Aggressive Bidding Puts India’s Energy Storage Push at Crossroads

The market is sceptical about the bankability of BESS projects

February 4, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Aggressive bidding is rapidly becoming the defining feature of India’s energy storage tender landscape, raising concerns among stakeholders.

As competition intensifies and tender volumes rise, discovered tariffs for battery energy storage systems (BESS) have converged sharply, raising a critical question for the sector: are today’s prices truly reflective of bankable projects, or are they setting the stage for long-term instability?

Between July and November 2025 alone, around 24 GWh of energy storage tenders were issued, while 25.6 GWh were auctioned, spanning both standalone BESS projects and solar-plus-storage configurations.

This steady uptick in tendering activity has coincided with increasing price pressure, particularly under the Viability Gap Funding (VGF)-linked framework, where tariffs have largely settled in the range of ₹150,000 (~$1,635)–₹185,000 (~$2,017)/MW per month.

While these numbers point to rapid market maturation, industry insiders emphasize the growing concerns around economic viability and execution risk.

Factors Driving Increasingly Aggressive Bids

Several structural shifts have reshaped India’s storage tender ecosystem, pushing bidders toward tighter pricing. The introduction of VGF for standalone BESS has significantly lowered the perceived entry barrier, attracting a wider pool of developers, engineering, procurement, and construction (EPC) companies, and new market entrants.

Kishor Nair, Chief Executive Officer at Avaada Energy, said, “The jump to ~25 GWh auctioned in a short window has fundamentally changed bidder psychology. Once volumes move from pilot scale to systemically meaningful size, developers begin bidding not just for a project, but for portfolio positioning. Standardised VGF-linked tender documents, fixed availability structures, and assured offtake have induced downside, encouraging more aggressive bidding.”

According to him, the initial days of falling lithium-ion battery prices and improving lifecycle assumptions have created a myth in the industry that costs will take care of themselves. However, India still lacks large-scale, multi-year operating data under grid conditions (high temperatures, cycling profiles, auxiliary losses). “The rising trend of battery prices is a major risk for the Indian market, which is solely dependent on the import of key components for BESS.”

The surge in tender frequency has further intensified competition. With developers eager to secure early scale and long-term pipelines, many bids are driven as much by strategic positioning as by near-term returns.

Economic Viability

On paper, today’s winning tariffs can work, but only under very specific conditions. Projects remain viable if battery procurement prices are locked at assumed levels, financing is secured at competitive rates, augmentation requirements are accurately provisioned for, and commissioning timelines are met without delay.

Nair said that for new entrants, multiple strategic market objectives include securing a first-mover reference project, building execution credentials ahead of larger future tenders, accessing the capital market to raise equity through an IPO, gaining preferred-vendor status with policymakers and lenders, and scouting for land, connectivity, or long-term grid access.

The challenge is that margins at these tariff levels are extremely thin. Even modest deviations, such as higher interest during construction, unexpected supply-chain delays, or penalties for shortfalls, can quickly undermine project economics.

A top executive from a leading power generator said, “Concerns were raised over how developers can maintain viable Internal Rate of Return (IRR) and sound project models under such compressed pricing. India’s BESS expansion should prioritize reliability and long-term value rather than a price war.”

“Similar to Rajasthan’s Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyaan (PM-KUSUM) project cancellations, the unrealistic bidding could risk similar setbacks if not grounded in realistic cost structures. Some of the current bids appear financially stretched, though future declines in global battery prices could improve feasibility. The overall sentiment remains one of cautious optimism, with the market waiting to see how these bids perform in execution,” he added.

Echoes of Early Solar, Wind Auction Cycles

The current storage bidding trend closely mirrors earlier phases of India’s solar and wind auctions. Aggressive price discovery initially accelerated deployment and established global benchmarks, but was followed by project delays, renegotiations, and a gradual elimination of weaker players.

The key difference is that energy storage is inherently more complex than standalone renewable generation assets. Battery degradation, thermal management, safety compliance, and real-time performance obligations introduce layers of operational risk that are difficult to capture in early-stage financial models designed to analyze the projects.

As a result, the gap between bid assumptions and ground realities can be significantly wider than in vanilla renewable projects.

