CEA Highlights Pumped Storage as Base Load to Address Peak Power Demand

The average annual capacity addition is projected to be 9 GW

January 29, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

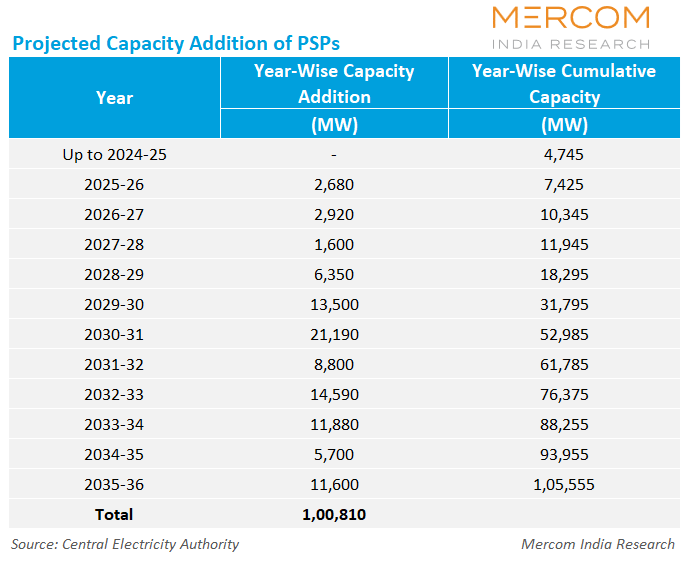

India’s total installed pumped storage project (PSP) capacity is expected to reach approximately 87 GW by 2033-34, according to the Central Electricity Authority’s (CEA) Roadmap to 100 GW of Hydro Pumped Storage Projects by 2035-36.

The average annual capacity addition is projected to be 9 GW, resulting in total installed capacity exceeding 100 GW by 2035-36.

However, the roadmap stated that PSP commissioning may accelerate in later years as projects’ potential increases, particularly for off-stream closed-loop projects with approximately four years of gestation.

Need for Flexible Generation

CEA advocated flexible generation assets that can efficiently and economically supply base load and peak power to address India’s evolving energy needs.

Energy supply from variable renewable energy sources cannot be regulated because it depends on the time of day, seasons, and changing weather conditions.

Therefore, energy storage assets are facing increasing demand. CEA stated that PSPs are best suited to address this surging demand and are an ideal complement to modern clean energy systems.

PSPs provide adequate storage scale and have a service life of approximately 100 years. These projects have a 40-year periodic renovation and modernization requirement. CEA said the PSPs’ service life is longer than that of other storage technologies available.

The longer service life also results in lower delivered energy costs over the projects’ lifetimes. PSPs also account for more than 95% of the installed global energy storage capacity. Pumped hydro projects globally store up to 9,000 GWh of electricity.

How PSPs Work

PSPs use surplus electricity to pump water from lower reservoirs to higher levels before releasing it to generate energy during high-demand periods. These projects help with effective power management for multi-hour storage needs, reduce renewable energy curtailment, and meet peak demand.

Additionally, PSPs provide voltage control, frequency support, and black-start capabilities. Black-start refers to a battery’s ability to initiate the restoration of an electric grid after a total or partial blackout without relying on external power.

Due to these characteristics, PSPs offer proven, reliable solutions to support power systems with high renewable energy penetration.

Future Storage Needs

The CEA roadmap said India’s resource adequacy studies highlight increasing requirements for long-duration energy storage. It stated that while battery energy storage systems (BESS) are effective for short-duration applications, PSPs are critical for meeting evening peaks and extended demand periods.

Storage durations of at least six hours are expected to become more important in renewable energy-heavy grids. PSPs will help enable round-the-clock renewable power supply, specifically for large commercial and industrial consumers and utilities.

Such projects will help cut dependence on thermal plants and support grid stability.

