Canadian Solar Revenue Flat in Q3, Solar Cell Plant to Go Online in 2026

Strong storage deliveries and profitable module shipments drove its performance

November 18, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

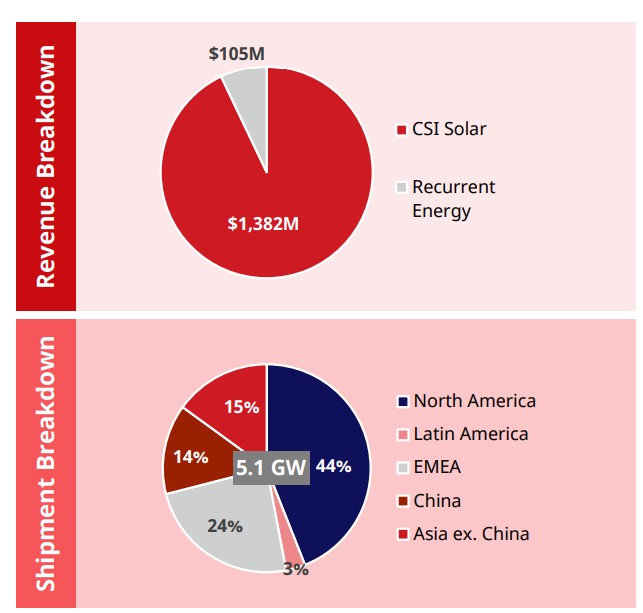

Renewable energy solutions company Canadian Solar’s revenue for the third quarter (Q3) of 2025 remained flat at $1.48 billion, reducing 1% year-over-year (YoY) from $1.5 billion. However, the revenue was at the high end of the company’s guidance.

This performance was attributed to strong energy storage deliveries and a high mix of module shipments to profitable markets.

Yan Zhuang, President at CSI Solar, said, “We delivered a sequentially higher share of module shipments to the profitable North American market. Our Mesquite factory, which has now successfully ramped up, contributed meaningfully to both shipment volume and profitability. In our energy storage business, earlier deliveries to two projects shifted certain volumes from the fourth quarter into the third, resulting in a record quarter of 2.7 GWh in shipments.”

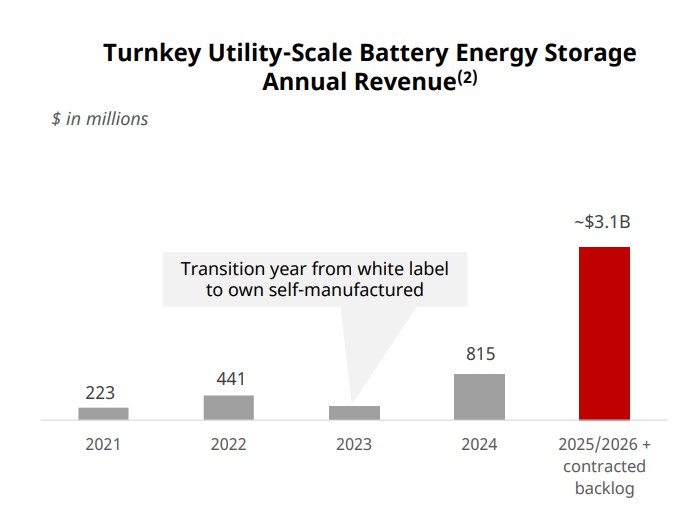

He added that CSI Solar’s $3.1 billion utility-scale storage backlog provides a line of sight to future growth.

Canadian Solar suffered a loss of $25.62 million, increasing 46.1% from $14.02 million in Q3 2024.

The company’s loss per share came in at $0.07, compared to $0.31 in the same quarter of the previous year.

“Until our independent power producer business scales further, near-term profitability will continue to depend primarily on global project sales,” the company stated in an earnings call.

Its revenue for Q2 2025 rose 4% YoY to $1.69 billion, due to higher sales of battery energy storage systems and solar modules. However, the revenue fell short of analyst expectations by $201.27 million.

Revenue for Q1 2025 dropped 10% YoY to $1.19 billion.