Pointing to key similarities between BESS projects and the initial boom of solar and wind projects, Nair emphasized that these include race-to-the-bottom pricing driven by balance-sheet strength rather than asset-level returns, overconfidence in execution timelines rather than supply chain constraints, and the entry of players without deep EPC or O&M experience, relying heavily on subcontracting and original equipment manufacturer information.

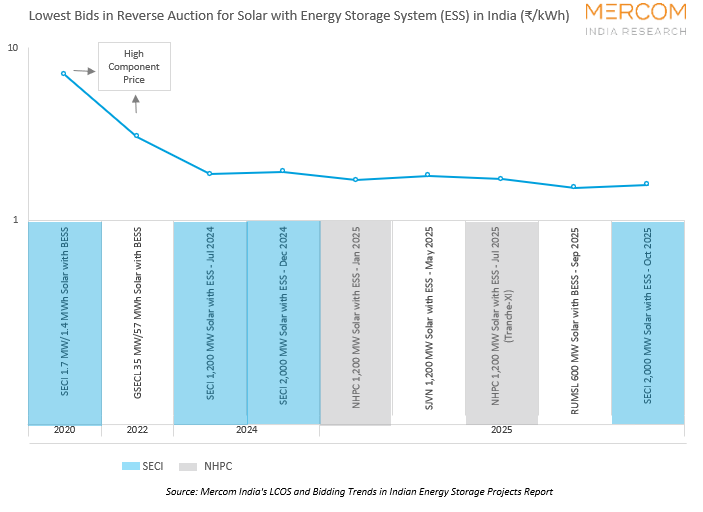

It’s not just standalone BESS projects that are witnessing aggressive bidding and tariff reductions; the same holds true for solar-plus-BESS projects over the last few years.

Solar Plus BESS Tariffs

The tariffs have fallen significantly for solar-plus-BESS projects. Tariffs for standalone as well as solar-plus-BESS projects have fallen significantly over the last few years, with the lowest ever tariff of ₹2.7 (~$0.029)/kWh discovered in Rewa Ultra Mega Solar’s 600 MW solar with BESS auction in September last year.

This gives a broader view of things to come, as solar/wind plus BESS projects will take the lead in the near future. But how far this optimism will sustain is anybody’s guess.

As of June 2025, the total installed battery storage capacity stood at 490 GWh, with solar plus storage accounting for the bulk of the deployments, according to the ‘Levelized Cost of Storage (LCOS) and Bidding Trends in Indian Energy Storage Projects’ report released by Mercom India Research.

Will the Market Self-Adjust?

Selective regulatory refinement may be necessary to avoid repeating past boom-and-bust cycles. Stronger pre-qualification criteria, clearer definitions around degradation and augmentation, and stricter enforcement of performance standards could improve bid quality without dampening competition.

Laying down the markers for the BESS market, Nair said that a partial self-correction is likely. A few developers have already begun to face the reality, but some regulatory intervention would definitely help avoid systemic risk.

Market forces will eventually penalize undercapitalized or inexperienced bidders and push lenders to demand higher equity buffers and higher interest rates for such unrealistic projects. This, in turn, would lead to consolidation through asset sales or restructuring. Market watchers say the goal should not be price control, but risk transparency and execution discipline.

The Path Forward

In the future, India’s energy storage tender ecosystem will need to evolve beyond pure price discovery. Incorporating performance-linked evaluation metrics and enabling constant revenue streams can help balance affordability with financial sustainability.

Highlighting the need for a mature ecosystem, Nair noted that the ecosystem would likely feature differentiated tenders and separate products for peak shaving support, renewable firming for RE-RTC, and grid ancillary services.

This allows pricing to better reflect the actual value delivered.

Calling for performance-based revenue structures, he said the ecosystem should move beyond fixed availability to include cycle efficiency, response time, degradation-adjusted output, and stronger domestic supply chains with the support of an ALMM-like framework.

Energy storage is a critical pillar of India’s energy transition and a strategic priority for the Government of India. Unlike early solar and wind projects, energy storage is at an inflection point, with significantly higher technical complexity and lifecycle risks, making execution failures at this stage potentially consequential.