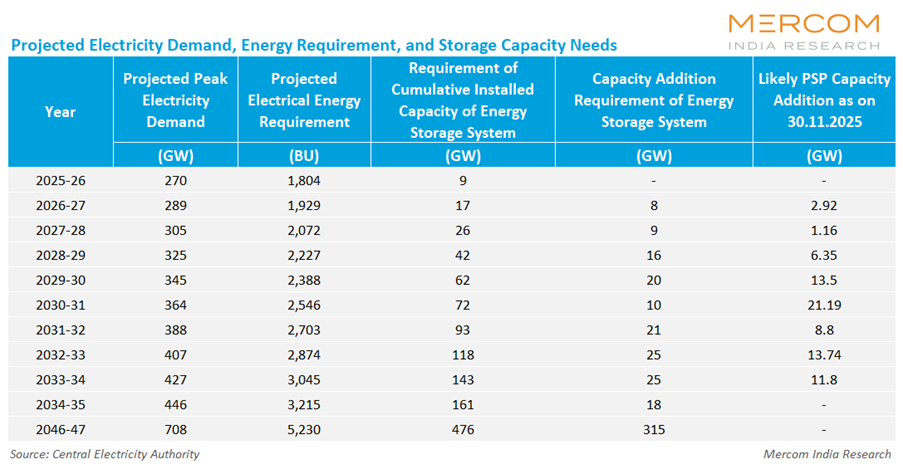

CEA stated that India’s total storage capacity is forecast to reach 62 GW by 2029-30, 161 GW by 2034-35, and 476 GW by 2046-47.

Pumped Storage Potential

CEA estimated India’s pumped storage potential at roughly 267 GW. This potential includes 58 GW of on-stream and 209 GW of off-stream PSPs.

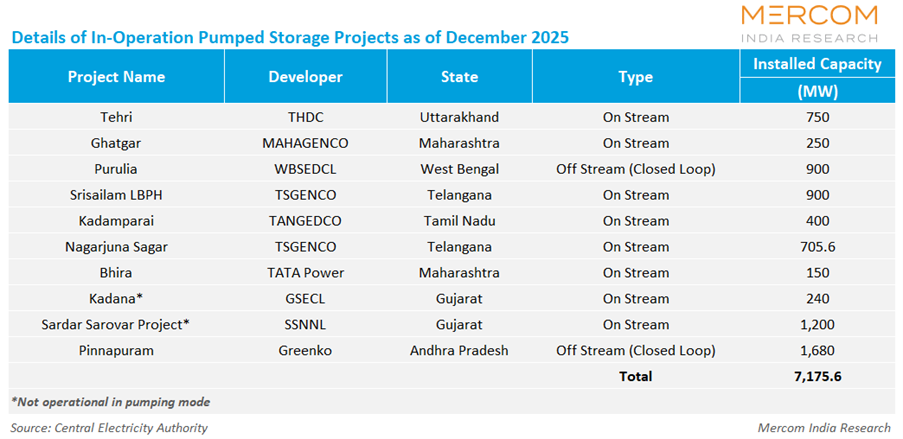

Approximately 7 GW of pumped storage capacity was operational as of December 31, 2025. Additionally, 10 PSPs with a total capacity of 12 GW are under construction. Projects with CEA-approved detailed project reports (DPRs) totaling 9.6 GW have yet to begin construction. Fifty-four PSPs with a total installed capacity of 75 GW, including 52 closed-loop projects designed exclusively for storage, are in the survey and investigation stage.

States such as Andhra Pradesh, Maharashtra, Madhya Pradesh, Karnataka, Odisha, and Uttar Pradesh offer viable PSP sites.

India’s assessed PSP potential rose from approximately 97,565.6 MW as of the end of 2022 to 124,290.6 MW at the end of 2023. It further increased to 183,330.6 MW by the end of 2024 and to 266,845.6 MW by the end of 2025.

However, converting this potential into operational capacity will require sustained project execution, regulatory clarity, and timely infrastructure development.

Investment Needed

PSPs with an aggregate capacity of 100,810 MW are expected to be commissioned by 2035-36. This includes 11,620 MW of PSPs under construction.

Total investment requirement for upcoming PSPs is estimated at approximately ₹5.8 trillion (~$63.08 billion). This would include an average cost of ₹60 million (~$652,617)/MW.

The investment requirement per project typically includes 20% expenditure in the first year, 30% in the second year, 30% in the third year, and the remaining 20% in the fourth year.

CEA stated that 29 units of turbines and generators with a total capacity of 6,580 MW are needed for CEA-approved projects, and are yet to be ordered.

Policy Measures

CEA suggested multiple policy and regulatory measures to enable the scale-up of PSP development, improve bankability, accelerate construction starts, and sustain annual capacity additions needed to meet the 100 GW target.

These include streamlined land-acquisition and rehabilitation provisions for PSPs, budgetary support for enabling infrastructure, and a waiver of interstate transmission system charges.