9M 2025

Canadian Solar posted a revenue of $4.38 billion in the nine-month (9M) period of 2025, a 2.1% YoY decline from $4.47 billion.

During this period, CSI Solar earned a revenue of $4.05 billion, reducing 6.6% YoY from $4.33 billion. Recurrent Energy earned $329.4 billion, rising 144% YoY from $135.01 million.

It posted a loss of $108.54 million, compared to a profit of $2.15 million in 9M 2024.

The company’s loss per share came in at $0.83, compared to $0.1 in the same period of 2024.

Operational

Canadian Solar’s Indiana, U.S.-based solar cell factory is expected to begin production in Q1 2026. Its lithium battery energy storage facility in Kentucky is projected to start production at the end of 2026.

The company is also planning adjustments to its U.S. business to comply with the One Big Beautiful Bill Act (Inflation Reduction Act), passed this year.

Additionally, it stated that it is collaborating with multiple data center customers to develop integrated solutions. Canadian Solar’s residential solar business is expected to become profitable within 2025. This segment has witnessed growth in Japan, Italy, and the U.S., with plans for expansion in Germany and Australia.

Canadian Solar said it has secured safe harbor for 1.5 GW of solar and 2.5 GWh of battery storage in the U.S., in addition to under-construction projects. It expects to have safe harbored at least 3 GW of solar and 7 GWh of battery projects by the summer of next year.

The company has recently received approval from the UK government for its Tillbridge solar and battery storage projects in Lincolnshire. The project is expected to comprise an 800 MW solar plus a 1,000 MWh battery energy storage system.

Canadian Solar’s total debt rose to $6.4 billion, primarily because of new borrowings tied to project development assets. It closed Q3 2025 with a cash position of $2.2 billion.

Outlook

In 2026, Canadian Solar expects capital expenditure to remain at similar levels to those in 2025. Most of the company’s investments will continue to target U.S. markets.

For Q4 2025, it expects solar module shipments to range from 4.6 GW to 4.8 GW in capacity and 25 GW to 30 GW for the full year. Canadian Solar forecasts shipments of 2.1 GWh to 2.3 GWh of its energy storage products. These would include approximately 600 MWh delivered for its own projects.

For Recurrent Energy, revenue in Q4 2025 is expected to range between $1.3 billion and $1.5 billion.

For 2026, Canadian Solar’s total solar module shipments are expected to range from 25 GW to 30 GW in capacity, including roughly 1 GW for its own projects. Energy storage shipments are forecasted to range between 14 GWh and 17 GWh.

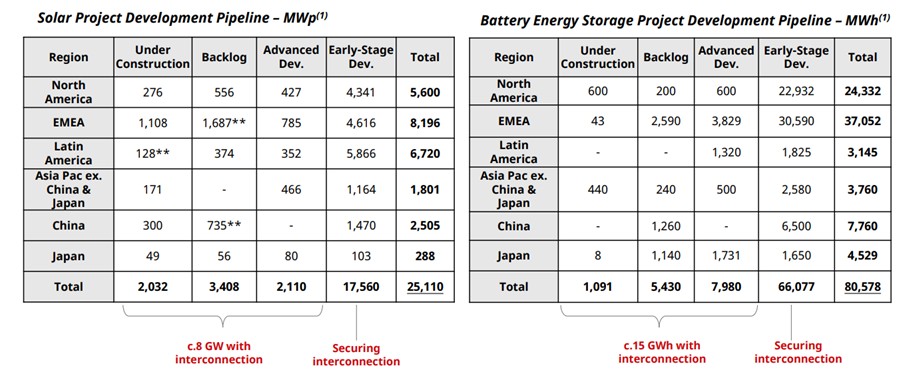

Pipeline

As of September 30, 2025, the company’s total battery energy storage project development pipeline was 80.6 GWh, including 6.5 GWh under construction and in backlog, and 74.1 GWh of projects in advanced and early-stage development.

The Company’s total solar project development pipeline was 25.1 GW, including 2.0 GW under construction, 3.4 GW of backlog, and 19.7 GW of projects in advanced and early-stage development.