellations. “Indian solar manufacturers will stand to gain from costlier imports, boosting the ALMM-listed module demand.”

According to Gajera, China’s rebate removal narrows the price gap by effectively raising Chinese export prices 9%, while India-made equipment costs have fallen nearly one-third as the industry scales.

He said that only about 50% of module PLI targets were achieved, with continued reliance on imported machinery and Chinese technical expertise limiting the industry’s ability to capitalize on this opportunity fully.