The introduction of tariff-based competitive bidding guidelines for storage procurement in February 2025 is also considered a critical reform that provides revenue visibility and encourages private participation.

It also highlights efforts to reduce delays in surveys, investigations, and DPR approvals, specifically for the projects that have already received CEA approval.

These include national guidelines to promote PSPs, the CEA’s guidelines for DPR formulation to fast-track report preparation, and faster DPR appraisal by CEA.

Transmission Planning

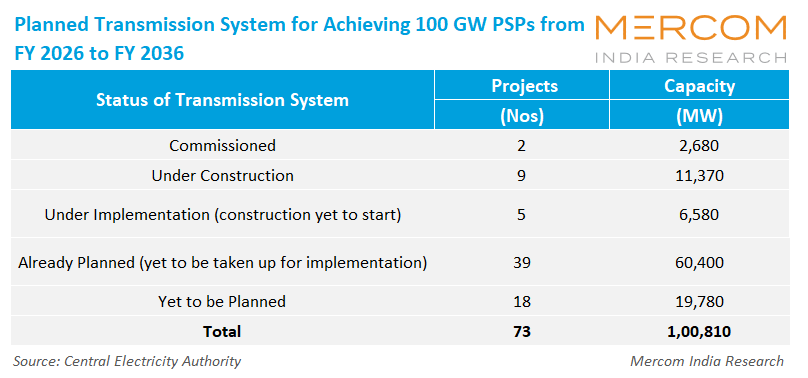

CEA stated that a PSP transmission system’s concept-to-commissioning period generally falls between three and four years.

Planning for transmission must be done in advance to ensure commissioning aligns with PSP implementation.

Transmission for 35.6 GW of PSP is already planned to be taken up by 2031-32.

The summary of the transmission system planned for achieving 100 GW PSPs from the year 2025-26 to 2035-36 is as follows:

Environmental Clearances

CEA noted that environmental and forest clearances remain among the most significant challenges for PSP development. It highlighted that these issues are critical, particularly for 75 GW of projects under survey and investigation.

While noting that the Ministry of Environment, Forest, and Climate Change is taking steps to relax survey-stage requirements in forest areas, CEA highlighted delays in compensatory afforestation, forest clearance, and approvals for off-stream projects, which continue to affect timelines. It calls for clearer guidelines, faster processing, and improved digital systems to balance environmental safeguards with project execution needs.

Financial Support for PSP

According to CEA, BESS costs have been declining, while PSP costs range from approximately ₹50 million (~$543,847.5)/MW to ₹60 million (~$652,617)/MW. These can make PSPs less cost-competitive with BESS. CEA calls for support initiatives such as viability gap funding for PSPs to address these issues.

Best Practices

CEA highlighted multiple best practices for future PSP development. These include suggestions covering the PSP design, development, and sustainability, prioritizing optimal site selection, efficient reservoir sizing, high-head layouts, and using proven reversible pump-turbines manufactured domestically.

Additionally, CEA calls for robust geological studies, optimized water conductor systems, and careful grid integration. Project execution must follow CEA guidelines and undertake realistic costing. It must also ensure the integration of renewable energy, strong safety standards, and efficient contracting.

CEA’s sustainability suggestions advocate for minimal environmental and social impact, local development, innovative site selection, and construction methods that reduce powerhouse timelines.

Global Pumped Storage Scenario

Global PSP installed capacity reached approximately 189 GW in 2024. Roughly 8.4 GW of new PSP capacity was added in 2024 alone. Global PSP development pipeline exceeds 600 GW. This includes over 105 GW under construction, with more than 90 GW in China.

Existing PSPs can store up to approximately 9,000 GWh of electricity.

China aims to achieve 120 GW to 130 GW of PSP development by 2030. Its system operators are projecting 129 GW of PSPs in their regions. China is expected to achieve 70 GW of under-construction PSPs to be commissioned by 2030.

About 90 GW of new PSP capacity is expected to be added by 2030, raising total capacity to approximately 280 GW, a nearly 50% increase from the current base.

CEA said this projection points to an average build rate of approximately 18 GW per year, roughly five to ten times the 2 GW to 4 GW added annually over the past two decades.

In May last year, the Forum of Regulators recommended exempting electricity duty and cess on input energy for pumping to reduce costs and promote investments in PSP.